Travel Insurance

Compare travel insurance prices, policy features, and medical cover in minutes.

Compare pet insurance quotes from the UK’s leading insurance providers

Find tailored travel insurance at the right price by comparing deals from the UK’s leading insurance providers.

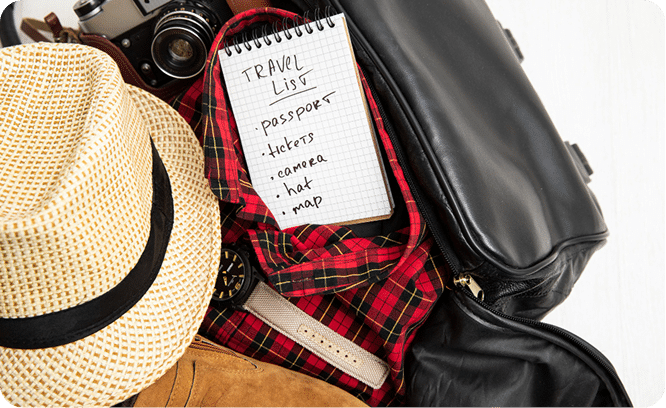

Why travel insurance matters

Even the best-planned trips can face unexpected challenges. Travel insurance provides a reliable safety net when things don’t go as expected which includes medical emergencies, hospital care overseas, lost baggage or cancelled flights. With the right cover in place, you can travel confidently knowing that support is available when you need it most.

Types of travel insurance plans

Annual Multi-Trip

This offers ongoing protection for multiple trips within a 12-month period.

Cruise Travel Insurance

This is tailored for cruise holidays with benefits for missed ports, medical care at sea and cabin confinement.

Single Trip

Provides cover for a single holiday, short break or one-off trip abroad.

Backpacker Insurance

It is designed for individuals who travel for extended periods or multi-destinations in one trip.

Winter Sports Cover

Adds protection for activities like skiing and snowboarding, including equipment and piste closure.

Business Travel Insurance

This is a type of insurance that supports work-related travel with protection for business equipment and disruptions.

Family Travel Insurance

Covers you and your family under one policy for convenience and value.

Pre-existing Medical Travel Insuance

Designed to cover travellers with declared medical conditions, providing medical and emergency support while abroad.

Worldwide Travel Insurance

One policy that protects your entire family against medical emergencies, cancellations, and lost belongings during travel.

90 Days Travel Insurance

Extended travel cover for journeys lasting up to 90 days, ensuring continuous protection throughout your trip.

Over 70s Travel Insurance

Specialised cover for travellers aged 70 and above, including emergency medical assistance and travel support.

What our policy covers

What is typically covered?

Trip cancellations If unforeseen events force you to cancel or shorten your trip, this could be illness, family emergencies, or other insured reasons, your policy can help reimburse prepaid, non-refundable travel and accommodation costs.

Personal liability If you accidentally cause injury to another person or damage their property while travelling, liability cover can help protect you from the financial consequences of legal claims and compensation costs.

Travel delays and missed departures

If delays beyond your control disrupt your schedule, you may receive compensation for unexpected expenses such as meals, accommodation, and rearranged travel plans, depending on the policy terms.

Emergency medical treatment

Suppose you fall ill or get injured overseas. In that case, travel insurance can cover the cost of medical treatment, hospital bills, ambulance services and emergency dental care, expenses that can be significantly higher outside the UK.

Repatriation In the event of a serious medical emergency, travel insurance can cover the cost of transport back to the UK, ensuring safe return with appropriate medical support if needed.

What is typically covered?

Missed flights due to late arrival If you miss your flight simply because you arrived late at the airport, this is generally not an insurable event. Travel insurance is designed to cover unforeseen circumstances, not delays caused by personal time management. Only disruptions outside your control, such as severe traffic accidents or public transport failures, may be considered under specific policy conditions.

