Bunnies may be small but vet bills certainly aren’t! Accidents and illnesses can occur at any time, regardless of whether your pet enjoys cuddling inside or bouncing around the garden. Additionally, the expenses of treating dental problems, digestive disorders, or even an unanticipated injury can mount up rapidly. Rabbit pet insurance can help with that!

But how can you choose the best policy when there are so many available? Does a basic accident-only plan suffice, or do you require lifelong coverage? What is and is not truly included? Rest assured that we have you covered! Everything you need to know about rabbit insurance will be included in this guide, along with how to compare rabbit pet insurance and assistance in selecting the best plan for your pet. Let’s get started!

Why Do I Need Rabbit Insurance?

Rabbits need just as much care and attention as cats and dogs, despite the common misconception among pet owners that they are low-maintenance animals. Costs associated with veterinary care can mount up rapidly, particularly when unforeseen health problems occur. By helping to pay for these costs, rabbit insurance makes sure your pet receives high-quality health care without breaking the bank. Here’s why it makes sense to have a policy in place:

Veterinary Costs

Rabbits can have unexpectedly huge medical expenses despite being tiny creatures. More complicated treatments, such as surgery for intestinal stasis or dental problems, can cost hundreds or even thousands of pounds, whereas a basic veterinary consultation can cost between thirty and fifty pounds. In order to prevent you from being unprepared for an emergency, insurance helps offset these expenses.

Rabbits are Prone to Health Issues

Due to their delicate nature, rabbits have special medical needs. Among the most prevalent ailments that require veterinary care are:

- Dental disease: Rabbit teeth grow continuously and this can cause discomfort if not properly managed.

- Gut Stasis: A potentially fatal disorder in which the digestive system stalls or slows down.

- Respiratory Infections: Rabbits are prone to respiratory problems that may make breathing difficult, antibiotics and constant care are necessary to prevent or manage these issues.

- Parasites and Infections: If left untreated, diseases like flystrike, a severe skin ailment, and ear mites can be lethal for your precious bunnies.

By taking out an insurance policy, you can ensure that your rabbit gets timely, expert care, increasing the possibility of a full recovery.

Accidents and Emergencies

Not every accident can be avoided, even by the most careful rabbit owners. An experimental nibble on something hazardous could end in poisoning, or a simple jump from a high surface could result in a broken leg. Because emergency care can be expensive, having insurance allows you to take quick action without worrying about the cost.

Protects Against Loss or Theft

Certain rabbit insurance plans provide protection in the event that your pet is lost or stolen. They also offer financial support for advertising to locate them or even compensation in the event that they are not retrieved. Your chances of finding a lost or stolen pet is greatly increased if your rabbit is microchipped and insured.

Peace of Mind

Nobody wants to find themselves in a situation where they must decide between their financial status and the health of their rabbit. Insurance gives you peace of mind by guaranteeing that you can always afford to give your pet the best care possible.

Ultimately, rabbit insurance is about safeguarding both your pet and your wallet. It doesn’t matter if your policy covers regular checkups, emergency surgery, or long-term therapies; it can make all the difference in having your rabbit hopping healthily.

What Level of Cover Can I Get for My Rabbit?

Selecting the appropriate level of coverage is crucial to ensuring your pet has the finest care possible without going over budget, as not all rabbit insurance plans are the same. There are four primary types of rabbit insurance: Time-Limited, Maximum Benefit, Accident-Only, and Lifetime Coverage. It’s crucial to understand the features of each policy type before choosing one because they all provide varying degrees of protection.

- Accident-Only

This is the most affordable option for rabbit insurance but it provides the least amount of coverage. As the name implies, it only covers veterinary expenses related to accidents like cuts, poisoning, or fractured bones. But it won’t pay for general checkups, chronic problems, or illnesses. This plan is ideal for budget-conscious owners seeking a certain amount of insurance against unforeseen mishaps. It is however not recommended for owners with bunnies prone to illnesses as it does not cover ailments like respiratory infections or intestinal stasis.

- Time Limited

Accidents and illnesses are covered by a time-limited coverage, but only for a predetermined amount of time, usually 12 months for each ailment. For up to a year, the insurer will pay for any medical problems your rabbit may have; after that, you will be responsible for paying for the bills yourself. This isn’t the best option for long-term ailments, but it may be helpful for acute ones. This plan is ideal for owners seeking short-term medical coverage policy at an affordable price. On the other hand, it is not recommended for rabbits with chronic or recurring illnesses because the cover expires after a year.

- Maximum Benefit

This policy covers accidents and illnesses for up to a certain amount of money per condition. There is no time limit on claims, unlike the time-limited insurance; you can keep filing claims for the same condition until you hit the maximum payout amount. However, the condition is no longer protected after you reach that limit. This plan is ideal for rabbit owners looking for mid-range coverage without lifetime commitments. It is not suitable for rabbits with chronic conditions that may eventually require more funds that surpass the payout cap.

