Rabbits are becoming a more and more popular pet due to their intelligence and cuteness. They can, however, experience health problems that call for the vet’s attention, just like dogs and cats. Many rabbit owners question whether pet insurance is worthwhile given the escalating cost of veterinary care. Let’s examine the benefits, and limitations of rabbit insurance.

Rabbit insurance can help you manage costs while ensuring your pet receives the best care. However, is it really necessary? What does it cover? we’ll go over everything you need to know about rabbit insurance so you can make an informed decision for you and your cherished bunny. Rabbits may be small, but when it comes to veterinary bills, the costs can be surprisingly high! From unanticipated injuries to common health issues like dental disease and digestive troubles, rabbit owners frequently face exorbitant treatment bills.

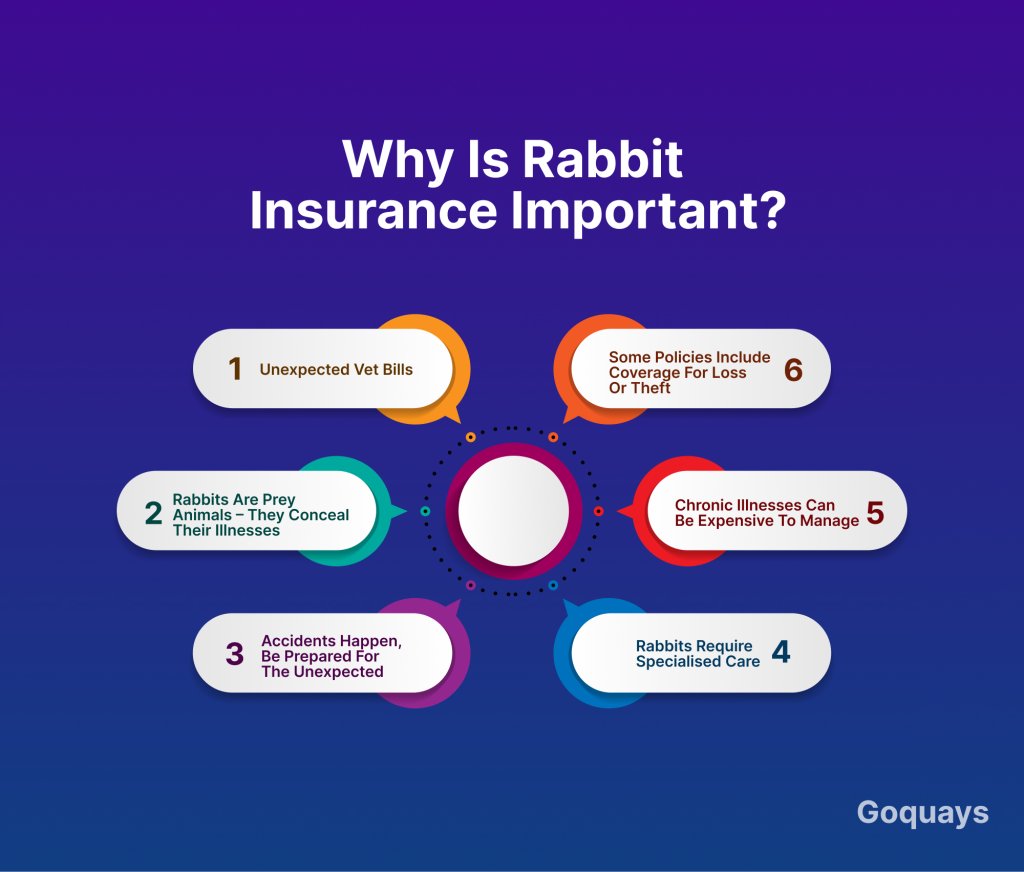

Why is Rabbit Insurance Important?

Although they make wonderful, loving pets, rabbits are delicate animals with complicated medical requirements. Rabbits need specialised veterinarian care, which can be expensive, unlike cats and dogs. Having pet insurance for your rabbit guarantees that you won’t have to worry about money when it comes to necessary treatments. The following are some reasons why rabbit insurance is important:

- Unexpected Vet Bills

Serious health problems such respiratory infections, dental disorders, and gastrointestinal stasis are common in rabbits. Depending on the severity, treatment for these disorders can easily cost hundreds or even thousands of pounds. Many pet owners find it difficult to pay for these expenses without insurance, which might occasionally force them to make tough choices regarding their pet’s care.

- Rabbits are Prey Animals – They Conceal Their Illnesses

As a survival instinct, rabbits, unlike dogs or cats, have learnt to conceal symptoms of disease. The illness is usually advanced by the time symptoms appear and would require urgent medical attention. When time is of the essence, insurance helps pay for emergency veterinary care, diagnostics, and treatments.

