If your dog has a pre-existing condition, you might wonder if pet insurance for dogs with pre-existing conditions is worth it. You’re not alone—many pet owners face the same concern. Vet bills add up fast, and ongoing health issues can be costly.

The good news? Some insurance providers still offer coverage. While most exclude pre-existing conditions, certain plans help with routine care, accidents, and new illnesses. Some may even cover past conditions after a waiting period.

Even if your dog’s current condition isn’t covered, pet insurance for dogs with pre-existing conditions can still be useful. It can protect against unexpected vet bills and provide peace of mind. The key is understanding how different policies work so you can make the best choice for your furry friend.

Let’s break it down.

What is a pre-existing condition in pet insurance?

Before jumping into insurance options, it’s important to understand what insurers mean by a “pre-existing condition.” Many pet owners assume that only major illnesses count, but even minor symptoms documented in your dog’s medical history could lead to exclusions.

A pre-existing condition is any illness, injury, or health issue that your dog had before you enrolled in pet insurance for dogs with pre-existing conditions. Even if the condition wasn’t formally diagnosed, insurers may consider it pre-existing if there were signs or symptoms before coverage began.

For example, if your dog had occasional limping before you signed up for insurance, and it later turns out to be arthritis, the insurance company could deny coverage for arthritis-related treatments. That’s why it’s important to understand how insurers define and evaluate pre-existing conditions.

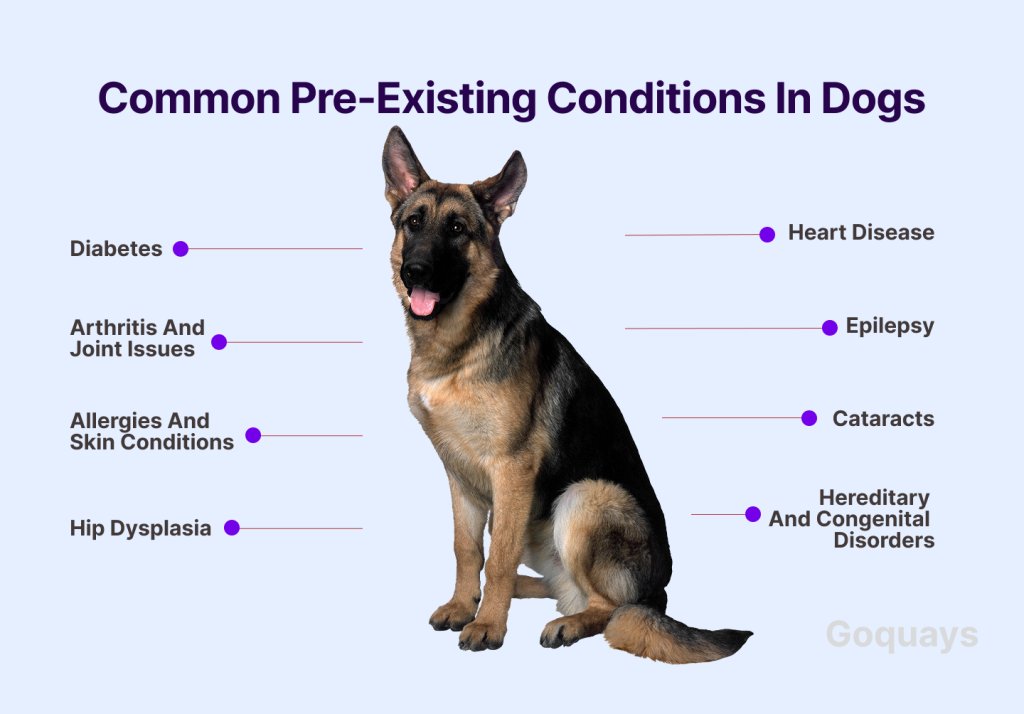

Common pre-existing conditions in dogs

When researching pet insurance for dogs with pre-existing conditions, it’s important to know that some health issues are more common than others. These include:

- Diabetes – requires lifelong management and frequent vet visits

- Arthritis and joint issues – common in older dogs, especially large breeds

- Allergies and skin conditions – can lead to chronic infections and discomfort

- Hip dysplasia – often seen in large breeds and can require surgery

- Heart disease – can develop over time and lead to costly treatments

- Epilepsy – requires long-term medication and monitoring

- Cataracts – may lead to vision loss or require surgery

- Hereditary and congenital disorders – conditions dogs are born with, like certain heart defects or neurological issues

Types of pre-existing conditions in dogs

Not all pre-existing conditions are treated the same way by insurers. Some may be covered eventually, while others are permanently excluded. Understanding the difference can help you determine whether pet insurance for dogs with pre-existing conditions is still a good option for your pup.

Curable vs. incurable pre-existing conditions

- Curable conditions: Some short-term illnesses or injuries can be considered curable if your dog has been symptom-free for a certain period. Conditions like ear infections, respiratory infections, or minor skin irritations may be covered after a waiting period, depending on the insurer’s policy. This means that if your dog develops the same issue again after a set period without symptoms, it might be covered.

