Multi-pet is a type of pet insurance policy that allows pet owners to cover more than one animal in one converge policy instead of purchasing separate policies for each pet. Multi-pet insurance simplifies pet insurance and offers cost-saving insurance through our multi-pet discounts.

How does Multi-pet insurance work?

Multi-pet insurance works by merging all pets into one policy with a single renewal date and one monthly premium instead of having individual policies for each pet. While each pet still has coverage details, including policy limits and exclusions, everything is managed under a unified plan.

Most pet insurance providers offer this type of insurance, with discounts for adding multiple pets. However, the cost and coverage structure can vary depending on the provider and the type of policy selected.

Types of Multi-pet Insurance Policy

When choosing multi-pet insurance, you must understand the different coverage types available. While multi-pet insurance allows multiple animals to be insured under a single policy, the level of coverage and how claims are handled varies depending on the type of policy you choose.

There are four main types of multi-pet insurance.

- Lifetime Multi-pet insurance

This is the most comprehensive type of cover. It’s best if you prefer long-term coverage for your pet. With a lifetime insurance,

- It provides coverage for all conditions and illnesses throughout your pet’s lifetime, as long as the policy is renewed each year.

- Each pet has its annual claim limit per condition. This means if one pet develops multiple health issues, you can claim for each one separately.

- If you renew the policy annually, the coverage resets, which ensures your insurance continues.

- Buying this policy when your pets are young and healthy means they will be covered for illnesses that may develop later in life.

The downside to this type of cover is;

- It is more expensive than other types of policies

- Pre-existing conditions are not covered–if your pet already has an illness it won’t be

included.

- Time-limited Mult-pet Insurance

This insurance is best for pet owners looking for affordable coverage for young, healthy pets with no pre-existing conditions.

With time limited, you can;

- Covers injuries and illnesses for a fixed period, usually 12 months from the date of diagnosis.

- If the condition is still ongoing after 12 months, it will no longer be covered, even if the policy is renewed.

Pros

- It is more affordable than lifetime cover.

- It covers a wide range of illnesses and accidents within the policy period.

- It is ideal for healthy, low-risk pets that don’t require long-term medical care.

Cons

- It is not suitable for chronic conditions—once the 12-month period expires, that illness will be excluded from coverage.

- Pre-existing conditions are not covered.

- Maximum Benefit Multi-Pet Insurance

This is best for pet owners looking for moderate long-term coverage for treatable conditions without paying the high cost

With Maximum benefit, it

- Provides a fixed limit per condition—meaning you can claim for an illness or injury up to a specified amount, but once the limit is reached, no further claims can be made for that condition.

- No time restriction on claims compared to a time-limited policy as long as the financial cap has not been met.

- Each pet on the policy has its condition limit, so they don’t share a single coverage.

Pros

- It is more affordable than lifetime cover.

- It covers ongoing conditions until the claim limit is reached.

- You do not have to worry about 12-month limits like in time-limited policies.

Cons

- Once you have hit the claim limit for a condition, no further claims can be made for that illness or injury.

- Pre-existing conditions won’t be covered.

- Accident-only Multi-pet insurance

This insurance is best for pet owners who only want protection from unexpected injuries at a low cost.

How it works?

- It covers vet bills for accidents only—such as broken bones, injuries from fights, or ingestion of harmful substances.

- It does not cover illnesses, infections, or hereditary conditions.

- Pet owners can set a claim limit per accident or choose an overall annual limit for all pets.

Pros

- Most affordable multi-pet insurance option.

- Covers emergency veterinary care for accidents, ensuring pets receive treatment when injured.

- Suitable for indoor cats that are at lower risk of developing illnesses.

Cons

- It does not cover illnesses such as cancer, kidney disease, or infections.

- Pre-existing conditions and hereditary conditions are excluded.

- If a pet is injured multiple times, claim limits may be quickly exhausted.

Factors that affect the cost of Multi-pet Insurance

The cost of Multi-pet insurance varies based on various factors which include;

- Number of Pets Insured

More pets mean bigger discounts, but higher total premiums Most insurance providers offer multi-pet discounts, ranging from 5% to 15% per additional pet. However, even with a discount, insuring multiple pets means higher overall costs. For example, insuring a cat could cost £20 per month.

While the second cat with a 10% discount could cost £18 per month and the third cat with a 15% discount could cost £17 per month. With a total premium of £55 for three cats even with the discounts. Also, keep in mind that some providers cap the number of pets for discounts.

- Breed of the cats

A Pedigree cat usually costs more to insure than mixed-breed cats. Some cat breeds are prone to hereditary conditions, which increases the risk for insurers. This often results in higher premiums for purebred and exotic breeds compared to mixed-breed cats.