- Lifetime Cover

The most expensive and comprehensive kind of rabbit insurance is lifetime coverage. As long as you renew the policy annually, it covers both accidents and illnesses for the duration of your rabbit’s life. Lifetime cover is beneficial for pets with ailments that could require long-term treatment, such as dental disease, arthritis, or digestive problems. Lifetime cover is ideal for owners looking for complete security and peace of mind particularly for older rabbits or breeds with a history of health challenges. However, it may not be suitable for those looking for affordable insurance.

The different types of rabbit insurance, what it covers and its pros and cons are outlined in the table below:

Insurance Type | Description | Pros | Cons |

Accident-only | Covers treatment costs for injuries resulting from accidents. | Ideal for owners on a budget who only want basic protection. | Provides limited coverage |

Time-Limited | Covers illnesses and injuries for a set period (e.g., 12 months per condition). | Provides short-term coverage for minor illnesses. | Cover expires after one year |

Maximum benefit | Covers each condition up to a set financial limit, without a time restriction | Ideal for owners looking for mid-range coverage. | Not suitable for rabbits with chronic conditions |

Lifetime cover | Provides coverage for chronic and ongoing conditions throughout a rabbit’s life. | Perfect for owners who want the best and most comprehensive protection. | It can be pricey for budget-conscious owners |

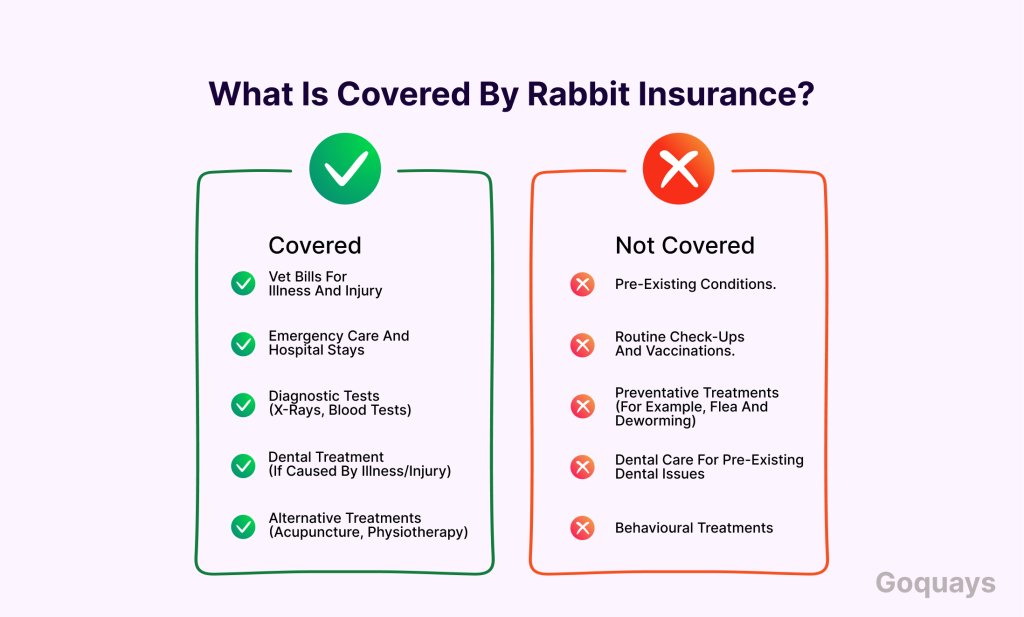

What is Covered by Rabbit Insurance?

It’s important to know exactly what your rabbit insurance policy covers and what it doesn’t in order to prevent unforeseen expenses when you need to file a claim. Although policies differ from one provider to the next, most cover necessary medical costs but not specific procedures or conditions. To assist you in making an informed choice, we have broken down the main inclusion and exclusions below.

What’s Covered

- Vet bills for illness and injury

- Emergency care and hospital stays

- Diagnostic tests (X-rays, blood tests)

- Dental treatment (if caused by illness/injury)

- Alternative treatments (acupuncture, physiotherapy)

What’s Not Covered

- Pre-existing conditions.

- Routine check-ups and vaccinations.

- Preventative treatments (for example, flea and deworming)

- Dental care for pre-existing dental issues

- Behavioural treatments

How to Compare Rabbit Insurance?

With so many providers offering varying levels of coverage, selecting the best rabbit insurance policy can be difficult. You should carefully consider each policy’s specifics in order to choose the best option for both your pet and your budget. These are the most crucial elements to take into account when comparing rabbit insurance policies.