- Accidents Happen, Be Prepared for the Unexpected

Even with the best care, rabbits can sustain unintentional injuries including wounds from fights with other pets, digestive blockages from eating foreign things, or broken bones from falls. In an emergency, insurance covers the cost of X-rays, procedures, and hospital stays.

- Rabbits Require Specialised Care

Not every veterinarian is prepared to care for rabbits. Because of their extensive training and specialised equipment, specialized vets charge higher fees. These more expensive consultation fees can be partially covered by insurance, guaranteeing your rabbit receives the proper care it deserves.

- Chronic Illnesses Can Be Expensive to Manage

Some rabbits get chronic illnesses including liver disorders, heart disease, or arthritis that need constant care and medication. In the absence of insurance, these costs can mount up rapidly. A sound policy guarantees ongoing care for your rabbit without breaking the bank.

- Some Policies Include Coverage for Loss or Theft

It may surprise you to learn that rabbits, particularly rare breeds, can be stolen. In the event that your rabbit is lost or stolen, some insurance policies will cover the cost of recovery or compensation.

- Peace of Mind for Every Rabbit Owner

Owning a rabbit should not be a stressful experience, it should be a happy one. Pet insurance frees you from worrying about future medical bills so you can concentrate on providing your rabbit with a happy and healthy life. You can relax knowing that you have enough money for both routine checkups and unforeseen illnesses.

Although it may not be required, rabbit insurance can come in rather handy in the event of unforeseen medical problems. Purchasing quality insurance coverage is a wise choice if you want to provide the best care for your pet while keeping your finances safe.

What Does Rabbit Insurance Cover?

Rabbit insurance is intended to help cover the cost of medical treatment and other unforeseen expenses, in order to ensure that your pet receives the finest care possible without leaving you with a large vet bill. The following are the most common things that rabbit insurance usually covers, though policies can vary based on the provider and the level of coverage selected:

Vet Fees for Illnesses and Injuries

Like other pets, rabbits are susceptible to a variety of diseases and accidents that require medical attention. Generally, insurance covers:

- Common illnesses, which include bladder problems, gastrointestinal (GI) disorders, and respiratory infections.

- Accidents and injuries: Covers injuries from chewing strange items, fight wounds, and broken bones from falls.

- Hospitalisation: Should your rabbit require hospital stay for monitoring or care.

- Specialist care: Consultations with specialised veterinarians that are experts in rabbit care may be covered by some policies.

Emergency and After-Hours Care

Due to their tendency to conceal illnesses, rabbits frequently require immediate medical intervention by the time their symptoms become obvious. Insurance can cover:

- Emergency veterinary care if your rabbit requires urgent care outside of regular business hours.

- Out-of-hours fees: Additional costs incurred by going to the veterinarian on the weekends, in the evenings, or on public holidays.

Diagnostic Tests and treatments

Veterinarians often need to perform tests and diagnostics in order to properly identify a rabbit’s illness. Insurance can assist with:

- Ultrasounds and X-rays: To look for tumours, digestive obstructions, or broken bones.

- Blood tests: To identify deficits, organ disorders, and infections.

- Biopsies and scans: In the event that a more thorough inquiry is required.

Surgery and Post-Operative Care

In the event that your pet requires surgery, the cost of surgery for your rabbit could be high. Insurance can cover both minor and major surgeries, including tooth extractions, fracture repairs, and tumour removal. Insurance also covers for:

- Medication and anaesthesia: Essential for operations and pain management.

- Rehabilitation and follow-up treatment, which includes wound care, physical therapy, and examinations.

Dental Care

One of the most prevalent health issues affecting rabbits is dental disease. Tooth extraction and trimming is covered by many insurance providers. Rabbit teeth grow continuously and become painful or grow too long. Insurance also covers the treatment of abscesses for dental infections that are frequent and may necessitate surgery.

Alternative and Complimentary Therapies

Some comprehensive plans provide coverage for alternative therapies that promote healing, such physiotherapy, which helps rabbits regain their range of motion following surgery or an injury. Also, some specialty veterinary clinics offer hydrotherapy and acupuncture.

Coverage for Theft, Loss, and Death

Some rabbit insurance providers offer monetary assistance in the event that your rabbit is misplaced, stolen, or dies:

- Rabbit cover lost or stolen: Certain insurance pay out if your rabbit is lost.

- Costs of reward and advertisement: Some insurance companies cover the price of advertising for a lost rabbit.

- End-of-life coverage: Some policies cover the expense of cremation and euthanasia.

Third-Party Liability

Though less common for rabbits than for dogs, some insurers offer liability coverage in case your rabbit causes damage or injury to another pet, person, or property.