- Age of the cats

Older cats are more expensive to insure due to increased health risks. As pets age, their risk of developing certain health conditions increases leading to higher insurance costs. Many providers increase premiums once a cat reaches 7 years old, and some insurers stop offering new policies for cats over a certain age.

- Types of policy and coverage limits

Lifetime policies cost the most but offer the best coverage. If you have multiple pets with different health risks, consider mixing different policies. (e.g., lifetime for older pets, accident-only for younger ones).

- Pre-existing Conditions

If one pet has pre-existing health issues, it can increase costs for all pets. Some multi-pet insurance policies calculate risk based on the entire group of pets. If one cat has a history of diabetes or kidney disease, providers may raise the cost for all pets under the same policy. So it’s important to check in with your provider before buying the policy.

- Location

Your location could also impact the cost of your pet insurance. Veterinary costs vary, which means, depending on location it could affect your insurance premium. In some cases, even if you move to a cheaper area, insurers may not reduce your premium immediately—it usually remains the same until the next policy renewal.

- Excess and Co-payment options

Choosing a higher excess can lower your monthly premiums. Most pet insurance policies allow you to select an excess amount (the amount you pay before the insurer covers the rest). Some also have co-payment options, where you pay a percentage of vet fees.

How many pets are covered in a multi-pet insurance policy?

One of the key advantages of multi-pet insurance is that it allows pet owners to cover multiple animals under a single policy. However, the number of pets you can include depends on your provider’s policy terms and the level of coverage you choose.

At Quays Insurance, we understand that pet owners may have more than just one furry companion. That’s why our multi-pet insurance policy is designed to accommodate households with two or more cats, ensuring that all pets receive the necessary protection while it budget budget-friendly.

The minimum number of pets starts with two pets. However, if you only have one cat, opting for individual pet insurance is the best option. The maximum number of pets depends on your provider’s set limit. Quays offers flexible coverage that allows pet owners to insure more than one cat under a plan.

How to reduce the cost of Multi-pet insurance

Owning multiple pets is a joy, but it can also be expensive, especially when it comes to insurance. Here are some tips to help lower the cost of multi-pet insurance while still ensuring your cat gets the protection they need.

Take advantage of Multi-pet discounts

One of the main benefits of multi-pet insurance is that providers offer discounts when insuring more than one pet. Typically, most providers offer a 5-15% discount for additional pets added to the policy. As you add more pets, so does your discount increases.

Choose the right coverage for each pet

Not every pet requires the same level of coverage. Instead of choosing one-size-fits-all insurance, consider customizing coverage based on your pets’ needs. For example, if you have older cats, you may want to opt for lifetime insurance and accident-only coverage could be more befitting for your young and healthy cat.

Increase your excess to lower monthly premiums

The excess is the amount you pay out-of-pocket before your insurance covers the rest. Choosing a higher excess can reduce your monthly premiums.

Insure your pets at a young age

Pet insurance costs more as your pets age, especially if they develop pre-existing conditions that won’t be covered under a new policy. It’s best to insure them early as premiums are lower for young healthy cats and you also lock in coverage before they develop any medical conditions.

Consider annual payment instead of Monthly instalments

Many insurers charge extra fees when you pay monthly instead of annually. If you can afford to, pay for the policy in one lump sum to reduce your overall costs.

Keep your pets healthy to avoid unnecessary claims

One of the best ways to reduce insurance costs is to prevent costly vet bills by keeping your pets healthy. To keep your cat healthy,

Schedule regular vet check-ups to catch potential health issues early.

Maintain a healthy diet and exercise routine to prevent obesity-related illnesses.

Keep up with vaccinations and flea/worm treatments to avoid preventable diseases.

Compare policy features instead of just looking at the price

It can be tempting to choose the cheapest policy but low-cost insurance may come with fewer benefits, exclusions or lower claim limits. You should look out for;

Claim limits: Ensure your pets are adequately covered for vet fees.

Exclusions: Some cheap policies exclude common conditions that your pet may need coverage for.

Customer reviews and claims process: A higher premium may be worth it if it means better customer service and faster claims approval.