Type of Coverage: Comprehensive vs Accident-Only Plans

Verifying whether the policy covers illness and accidents or just accidents should be one of the first things you check. Although accident-only plans are less expensive, they do not cover common ailments that are common to rabbits, like dental disease, respiratory infections or intestinal stasis. There are different levels of coverage but a comprehensive plan provides more protection for your beloved bunny. You may also want to consider lifetime coverage if you want total protection because it provides coverage for chronic diseases for the entire life of your rabbit.

Maximum Payouts Limits: How Much Will Your Insurer Pay?

Most insurance companies have caps on the maximum amount they will pay out for each disease, per year, over the lifetime of your rabbit. Consider the limit set for each condition, this is the set sum made available for every disease or trauma. Also verify the annual limit which is the maximum amount, irrespective of condition, that you are eligible to receive each year, as well as the lifetime limit which is the maximum amount you can claim during the course of your rabbit’s life.

For example, if your veterinary bill for the entire year is £3000 and your policy has a yearly maximum limit of £2000, you will be required to pay the additional £1000 out of pocket.

Exclusions and Limitations: What’s Not Covered?

Every insurance policy has exclusions. It is important that you know what is covered in your plan and what is not. Typical exclusions from rabbit insurance policy include:

- Pre-existing conditions for diseases diagnosed prior to the issuance of the policy

- Routine care that includes vaccinations, dental check-ups, flea treatment and neutering.

- Age limits, some providers have a specific age limit for their coverage plans, this usually affects older rabbits.

- Breeding-related problems such as pregnancy related expenses will not be covered if your rabbit is used for breeding.

It is important that you read through the fine prints containing the terms and conditions of your policy to ascertain what will be covered and what will not.

Excess Fees: How Much Will You Pay Per Claim?

The amount you have to pay before your insurance pays the remaining balance is known as an excess fee. Insurers may have:

- Fixed excess: a predetermined sum that you pay for each claim for example, £50 per veterinary visit.

- Percentage excess: a portion of the vet’s bill, such as 10% of the entire cost.

For example, if your vet bill is £500 and your excess fee is £50, your insurer will pay £450 and you will pay the remaining £50.

Vet Networks and Direct Payment Options

Some insurance companies only pay for care at particular clinics because they have preferred vet networks. Others let you see any veterinarian with a license. You won’t have to pay upfront and wait for reimbursement because some suppliers also pay veterinarians directly. For high veterinary expenditures, this can be beneficial. It is important that you verify whether the policy covers your preferred vet and if direct payments are an option.

Multi Pet Discounts and Extra Add-ons

Some insurance companies provide multi-pet discounts, which might help you save money if you own more than one rabbit or other pets. Additionally, some policies allow you to include optional extras such as:

- Theft and loss coverage: in the event that your rabbit disappears, the insurer will pay for advertising costs and offer reward money.

- Alternative therapies: these can come as extra add-ons, they include acupuncture, hydrotherapy and physiotherapy.

Boarding fees: pays for temporary boarding if you’re hospitalized or need to travel.

How Much is Pet Insurance for a Rabbit?

There are many factors that affect the price of rabbit insurance, some of them include:

- Location: insurance providers determine your premium costs based on where you live. Type in your postal code on our website to get a quote.

- Your Budget: this will determine the level of coverage you receive. Lifetime coverage provides the highest level of protection though it is the most expensive.

- The age and breed of your rabbit: certain breeds are more likely to experience health problems, so lifetime coverage is the smart choice.

- Your Risk Tolerance: A maximum benefit or lifetime coverage is the ideal choice if you would rather be ready for any medical emergency.

- Medical History: if your rabbit has pre-existing conditions that you want covered, your premium will be more expensive.

When choosing rabbit insurance, don’t just settle for the cheapest option, instead look for a policy that strikes the ideal balance between affordability and coverage. You can make an informed choice that guarantees your rabbit has the best treatment possible without incurring unexpected expenses by carefully reviewing the payout limits, exclusions, excess fees, and extra perks.

Making the Best Decision for You and Your Rabbit

Ultimately, the right rabbit insurance policy should give you peace of mind that your pet will always receive the best care, without financial stress. By doing your research and making an informed choice, you can ensure a long, happy, and healthy life for your beloved bunny.

Many rabbit insurance providers offer online quote tools, so you can get an estimate based on your rabbit’s breed, age, and medical history. If you have multiple rabbits, multi-pet discounts can make coverage more affordable. You should also think about whether the insurer offers customer support and an easy claims process, as these can be crucial when you need urgent assistance.

A Quays we offer you the best, affordable and reliable insurance for your beloved bunny. Click on the link below to get a free quote.

By comparing policies carefully, you can ensure your furry friend gets the best possible care without financial stress. Have you insured your rabbit yet? Let us know in the comments!