Holidays are a great time to relax, unwind and have fun but planning it can be a tedious experience. Planning your next holiday should not be stressful. It is however important to prepare for unexpected events like medical emergencies, flight cancellations or lost baggage that can happen during your trip. Travel insurance becomes crucial in this situation and having the right type of coverage even more so.

Selecting the appropriate coverage can protect you from expensive interruptions and provide you with the assurance that you are covered in the event of an emergency, allowing you to enjoy your travels. We’ll walk you through the process of selecting the best travel insurance for your upcoming vacation in this guide, helping you understand what to look for, what to avoid, and how to make an informed selection before departing.

What is travel insurance and why do you need it?

Travel insurance is a type of cover that protects you financially in the event that something goes wrong before or during your trip. It acts as a financial safety net for your trips, shielding you from unforeseen circumstances. A comprehensive travel insurance policy covers medical emergencies, trip cancellations, lost or stolen baggage, and travel delays.

For UK travelers, travel insurance is extremely important as medical treatment and emergency services can be very expensive abroad. In some countries, healthcare costs are through the roof and a simple hospital stay can cost thousands of Pounds. However, if you’re insured you do not need to worry about this as your provider will cover the cost of your treatment and even pay for repatriation back to the UK if it becomes necessary.

Why travel insurance is essential

Travel insurance protects you not only when you are on a trip, it covers you even before you leave your house. It covers non-refundable expenses like airfare, hotel accommodation, excursions and tickets for tours and other vacation activities if you have to cancel your trip due to illness, injury or any personal emergency involving you or a family member.

Travel insurance guarantees peace of mind. No matter where you are in the world as long as your trip is insured, you can also get help if something goes wrong because you will have access to emergency support at all times. Travel insurance ensures that you’re never left to manage an emergency on your own, whether it is getting you to a hospital, replacing lost valuables or getting you home safely

Travel insurance is essential because:

- Medical emergencies can be expensive

- Flight delays and cancellations can disrupt your plans

- You may lose money of hotel bookings

- Lost, stolen or damaged luggage are common with travels both local and international

- A family emergency can force you to cancel your trip

- If an unforeseen situation causes you to cut your trip short, you can be refunded for paid excursions and activities

Travel insurance ought to be an essential part of planning your next trip, not just an optional extra like an extra topping on a fully iced cake. Making it a key component of your trip guarantees that you can have fun without worrying about what can go wrong.

