Compare pet insurance quotes from the UK’s leading insurance providers

We simplify your search by comparing policies from over 25+ top-rated UK insurers all in one place. We help you compare key features like: vet fee limits, cover types (lifetime, accident-only, etc.), excess amounts to get cover for your dog, cats and rabbits.

Easily set and manage reminders, from vet appointments to flea treatments and even personal notes. Quays helps keep both your pet’s care and your personal tasks on track, so you never miss a thing.

Our platform connects you with fellow pet parents for advice, tips, and shared experiences, so you’re never navigating pet care alone.

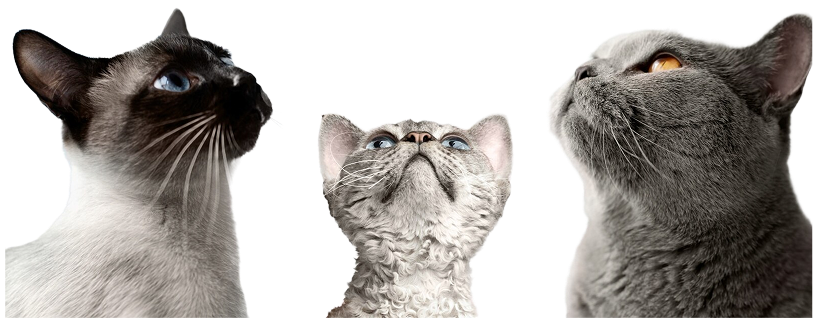

Why Insure Your Cat?

Cats are curious explorers, always climbing, jumping, and sometimes getting into trouble! From sudden illnesses to unexpected accidents, vet bills can add up fast. Cat insurance ensures your feline friend gets the best care without draining your wallet.

Why Choose Quays?

At Quays, we know your cat is more than just a pet, they’re family. That’s why we offer coverage that keeps your furry friend happy and healthy, with benefits that make life easier for you.

24/7 Access to our Veterinary Helpline

Worried about your pet in the middle of the night? Our round-the-clock veterinary helpline connects you with experts anytime, so you can get advice and peace of mind whenever you need it.

Quick & Simple Claims Process

No complicated forms or endless waiting! With Quays, you can easily submit and track your claims through our user-friendly online portal.

Illness & Accidents Covered

From unexpected injuries to sudden illnesses, Quays ensures your cat gets the best treatment without breaking the bank.

Policies with Third-Party Liability

Accidents happen, and we’ve got you covered. Our insurance policies include third-party liability, so if your pet causes damage to property or injury to others, you won’t have to pay for it out of pocket.

Join the Best Community of Pet Lovers

At Quays, you’re not just a policyholder, you’re part of a passionate pet-loving community where you get access to expert tips & exclusive pet events.

What does cat insurance cover?

Cover varies by provider and policy, so always check your insurance documents.

Typically covered

- Vet fees for illnesses and injuries

- Emergency treatments & surgeries

- Dental care for accidents or disease-related issues

- Third-party liability (where applicable)

- Loss or theft cover (optional add-on)

- End-of-life cover (including euthanasia & cremation costs)

Not typically covered

- Pre-existing conditions

Pet Tips & Advice

Frequently Asked Question

What is the average cost of cat insurance?

The average cost of cat insurance depends on factors like age, breed, location, and coverage type. However, here is a general cost breakdown

- Basic accident-only plans: $10–$20/month (£7–£15 in the UK)

- Comprehensive plans (accidents & illnesses): $25–$60/month (£15–£40)

- Premium plans with wellness add-ons: $50–$100/month (£30–£70)

Purebred cats and older cats usually have higher premiums due to a greater risk of health issues.

Is insurance worth it for cats?

Yes, cat insurance is often worth it since unexpected vet bills can range from £800 to £5,000. Insurance ensures you can afford care without financial strain. It’s particularly valuable for kittens (avoiding future coverage gaps), senior cats (prone to chronic illness), and outdoor cats (at higher risk of accidents or injuries).

Is it worth having cat insurance in the UK?

Yes, cat insurance is worth it in the UK, as vet fees can be costly. The average vet bill for unexpected illnesses can range from £500 to £2,500. With pet insurance, you can claim back a significant portion of these costs, reducing financial strain. Also, UK policies often offer third-party liability coverage in case your cat causes injury or property damage.

Do cats have to be microchipped?

Yes. As of June 2024, it is a legal requirement for all pet cats over 20 weeks old to be microchipped. Owners who fail to comply could face fines of up to £500.

What else does cat insurance include?

Depending on the policy, cat insurance may cover dental care (injuries or extractions), behavioural therapy, alternative treatments like acupuncture, boarding fees, lost pet advertising and rewards, and in some cases, euthanasia and cremation.

Can I get pet insurance for my older cat?

Yes, but options may be limited. Some insurers have age restrictions (often 10–14 years for new enrollments), and premiums for older cats are higher due to increased health risks. However, if your cat is already insured before reaching senior age, their policy can usually continue for life.

What are the most common cat health problems?

Cats are prone to several health conditions, including:

- Dental disease

- Kidney disease

- Urinary tract infections (UTIs) & blockages

- Diabetes

- Hyperthyroidism

- Cancer.

- Obesity-related illnesses

- Parasites (fleas, ticks, worms) – Even indoor cats can be affected.

- Feline asthma Heart disease

Does cat insurance cover pre-existing conditions?

No, most policies do not cover pre-existing conditions (health issues that were diagnosed or showed symptoms before you enrolled). However, some insurers may cover curable pre-existing conditions if your cat has been symptom-free for a certain period (e.g., 6–12 months).