Owning a pet is a long-term commitment, and ensuring they are in good health and well-being is a top priority for pet owners. Veterinary treatments can be expensive, especially when dealing with chronic illnesses or unexpected emergencies. This is where pet insurance comes in—helping pet owners manage medical costs and providing peace of mind.

One of the most comprehensive types of pet insurance available is a lifetime pet insurance policy. Unlike other types of coverage (time limited or accident-only policies), a lifetime policy ensures that your pet remains protected throughout its life. It covers ongoing conditions, long-term illnesses or recurring illness as long as the policy is renewed each year.

This guide will explain everything you need to know about lifetime insurance as a pet owner. How it works, what it covers, how much it costs, and how to choose the best policy for your furry companion. At the end of this content, you will have a clear understanding of whether a lifetime insurance policy is the best coverage for your cat.

What is Lifetime Pet insurance?

Lifetime pet insurance is one of the most comprehensive types of pet insurance. It provides continuous coverage for your pet’s medical expenses, including illnesses and injuries, as long as you renew the policy each year. This type of policy is beneficial for pets prone to chronic conditions, hereditary diseases, or unexpected health issues that require long-term treatment. Here are some of the important aspects of lifetime insurance.

- Continuous coverage: This covers long-term conditions like arthritis, diabetes, and heart disease for the pet’s entire life.

- Annual benefit limit: Most policies have a set limit per condition per year (e.g., £5,000 per condition) or an overall annual limit (e.g., £10,000 for all conditions).

- Renewal requirement: Coverage is only guaranteed if the policy is renewed each year without interruption.

- Covers chronic and hereditary conditions: Compared to some other policies that exclude pre-existing or genetic conditions, lifetime insurance covers these as long as they develop after the policy starts.

How lifetime pet insurance differs from other types of Pet Insurance

Type of Pet insurance | Coverage | Best for | Limitations |

Lifetime | Covers conditions for the pet’s lifetime (as long as policy is renewed) | Pets with chronic illnesses, hereditary conditions | Higher premiums, must renew annually to maintain coverage |

Timelimited | Covers conditions for a set period (e.g., 12 months) | Short-term illnesses and injuries | Conditions are excluded after the time limit expires |

Maximum Benefit | Covers conditions up to a fixed amount | Pets with one-off conditions | Once the limit is reached, the condition is no longer covered |

Accident-Only | Covers injuries from accidents but not illnesses | Healthy pets needing emergency coverage | Does not cover illnesses or long-term conditions |

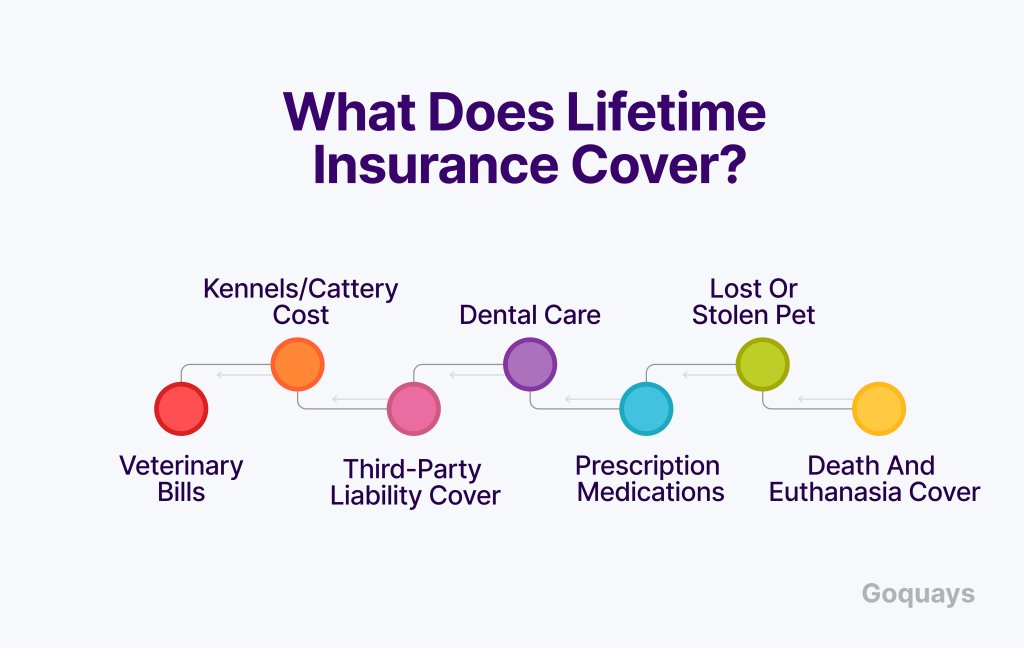

What does Lifetime Insurance cover?