- Incurable conditions: Chronic or long-term diseases that require ongoing treatment are usually excluded permanently from coverage. This includes conditions like diabetes, hip dysplasia, arthritis, epilepsy, and heart disease. Since these conditions typically require continuous care, insurers consider them too risky to cover once they’ve been diagnosed.

- Bilateral conditions: If a condition affects one side of your dog’s body, insurers may automatically exclude coverage for the other side, even if it hasn’t happened yet. For example, if your dog has a torn ligament in one knee, most policies will assume the other knee is at risk too and won’t cover future treatment for it. This rule often applies to conditions like cruciate ligament injuries, cataracts, or hip dysplasia.

4. Hereditary and congenital conditions: Some dogs are born with genetic or breed-specific conditions, such as certain heart defects or neurological disorders. While some insurers offer coverage for hereditary conditions if diagnosed after enrollment, others may exclude them entirely, especially if they are known issues for your dog’s breed.

Temporary vs. permanent pre-existing conditions in dogs

Condition Type | Definition | Examples | Coverage Possibility |

Temporary pre- existing conditions | Short-term illnesses or injuries that have fully healed and have shown no symptoms for a set period | Ear infections, respiratory infections, minor skin allergies, stomach issues | May be covered after a waiting period if the condition doesn’t return |

Permanent pre- existing conditions | Chronic or lifelong conditions that require ongoing treatment and management | Arthritis, diabetes, kidney disease, epilepsy, hip dysplasia | Typically never covered, as they are considered high-risk and progressive |

Temporary conditions are usually those that don’t have long-term health consequences and have fully resolved without recurrence. Many insurers require a “symptom-free period” (often six months to a year) before they will consider covering a previously diagnosed condition.

On the other hand, permanent conditions are those that require continuous medical care and are unlikely to ever be covered under any policy. Even if a condition isn’t causing major issues now, if it’s known to worsen over time (like hip dysplasia or heart disease), insurers will likely exclude it.

If your dog has a temporary pre-existing condition, it may be worth looking into pet insurance, as coverage could still become available after the waiting period. However, if your dog has a permanent condition, insurance may still be useful for covering unrelated illnesses or new injuries that arise in the future.

How do insurers determine pre-existing conditions?

When applying for pet insurance for dogs with pre-existing conditions, insurers carefully assess your dog’s medical history to determine if any conditions qualify as pre-existing. This process typically includes:

- Reviewing past vet records – Insurers may request your dog’s veterinary history, sometimes going back 12 to 24 months or more.

- Checking for past diagnoses or treatments – Any previous illnesses, injuries, or ongoing medical treatments will be evaluated.

- looking at symptoms that appeared before you enrolled in coverage – Even if a condition wasn’t officially diagnosed, insurers may still classify it as pre-existing if related symptoms were noted before your policy started.

For example, if your dog was limping before you got insurance but was never diagnosed with a joint issue, the insurer may still exclude any future claims related to mobility problems.

Do you need to disclose your dog’s condition?

Yes, and it’s in your best interest to be completely honest. If you fail to disclose a pre-existing condition and later file a claim for it, your insurer could deny coverage, leaving you responsible for the full cost of treatment. In some cases, providing false or incomplete information could even lead to policy cancellation.

Being upfront about your dog’s health also allows you to choose an insurance plan that fits your situation. Some insurers may still cover unrelated illnesses and injuries, making a policy valuable even if your dog has a pre-existing condition.

Do pre-existing conditions increase premiums?

Pre-existing conditions don’t usually make your premium more expensive, but they do affect what’s covered. Since insurers already exclude these conditions, they don’t need to raise rates to account for them.

However, some providers offer special plans designed for pets with pre-existing conditions. These plans often come with:

- Higher monthly costs – Since they cover more risks, the premiums are usually more expensive.

- Reduced benefits – Some may cover only new conditions and have stricter limits on payouts.

Longer waiting periods – Coverage might not start immediately, especially for specific conditions.

How to find the best pet insurance for dogs with pre-existing conditions

Finding pet insurance for dogs with pre-existing conditions takes some extra effort, but it’s not impossible. While most standard pet insurance plans won’t cover existing conditions, there are still options to help you manage costs. Here’s what to look for:

- Providers that cover curable conditions – Some insurance companies will cover past conditions if your dog has been symptom-free for a certain period, usually between 6 to 12 months.

- Accident-only plans – These policies won’t cover illnesses but can still provide financial protection for unexpected injuries like broken bones or bite wounds.

- Wellness plans – While these don’t cover major medical conditions, they can help with routine care, including vaccines, dental cleanings, and regular checkups.

- Alternative pet insurance providers – Some insurers offer coverage for pre-existing conditions with limitations, such as only covering new treatments but not ongoing care.