Travel to destinations under official government warnings Most insurers will not cover travel to countries or regions where the UK government has issued an official warning against all travel or all but essential travel. Travelling to these destinations increases personal risk significantly, and any claim made while in a restricted zone is likely to be excluded. Always check government travel advisories before finalising your plans.

Undeclared pre-existing conditions If you have a medical condition and don’t disclose it when buying your policy, your insurer may not cover any claim related to that condition. This is because insurance relies on accurate information to assess risk. Failing to declare a condition, even unintentionally, can invalidate parts of your cover and leave you responsible for medical costs that would otherwise have been insured.

Incidents involving alcohol Most travel insurance policies exclude claims arising from excessive alcohol consumption. If an accident, injury or lost item occurs while you are under the influence, insurers may decline the claim because of alcohol-impaired judgment.

How much does travel insurance cost?

There are key factors that will affect the price you pay, which include:

Where you’re travelling (Europe vs. worldwide)

Destinations with higher medical costs or greater risks usually mean higher premiums. For example, worldwide cover, particularly including the USA or Canada is typically more expensive than European-only protection due to healthcare pricing differences.

Duration of the trip

Longer trips increase the chance that something could go wrong, so the length of your holiday has a direct impact on the cost of your policy. Short breaks usually cost less to insure than extended travel.

Your age and health

Insurance pricing reflects the likelihood of needing medical support abroad. Older travellers or those with certain pre-existing conditions may pay slightly more because they face higher health-related risks while travelling.

Level of cover you choose

Policies with higher limits, broader benefits, and lower excess fees offer more protection, but often come at a higher price. Choosing the right balance ensures you’re covered without paying for features you may not need.

How to get affordable travel insurance online

Compare Quotes

Comparing quotes from several brands at once makes it easier to assess whether the price and features meet your needs.

Consider optional extras

Optional add-ons can enhance your coverage, but it’s worth checking whether they're already covered by other policies.

Consider annual cover

If you travel more than twice a year, an annual multi-trip policy can be a great money-saving option

Increase your excess

Choosing a higher excess can help reduce your premiums. However, if you do have to make a claim, you will have to pay more toward it.

Group travel cover

Grouping family members or multiple travellers under one policy may be cheaper than taking out separate cover for each person.

Be mindful of trip length

With single trip cover, your premiums reflect the length of your trip, so don’t pay more than you need.

Get Travel Insurance with Quays

Choosing the right travel insurance shouldn’t feel complicated. With Quays, you can compare trusted UK providers in one place and find a policy tailored to your destination, travel style and budget. Our platform is designed to give you clear, reliable information so you can make confident decisions without the stress of navigating multiple websites or confusing terms.

When you search with Quays, you get access to competitive pricing, straightforward explanations and a wide range of cover options from essential single-trip protection to comprehensive worldwide policies. Every quote is presented transparently, helping you understand what’s included before you buy. Once you have found the right policy, you can purchase it online in minutes and receive instant confirmation.

Tips & Advice

Frequently Asked Question

Do I really need travel insurance?

Yes. Without insurance, you may be responsible for unexpected costs such as emergency medical treatment, lost luggage or cancellations. Travel insurance offers essential protection throughout your trip.

When should I buy travel insurance?

Ideally, as soon as you book your trip. This ensures you’re covered if you need to cancel before you travel due to an insured reason.

Can I get insurance if I have a pre-existing medical condition?

In most cases, yes — as long as you declare any conditions when getting your quote. Failure to disclose medical history may affect your ability to make a claim.

Does travel insurance cover COVID-19?

Many providers include COVID-19 benefits, such as cancellation or medical cover, but details vary by policy. Always check what’s included before purchasing.

Is worldwide cover the same everywhere?

Not necessarily. Some policies exclude higher-cost regions like the USA, Canada or the Caribbean unless specifically selected. Make sure you choose the correct destination zone.

What is the difference between single-trip and annual multi-trip cover?

Single-trip policies offer cover for one holiday. Annual multi-trip insurance protects you for multiple trips within a 12-month period and may be better value for frequent travellers.