A good lifetime policy should cover the following;

- Veterinary bills: Lifetime insurance covers treatment for injuries and illness up to a set limit per year. These limits reset each year upon renewing your policy, this helps to ensure continued coverage for ongoing conditions. The vet bills coverage includes consultations, diagnostic tests, surgery, hospital stays and specialist treatments. However, you may need to pay an excess before making a claim.

- Kennels/Cattery cost: This covers the cost of boarding your pet in a kennel or cattery if you are hospitalized or unable to look after your pet. There’s usually a maximum limit for kennels on some policies.

- Third-party liability cover: This cover applies to dogs. Dogs lifetime insurance offers protection if your dog causes injury to other dogs or damages a property whereby you are responsible for the compensation or the legal fees. This doesn’t apply to cat lifetime insurance, as cats are free to roam about.

- Dental care: This covers dental treatment related to accidents or illnesses. Routine dental cleanings are usually excluded.

- Prescription medications: These cover long-term medication costs for chronic conditions. This includes pain relief, antibiotics, and ongoing treatments like insulin for diabetes

- Lost or stolen pet: Some policies cover advertising and reward costs if your pet goes missing. Some also include compensation if the pet is not found.

- Death and euthanasia cover: Some policies reimburse the cost of euthanasia, cremation, or burial. Covers the purchase price of the pet if they pass away due to an accident or illness.

What is excluded from lifetime insurance

While lifetime pet insurance offers extensive coverage, there are some common exclusions, including:

- Pre-existing conditions (any illness or injury diagnosed before taking out the policy).

- Routine and preventive care (vaccinations, flea and worm treatments, neutering, microchipping).

- Pregnancy and breeding-related costs.

- Cosmetic or elective procedures (ear cropping, tail docking).

- Waiting periods (most policies have an initial waiting period of 10–14 days before coverage starts).

How to get cheaper lifetime pet insurance

There are a few ways to reduce the cost of a lifetime insurance policy for your pet.

- Choose a higher excess to lower your monthly premiums: The excess is the amount you pay towards a claim before your provider covers the rest. Most insurers allow you to adjust your excess, which affects your monthly premium. More like; Higher excess = lower monthly payments and Lower excess = higher monthly payments.

- Look for multi-pet discounts: If you have more than one pet, many insurers offer multi-pet discounts when you insure them under the same policy. This is best for pet owners with multiple pets. But remember that some insurers offer separate policies per pet, while others combine them into a single plan. Compare both options to see which is cheaper!

- Consider annual payments instead of monthly payments: Check how you make payments for your insurance. Is it monthly? Or yearly? This is because many pet insurers charge extra fees for monthly payments which increases your overall cost. If you can afford it, pay annually instead of monthly.

- Insure your pets while they are young: The younger your pet is when you take out a lifetime insurance policy, the cheaper the premiums will be. This is because:

- Young pets have fewer health issues, making them less risky to insure.

- Once a pet is diagnosed with an illness, it becomes a pre-existing condition—which will not be covered if you switch providers later.

- Some insurers refuse to offer new policies for older pets, leaving you with limited (and expensive) options. The best time to insure your cat? As soon as you bring them home.