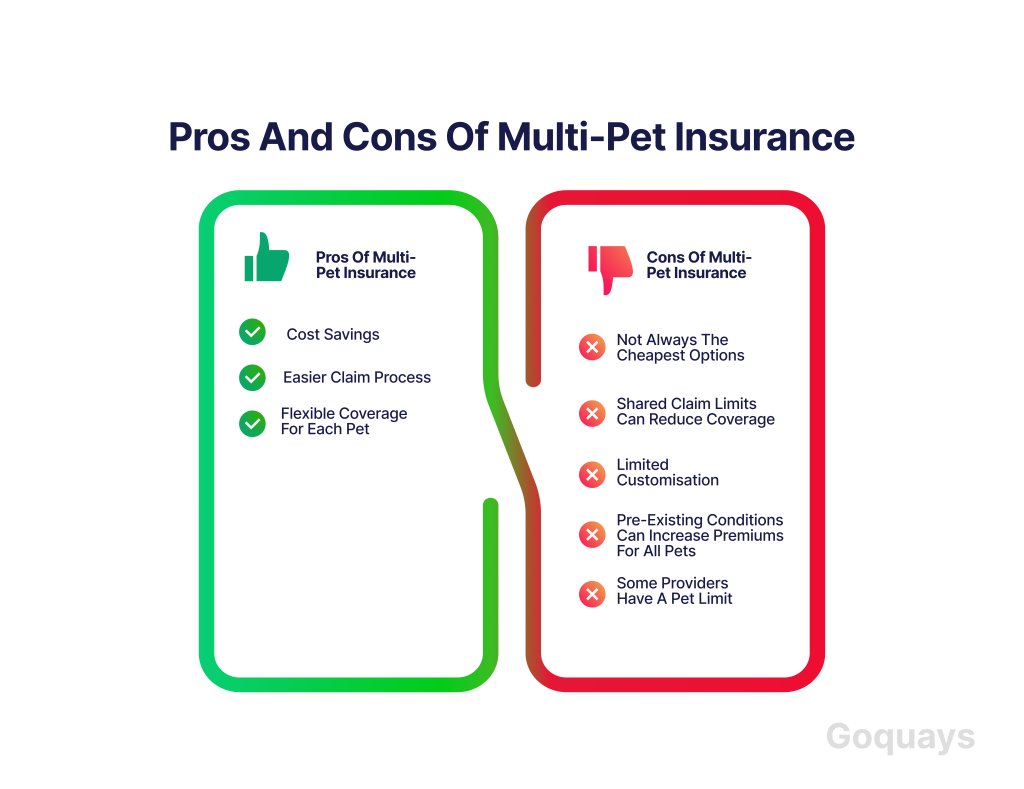

Pros and Cons of Multi-pet Insurance

Here are some of the pros and cons to consider when choosing Multi-pet insurance

Pros of Multi-pet Insurance

- Cost savings

One of the biggest reasons cat owners choose multi-pet insurance is mainly due to the discount. Many providers, offer multi-pet discounts (usually 5-15% per additional pet) to encourage pet owners to bundle their pets under one provider.

- Easier claim process

Filing claims can be time-consuming, especially when dealing with multiple pets and different insurers. With multi-pet insurance, you only deal with only one insurer for all claims. Also, the claim process is streamlined, making it quicker to get reimbursed.

- Flexible coverage for each pet

A lot of multi-pet policies allow customized coverage per pet, so you don’t have to pay for unnecessary coverage.

Cons of Multi-pet Insurance

- Not always the cheapest options

While multi-pet discounts can save money, it’s not guaranteed to be the most affordable choice. As some insurers increase the premium if one of your pets has a pre-existing condition, individual policies may have lower overall premiums, depending on the pet’s breed, age, and health. If one pet develops a chronic condition, renewal costs for all pets could rise.

- Shared claim limits can reduce coverage

Some multi-pet policies share a single claim limit between all pets, which can be a major disadvantage if multiple pets need medical care in the same year.

- Limited customisation

Some multi-pet policies force all pets onto the same level of coverage, meaning you might overpay for unnecessary benefits. If one cat is healthy and young, they may not need a comprehensive lifetime policy. If the policy does not allow individual customizations, you might end up paying extra for coverage that only one pet needs.

- Pre-existing conditions can increase premiums for all pets

Some providers calculate risk across all pets in a multi-pet policy. If one pet has a chronic condition or a history of illness, it can drive up the premium for every pet in the policy.

- Some providers have a pet limit

Most multi-pet policies limit the number of pets you can insure under one policy. While some providers cover up to 5 pets per policy, some others cover up to 10 pets.

Conclusion

Multi-pet insurance offers convenience, potential discounts, and an easier claims process, making it a great choice for households with multiple cats. It simplifies policy management by providing one renewal date and one insurer and often includes 5-15% discounts for additional pets.

However, it’s important to consider factors like shared vs. individual claim limits, pre-existing conditions, and coverage flexibility. If your pets have different health needs, separate policies may be a better option. You can also consider opting for customizable multi-pet insurance that ensures each pet gets the right coverage at an affordable price.

Get a free quote today and find the best multi-pet insurance for your cat!