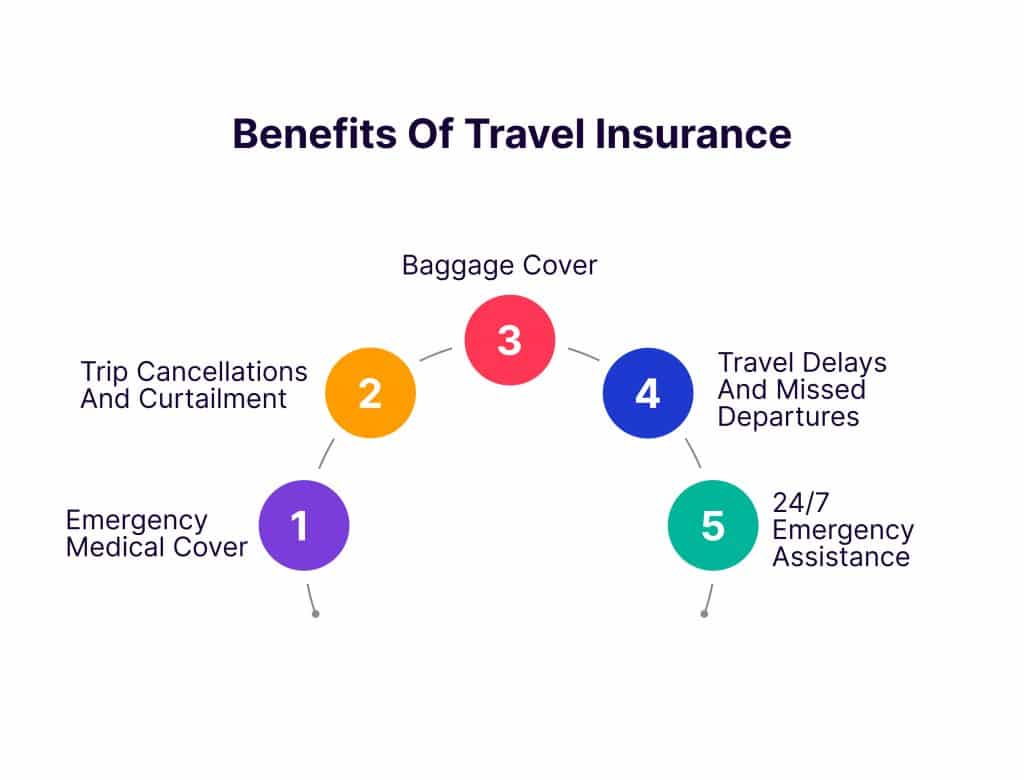

Benefits of travel insurance

In addition to offering basic protection for your trips, travel insurance also provides financial security, peace of mind and professional expert support when you need it most. Having the appropriate coverage in place prepares you for every scenario that may play out whether you are travelling for leisure or business.

Here are the key benefits of travel insurance

- Emergency medical cover: this is one most significant advantage of travel insurance. A comprehensive travel insurance will pay for hospital care, tests, prescription drugs, emergency surgery, and ambulance costs if you get sick or injured while travelling. It can also cover emergency repatriation if it is medically advised.

- Trip cancellations and curtailment: travel insurance can cover non-refundable expenses like airfare, accommodation, and pre-booked activities if you have to cancel your vacation or cut short your trip due to illness or bereavement.

- Baggage cover: your personal belongings are covered by travel insurance, your insurance provider will cover some or all of the cost of replacing your passport, luggage or other valuables if they are stolen or damaged while travelling.

- Travel delays and missed departures: Another frequent source of annoyance when travelling is delays and missed departures. If your trip doesn’t go as planned, you might be eligible for reimbursement for travel delays, which could help pay for lodging, meals, or alternate transportation.

- 24/7 Emergency assistance: The availability of round-the-clock emergency support is possibly one of the most overlooked benefits of travel insurance. The majority of UK travel insurance plans offer 24-hour assistance, providing you with instant access to professionals who can set up medical care, communicate with local authorities, or provide advice if you experience any difficulty while abroad.

The peace of mind that travel insurance provides is possibly one of its biggest benefits. Knowing that you can relax and enjoy your vacation without worrying about unforeseen problems.

Factors to consider when choosing travel insurance

Whether you are thinking of a weekend getaway, a fun adventure trip, backpacking across Asia or travelling for business, making sure you have the right level of coverage for your travel needs is more important than simply finding the best deal when selecting a travel insurance policy. With so many policies to choose from, knowing the important aspects to take into consideration will enable you to make an informed and confident choice. Here are some key factors you must consider when choosing travel insurance

Destination

Where you are travelling to is one of the first things you consider when getting travel insurance. Your destination determines the amount you pay and the level of coverage you get. Travelling within the EU usually has a different insurance than other parts of the world, some providers call it Europe-only travel insurance or worldwide travel insurance. Healthcare costs more in some countries hence you should make sure that you are adequately covered for the country you intend to visit.

Length of your trip

Another crucial consideration is the nature and duration of your trip. Single-trip travel insurance can be the best choice if you’re going on a one-time vacation. An annual multi-trip coverage, however, can provide superior value and convenience if you travel frequently. Make careful to review any annual policy about trip time restrictions

Medical history

You should also carefully assess your medical history before you decide on the insurance policy that suits your trip. When buying travel insurance, you should disclose any pre-existing medical conditions. Many UK insurers provide coverage for a variety of conditions, but if you don’t disclose them, your policy may be void and your claims may be denied.