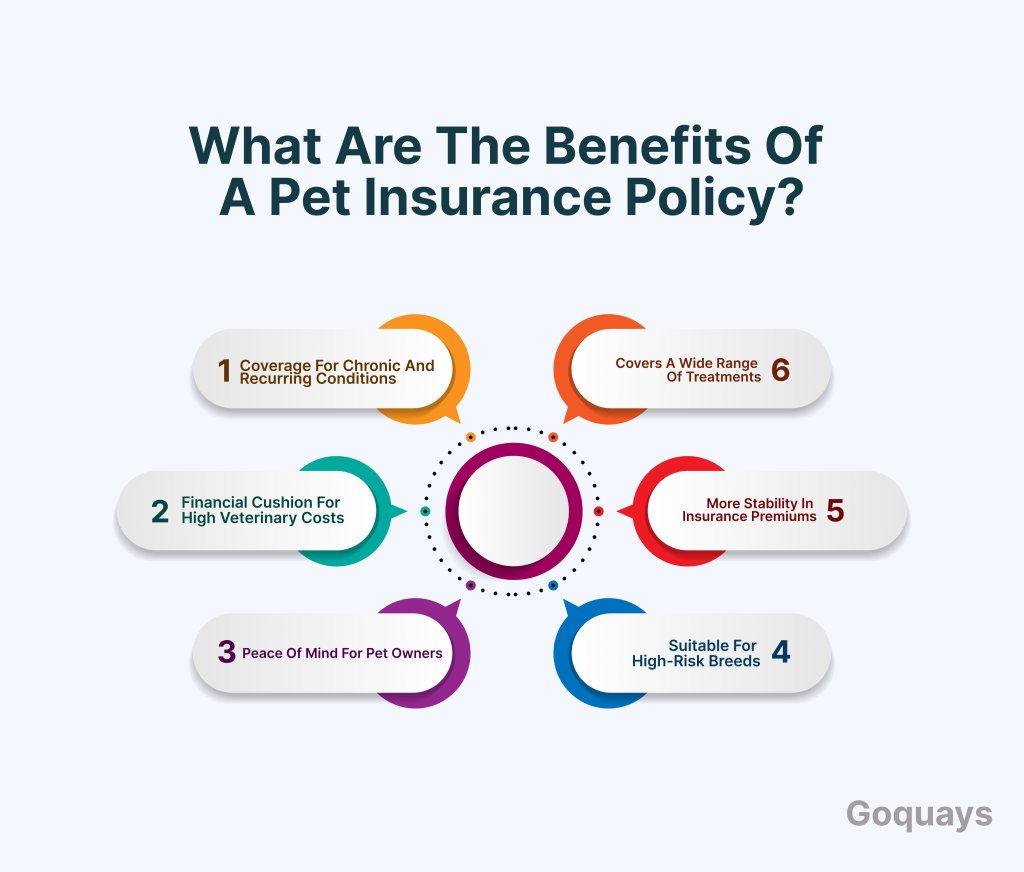

What are the benefits of a Pet insurance policy?

Here are some of the benefits you get to enjoy when you choose a lifetime pet insurance policy;

- Coverage for chronic and recurring conditions

One of the biggest advantages of lifetime pet insurance is that it covers long-term and recurring medical conditions, such as diabetes, arthritis, or heart disease, as long as the policy is renewed each year. Other types of pet insurance policies may stop covering these conditions after a certain period or after reaching a claim limit. With lifetime coverage, your pet continues to receive treatment for chronic illnesses without the risk of exclusions.

- Financial cushion for high veterinary costs

Vet bills in the UK can be expensive, particularly for specialist treatments, surgeries, and long-term medications. Lifetime pet insurance helps ease the financial burden by covering substantial portions of these costs. Some policies offer annual benefit limits per condition, meaning you have a set amount you can claim each year per health issue. This ensures that even expensive treatments remain manageable.

- Peace of mind for pet owners

Owning a pet comes with uncertainties, and medical emergencies can come up unexpectedly. With a lifetime policy, you won’t have to worry about making difficult financial decisions regarding your pet’s healthcare. Instead, you can focus on getting them the best treatment without hesitation.

- Covers a wide range of treatments

Lifetime pet insurance policies include coverage for:

- Accidents and injuries (e.g., broken bones, road traffic accidents)

- Illnesses (both minor and serious conditions)

- Diagnostic tests (such as X-rays, MRIs, and blood tests)

- Surgeries and hospitalisation

- Specialist treatments (such as cancer treatments or physiotherapy)

- Prescription medications

- More stability in Insurance Premiums

Although lifetime pet insurance premiums can increase as your pet ages, they generally remain more stable compared to other types of policies. With annual policies, insurers may exclude pre-existing conditions upon renewal, forcing you to switch providers or pay out-of-pocket. Lifetime coverage reduces the risk of losing financial protection due to changing terms.

- Suitable for High-Risk Breeds

Certain dog and cat breeds are more prone to hereditary or congenital conditions (e.g., hip dysplasia in Labrador Retrievers or heart disease in Cavalier King Charles Spaniels). Lifetime insurance is beneficial for these breeds, as it ensures long-term medical coverage for breed-specific health issues.