What is Not Covered By Rabbit Insurance

Although rabbit insurance offers useful protection against medical costs, it is not comprehensive. In order to avoid claims for pre-existing conditions or normal care that pet owners are required to perform, insurance companies establish particular exclusions. You may select the best coverage and steer clear of unforeseen out-of-pocket costs by being aware of these exclusions. The following is a thorough explanation of what is normally excluded from rabbit insurance:

Pre-existing Conditions

With the exception of very few providers, most rabbit insurance providers do not cover ailments or injuries your rabbit suffered prior to obtaining the policy. This includes:

- Chronic conditions (such as arthritis or persistent dental disease) identified prior to the start of coverage.

- Injuries from the past that still present issues (e.g., a fractured leg that healed poorly).

- Congenital disorders (if identified before obtaining insurance).

Preventive and Routine Care

Costs for regular and preventative treatments like these are typically not covered by rabbit insurance policies.

- Annual check-ups – General wellness exams are usually out-of-pocket expenses.

- Vaccinations – Rabbit vaccines (like Myxomatosis and RVHD) are important but rarely covered.

- Parasite treatments – Flea, mite, and worm treatments are typically excluded.

- Grooming costs – Nail trimming, fur maintenance, and ear cleaning are not included

Neutering and Spaying

Since spaying or neutering a rabbit is regarded as a regular treatment, most insurance companies will not pay for it. The procedure may become medically necessary due to the following reasons:

- Cancerous tumours in reproductive organs.

- Aggressive behavior linked to hormones requiring intervention.

Cosmetic and Elective Procedures

These are procedures that are not medically necessary such as ear cropping or tail docking (which is uncommon for rabbits), cosmetic dental procedures that are beyond essential care will not be covered by most insurance providers.

Deliberate or Negligent Harm

Insurance companies won’t pay for medical expenses if your rabbit’s disease or injury is the result of carelessness or deliberate damage. This includes:

- Damage brought on by inappropriate handling (such as being dropped from a height).

- Health issues caused by an unsuitable environment (e.g., exposure to extreme temperatures).

- Malnutrition due to an improper diet.

Certain Dental Treatments

Regular tooth trimming for overgrown teeth and preventative dental procedures unrelated to a medical condition are two things that many insurers do not cover, even if some cover dental disease brought on by illness or injury.

Alternative therapies (Unless Otherwise Included)

Although some comprehensive plans cover alternative therapies, the following are frequently not covered by basic policies, hydrotherapy, acupuncture and chiropractic adjustments.

Breeding and Pregnancy Costs

Insurance policies usually do not cover the following if you breed rabbits; Pregnancy or delivery complication costs, veterinary care for newborn bunnies (kits) unless they are insured individually.

Although many necessary medical costs are covered by rabbit insurance, it’s crucial to be aware of the restrictions to prevent unpleasant surprises when filing a claim. If you want more coverage, always carefully examine the policy terms and think about getting a comprehensive plan.

How Much Does Rabbit Insurance Cost?

The cost of your rabbit insurance is affected by the factors such as the type of coverage you choose, the provider, the age and breed of your rabbit. Rabbit insurance typically costs between £5 to £15 per month, however comprehensive plans may cost more. Let’s examine the factors that influence the price of your insurance.

What are the Factors That Affect the Cost of Rabbit Insurance?

The cost of rabbit insurance is determined by the following factors:

- Level of Coverage

Rabbit insurance policies range from basic accident-only plans to comprehensive lifetime coverage plans. The more extensive the coverage, the higher the premium that you have to pay. Accident-only insurance, which is the least expensive option and costs between £5 and £7 a month, only covers injuries sustained in accidents. Time-limited policies cover injuries and illnesses for a predetermined amount of time, and usually costs £7 to £10 per month. Finally, Lifetime Coverage, which is premium and usually costs £10 to £15 a month, offers continuous coverage for conditions that persist and are renewed annually.

- The Age of Your Rabbit

Older rabbits are more likely to experience health problems, so their insurance costs are higher than those of younger bunnies. For example, a young rabbit (less than a year old) could cost £5 to £10 a month. While an older rabbit (5 years or older) may cost more than £15 a month due to additional health concerns.

- The Breed of Your Rabbit

Certain health issues that can affect insurance rates are more common in certain breeds of rabbits. Larger breeds like the Flemish Giant are more expensive to insure because they are more likely to develop heart and joint problems. On the other hand, smaller breeds such as the Netherland Dwarf that are more to dental issues may have higher premiums. Since ear infections are common in lop-eared rabbits like Holland Lop, their insurance costs are a little higher.

- Location

The cost of insurance might change depending on where you reside. Urban areas in cities like London, usually attract a higher vet expense which will ultimately raise the price of your insurance. Whereas in rural areas you will pay a significantly lower price for the same insurance cover.

Additional Costs to Consider

In addition to the monthly premium, there are additional fees that are included that you need to consider when buying rabbit insurance:

- Excess Fees

Most insurance policies require you to pay an excess (a portion of the vet bill) before the insurer covers the rest. Excess fees usually range from £50 to £100 per claim.