Since every provider has different rules, it’s important to compare multiple plans and read the fine print carefully before signing up.

Factors to consider when choosing pet insurance for dogs with pre-existing conditions

Deciding whether pet insurance is the right choice for your dog comes down to a few key factors:

- Cost of treatment without insurance – If your dog’s condition requires expensive medications, surgeries, or ongoing care, insurance won’t cover those pre-existing costs. However, it can still help with future illnesses or accidents.

- Exclusions and limitations – Some policies exclude entire categories of conditions, while others may only restrict coverage for specific treatments. Be sure you understand what’s actually covered before committing.

- Future health concerns – Even if your dog has a pre-existing condition, they could still develop new health problems down the line. A good insurance plan can help cover those unexpected vet bills.

4. Alternative financing options – If insurance isn’t the right fit, consider setting up a pet savings account, enrolling in a veterinary discount program, or using crowdfunding platforms to help with medical expenses.

Tips for dog owners dealing with pre-existing conditions

Managing a dog’s pre-existing condition takes some extra care, but small changes can make a big difference in their overall health and quality of life.

- Keep up with regular vet visits – Routine checkups can help catch complications early and prevent conditions from worsening.

- Maintain a healthy diet and exercise routine – Proper nutrition and moderate exercise can help manage weight, joint health, and overall well-being.

- Explore alternative treatments – Physical therapy, acupuncture, or dietary supplements may help ease symptoms and improve mobility for conditions like arthritis.

Compare multiple insurance providers – Some insurers offer partial coverage for pre-existing conditions, so it’s worth shopping around before deciding.

Why don’t pet insurance policies cover pre-existing conditions?

Insurance is designed to protect against unforeseen medical expenses, not conditions that already exist. If insurers covered pre-existing conditions, they would be taking on guaranteed claims, which would drive up costs for all policyholders. Think of it like trying to buy car insurance after an accident—it wouldn’t make financial sense for the insurer.

That being said, some insurers do cover curable pre-existing conditions if your dog has been symptom-free for a certain period. It’s always worth checking with different providers to see what options are available.

Are allergies considered a pre-existing condition in dog insurance?

Yes, allergies are typically classified as pre-existing conditions if your dog has a documented history of allergic reactions, skin issues, or food sensitivities. This means that:

- Any future treatments for allergies may be excluded from coverage.

- If allergies lead to secondary conditions (like infections), those might also be excluded.

- Some insurers might offer coverage if your dog has gone a long time without allergy symptoms.

Since allergies can be managed but not cured, most providers will permanently exclude them from coverage.

How can I compare pet insurance for dogs with pre-existing conditions?

Finding the right insurance for a dog with pre-existing conditions requires careful comparison. Here are some key factors to consider:

- Policy exclusions – Check the fine print to see which conditions are excluded and whether any exceptions exist for curable conditions.

- Waiting periods – Some insurers will cover certain pre-existing conditions if your dog has been symptom-free for a set period (e.g., 6 to 12 months).

- Type of coverage – Consider if the plan includes accident-only coverage, wellness plans, or specialized policies for dogs with medical histories.

Cost vs. benefit – Weigh the cost of premiums against what’s actually covered. If the exclusions are too restrictive, you might be better off setting up a pet savings fund.

Is it worth getting pet insurance if my dog has a pre-existing condition?

It depends on your dog’s needs and the policy details. Pet insurance for dogs with pre-existing conditions might still be worth it if:

- Your dog is still young and may develop future conditions. Insurance won’t cover what’s already there, but it can protect you from unexpected health issues later.

- You want coverage for accidents and unrelated illnesses. Even if your dog has a pre-existing condition, they could still get injured or develop a new illness that would be covered.

- Some aspects of their care are still covered. If a policy helps with routine checkups, vaccinations, or emergency care, it could still save you money over time.

However, if the exclusions are too broad and everything your dog needs is left out, then insurance may not be the best option.

Are symptoms considered indicative of a pre-existing condition in dogs?

Yes, and this is where things can get tricky. Even if a formal diagnosis hasn’t been made, insurers may still classify a condition as pre-existing based on past symptoms. For example:

- If your dog was limping before you got insurance and later got diagnosed with arthritis, the insurer may exclude arthritis from coverage.

- If there were past vet notes about skin irritation, future skin conditions might be considered pre-existing, even without an official allergy diagnosis.

Final thoughts

Pet insurance for dogs with pre-existing conditions may seem overwhelming, but the right research can help you find a policy with valuable coverage. Most insurers won’t cover existing conditions, but they still help with future accidents, illnesses, and routine care.

To get the best coverage, compare policies, check exclusions, and explore alternative options like accident-only plans or wellness programs. Even if insurance doesn’t fully meet your needs, budgeting for vet expenses and looking into financial assistance programs can help.

Every dog deserves quality care, and as their owner, you’re their best advocate. Stay informed and proactive to ensure your dog gets the medical attention they need—through insurance, savings, or financial support programs.