Coverage level and policy limits

Carefully consider the maximum amounts provided for personal things, baggage, medical costs, and cancellation. Lower limitations on low-cost coverage might not be adequate in the event of a serious incident. It’s also crucial to check the excess, or the amount you’ll have to contribute to a claim.

Activities and sports

The activities you intend to engage in should also be taken into account. Adventure sports, winter sports, and high-risk activities may not be covered by standard coverage. If skiing, hiking, scuba diving, or other similar activities are part of your vacation, make sure they are stated clearly in your policy, some providers charge an additional premium and offer them as optional extras.

Policy exclusions

Finally, go over the fine prints in your policy document to determine the exclusions in the policy. Knowing what is and isn’t covered is crucial in order to avoid any surprises in the event that you need to file a claim. Take the time to read the terms and conditions.

By carefully considering these factors, you will select travel insurance that provides the ideal mix of value, coverage, and peace of mind, freeing you up to enjoy your vacation rather than worry about potential problems.

The European Health Insurance Card (EHIC)

The European health insurance card is not a replacement for travel insurance, it however entitles the holder to state-provided healthcare in countries within the European Union at a discounted rate or sometimes even free. You still need to get travel insurance even if you have an EHIC because it does not cover the following:

- Repatriation to the UK

- Mountain rescue

- Lost, stolen or damaged luggage

- Trip cancellation and delays

- Paid excursions

- Winter sports and activities

When visiting Europe, you should always obtain a comprehensive travel insurance, even if you have an EHIC card

How to choose the right travel insurance provider?

Choosing the right level of coverage is as important as selecting the suitable travel insurance provider. In the event that something goes wrong before or during your trip, a reputable insurer ensures that you get timely assistance, a fair treatment, and a seamless claims process.

The insurance industry in the United Kingdom is regulated by the Financial Conduct Authority (FCA), ensuring that the provider you choose is duly accredited by this body. This will guarantee your peace of mind that your provider complies with the stringent regulations set by the FCA and will provide suitable cover for your trip.

What to look for in a travel insurance company

Here are some of the things you should look out for when choosing a travel insurance provider

Customer support

This is perhaps one of the most important characteristics of a good travel insurance provider. No matter where you are in the world, you should have access to round-the-clock emergency support. Being able to communicate clearly and quickly is crucial in stressful situations like medical emergencies or travel disruptions.

Claims filing process

Claims filing process should be seamless and straightforward with clear instructions on the documents you need to provide. For most providers you can file your claims online without visiting their physical office or handling too much paperwork. The right provider should have fast processing and claims payment times.

Customer reviews and ratings

Visit the websites of providers to read customer reviews and ratings on their service. You can learn more about how they manage claims, customer complaints and how they handle emergencies by reading reviews left by other travelers. Rather than focus on pricing alone, look for providers that have consistently positive reviews.

Flexibility

If you decide to extend your vacation or include optional covers like winter sports or cruise travel, ensure that your provider allows this kind of extension mid-trip. Whether you require coverage for pre-existing medical issues, winter sports, business travel, or annual multi-trip coverage, the right provider should give a variety of policies and extra add-ons so you can customize your travel insurance to meet your needs.

Policy wording

The policy should be worded in plain simple English with no hidden exclusions. If there are exclusions in the policy, they should be clearly stated and unambiguous so that you can travel with confidence and not be disappointed if you have to file a claim because you know exactly what is covered and what is not.

Conclusion

An essential first step in planning your next holiday is choosing the right travel insurance. Travel insurance offers crucial protection against unforeseen circumstances that could otherwise result in substantial financial loss or needless worry, despite the temptation to see it as an optional extra.

You can choose a policy that really suits your holiday plans by knowing what travel insurance covers, appreciating its benefits, and carefully taking into account factors like your destination, medical requirements, and scheduled activities. Selecting a trustworthy insurance provider is equally crucial since it guarantees that, should the need arise, you will have access to dependable assistance, unambiguous guidance, and a seamless claims procedure.

With a comprehensive cover you can focus on creating memories, exploring new destinations, and enjoying your holiday knowing that you are protected every step of the way.