- Co-Payments for Older Rabbits

Some insurance companies demand you to pay a portion of the veterinarian expense in addition to the excess for older rabbits, who are aged five years and above. This is referred to as a co-payment, and it may represent 10 – 30% of the entire expenditure. For example, you would pay £100 plus any applicable excess fees if the veterinary charge was £500 and the co-payment was 20%.

- Optional Extras

Some insurance providers offer you optional extras that can increase the price of your monthly premium. Some of these include:

- Dental coverage: an additional £2 – £5 a month.

- Theft and loss coverage: An extra £1 to £3 a month.

- Alternative therapies, such as hydrotherapy and acupuncture, may cost an additional £2 to £4 a month.

Is Rabbit Insurance Worth the Cost?

Rabbit insurance may seem like an extra expense, but vet bills can be significantly higher than monthly insurance premiums. Here’s an idea of what common rabbit treatments cost without insurance:

Treatment | Estimated Cost Without Insurance |

Routine vet check | £25 – £50 |

Emergency Consultations | £100 – £200 |

X-rays and scans | £80 – £300 |

Surgery | £200 – £1000 |

Hospitalization | £100 – £500 per night |

On-going medical care | £10 – £50 per month |

Many rabbit owners wonder if the expense of rabbit insurance is worth it. Despite their reputation as low-maintenance pets, rabbits are actually susceptible to a number of health problems that can result in costly veterinary care. Insurance is a vital safety net because a single emergency visit can cost hundreds of pounds. The benefits rabbit insurance cannot be overemphasized.

Understanding the Risks: Why Vet Bills for Rabbits Can Be Costly

Despite their small size, rabbits can have serious medical needs. Among the most prevalent health problems in rabbits are:

- Dental Issues: Overgrown teeth, infections, and abscesses can result from rabbit teeth’s constant growth. Surgery might cost anywhere from £100 to £1,000.

- Digestive Issues (GI Stasis): This potentially fatal ailment causes the gut to slow down and necessitates urgent care that costs between £200 and £500.

- Respiratory Infections: Rabbits can have respiratory infections like snuffles, which can require antibiotics and more than £100 in veterinary care.

- Parasite Treatment: Treatment for ear mites, fleas, and E. cuniculi, a parasite that damages the kidneys and brain, may cost between £100 and £300.

- Emergency Care: X-rays, surgery, and aftercare frequently cost more than £500 for accidents, fractures, and unexpected diseases.

When is Rabbit Insurance Worth It?

If your rabbit is a high-risk breed, rabbit insurance is strongly advised. Certain breeds, such as gigantic breeds and lop-eared rabbits, are more likely to experience health problems than others, so insurance is a wise investment. Other reasons why rabbit insurance is worth it are when:

- You want financial peace of mind – Insurance can shield you from unforeseen costs if you can’t afford an unexpected vet bill of £500 or more.

- You have several rabbits: Keeping more than one rabbit might rapidly get expensive. Insurance makes sure kids receive the best care possible without going over budget.

- Your rabbit is young: It is less expensive to insure a young rabbit, and it guarantees that any pre-existing conditions won’t be excluded later.

When Might Rabbit Insurance Not Be Worth It?

In certain circumstances, rabbit insurance may not be required:

- You might not want insurance if you have a sizable savings account and are able to pay for unforeseen veterinary expenses on your own.

- If your rabbit is really old, it may not be as cost-effective to get insurance because some companies charge significantly higher premiums for older bunnies.

- If you only require routine care, you might want to pay as you go because many insurance companies do not cover basic checkups, vaccinations, and parasite treatments.

What to Look Out For in a Rabbit Insurance Policy

When comparing policies, consider these key factors:

- Vet Fee Limit: What is the annual amount that the insurance will pay for veterinary bills? Seek out plans with yearly coverage of at least £1,000 to £2,500.

- Excess Fees: These are the costs you have to cover before your insurance starts to pay. Less excess translates into reduced out-of-pocket costs.

- Coverage for prevalent Rabbit Health Issues: Since dental procedures, digestive problems (including GI stasis), and emergency care are the most prevalent medical concerns for rabbits, make sure the coverage covers them as well.

- Alternative Therapies: Acupuncture, herbal remedies, and physiotherapy are covered by certain insurance and may help with pain management.

- Multi-Pet Discounts: Some insurance companies provide discounts for several pets, such as rabbits.

- Waiting Periods – Most policies have a waiting period (e.g., 14 days) before coverage starts, so plan accordingly.

Conclusion

Although they are among the most popular pets, rabbits frequently need specialised veterinary care, which can be costly. Rabbit insurance gives you peace of mind by guaranteeing that you can afford the best treatment without worrying about unforeseen veterinary expenditures, regardless of how many bunnies you have or how long you’ve owned them.