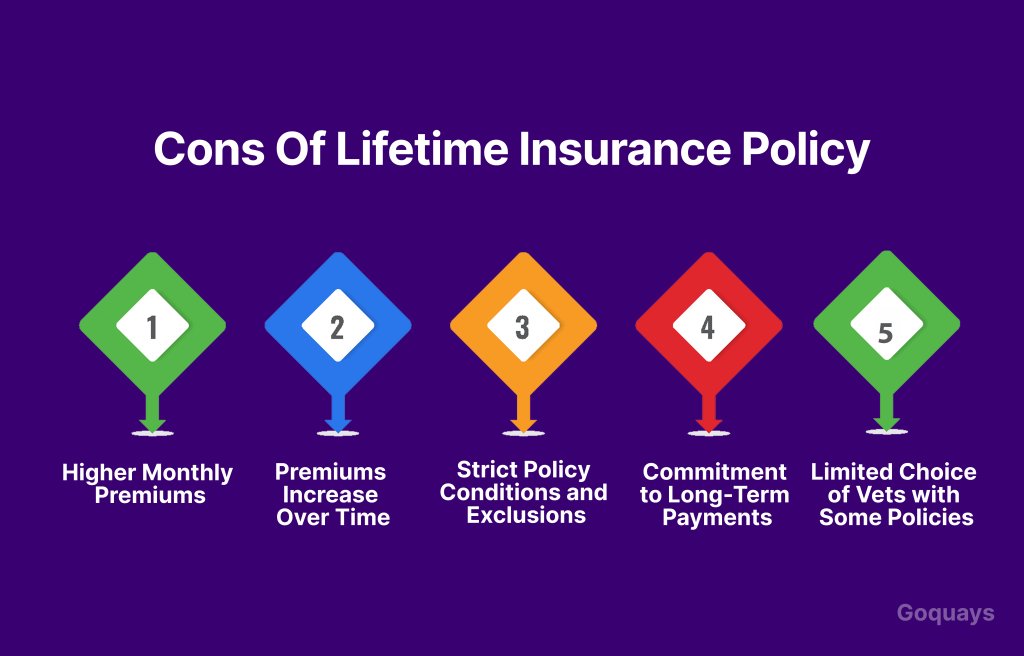

Cons of Lifetime insurance policy

- Higher Monthly Premiums

Lifetime pet insurance is the most expensive type of pet insurance. Monthly premiums can be significantly higher than time-limited or accident-only policies. Costs vary depending on factors such as:

- The pet’s breed (pedigree breeds cost more)

- The pet’s age (older pets have higher premiums)

- The level of cover chosen (higher annual limits = higher premiums)

While the cost is high, it provides better long-term value if your pet develops a chronic condition.

- Premiums Increase Over Time

Even though lifetime policies offer continued coverage, insurance premiums can rise each year—especially as your pet gets older or if you make multiple claims. Some owners may find that their policy becomes too expensive to maintain in later years.

- Strict Policy Conditions and Exclusions

- Pre-existing conditions are not covered: If your pet has already been diagnosed with an illness before you take out a policy, it won’t be covered.

- Annual condition limits apply: Most policies set an annual limit per condition, meaning that if you exceed this limit, you will need to pay the remaining costs yourself.

- Certain breeds may not be eligible: Some insurers exclude specific breeds due to their high-risk nature. Always check the policy details before purchasing.

- Commitment to Long-Term Payments

Since lifetime policies require continuous renewal to maintain coverage, you must be prepared for a long-term financial commitment. If you cancel your policy, any conditions your pet has been treated for will no longer be covered under a new policy (as they would now be considered pre-existing conditions).

- Limited Choice of Vets with Some Policies

Some insurers may require you to use specific veterinary networks to access full coverage, limiting your choice of vet. Always check whether your preferred vet is accepted under your chosen policy.

Is a Lifetime pet insurance policy worth it?

Lifetime pet insurance is worth it, especially if you want comprehensive, long-term coverage. It offers financial security, ongoing treatment for chronic conditions, and peace of mind, making it the best option for those who can afford it. However, if you are on a tight budget or have an older pet with pre-existing conditions, other insurance options or a savings plan may be more suitable.

Conclusion

A lifetime pet insurance policy is one of the most comprehensive ways to protect your pet’s health and save yourself from unexpected veterinary costs. While it comes with higher premiums, its ability to provide continuous coverage for chronic conditions, accidents, and illnesses makes it an important investment as a pet owner.

If you want long-term peace of mind and financial security, a lifetime policy is often the best choice—especially for pedigree breeds or pets prone to hereditary conditions. However, be sure to carefully compare different policies, check for exclusions and annual limits, and choose a plan that suits your pet’s needs and your budget.

However, the right pet insurance policy depends on your personal circumstances, but investing in lifetime cover ensures that your cat receives the best care possible—no matter what life throws their way.