Choosing the right insurance for your furry companion can feel overwhelming, especially with so many options available. Every provider claims to offer the best coverage, but the reality is that policies vary widely in terms of what they cover, how much they cost, and how easy they are to use. That’s why it’s crucial to compare dog insurance carefully before making a decision.

Dog insurance isn’t just about protecting your pet—it’s about protecting yourself from unexpected vet bills that could strain your finances. A well-chosen policy can provide peace of mind, ensuring that your dog gets the best medical care without you having to worry about the cost. But with different policy types, coverage limits, exclusions, and hidden fees, how do you know which plan is right for you?

That’s where this guide comes in. Whether you’re looking for accident-only coverage, a comprehensive lifetime plan, or something in between, we’ll break down the most important factors to consider. By the end of this article, you’ll have a clear understanding of how to compare dog insurance effectively and choose a policy that offers the best value for your pet’s needs. Let’s dive in!

Start with your dog’s needs

Before you even begin comparing policies, the first and most important step is to consider your dog’s unique needs. No two dogs are the same, and factors like breed, age, lifestyle, and health history play a huge role in determining the type of insurance that’s best for them.

For example, certain breeds are more prone to hereditary and genetic conditions. Large breeds like Labradors and German Shepherds are more susceptible to hip and elbow dysplasia, while smaller breeds like Bulldogs and Pugs often struggle with breathing issues. If your dog belongs to a breed with known health risks, you’ll want a policy that covers breed-specific conditions—otherwise, you could be left paying out of pocket for expensive treatments.

Age is another key factor. Puppies tend to be playful and adventurous, which increases their risk of accidents, fractures, and swallowed objects—so an accident-inclusive policy might be a smart choice. Meanwhile, senior dogs are more likely to develop arthritis, diabetes, or heart disease, making lifetime coverage or ongoing condition support a must-have to help manage long-term care costs.

Pre-existing conditions can also be a challenge. If your dog has already been diagnosed with a health issue, many insurers won’t cover treatments related to that condition. However, some providers offer limited coverage for pre-existing conditions if your dog has been symptom-free for a certain period. It’s essential to check whether the policy you’re considering includes any exceptions or waiting periods that could impact your dog’s care.

Taking the time to evaluate your dog’s specific needs ensures that you don’t just pick the cheapest policy—but the right policy that will provide the best care throughout their life.

Understand the types of dog insurance

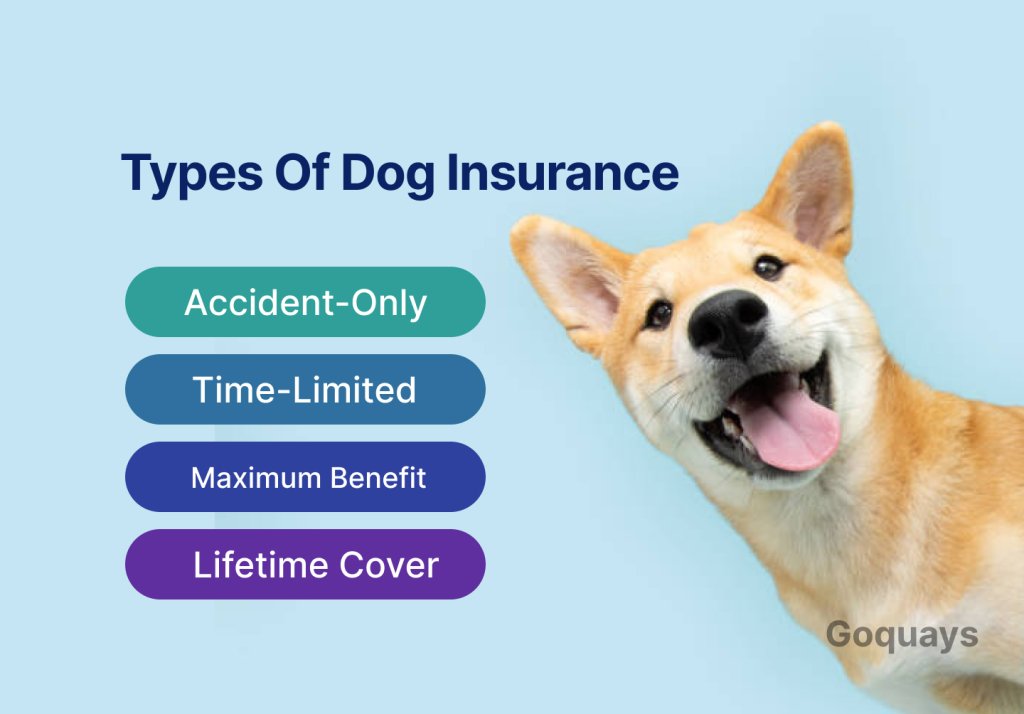

Dog insurance isn’t one-size-fits-all, and understanding the different types of policies available is key to making the right choice. Each type of coverage has its own benefits and limitations, so it’s important to know what you’re signing up for before committing.

- Accident-Only – This is the most basic and budget-friendly option. It covers injuries from accidents, like fractures or poison ingestion, but won’t cover illnesses or long-term health conditions. If your dog is generally healthy and you’re looking for emergency protection, this could be a cost-effective choice. However, it may not be ideal for breeds prone to hereditary or chronic conditions.

- Time-Limited – This policy provides coverage for illnesses and injuries, but only for a fixed period—usually 12 months from the time a condition is first treated. Once that period ends, the insurer will no longer cover that particular condition, even if your dog still needs treatment. This can be a good short-term solution but might not be ideal for dogs with long-term health concerns.

- Maximum Benefit – With this type of policy, there’s a set financial limit for each condition. You can claim for a condition until you reach that limit, but after that, coverage stops for that particular issue. Unlike time-limited policies, there’s no time restriction—as long as you haven’t exceeded the payout limit, your dog remains covered. This can work well for one-off conditions but may not be enough if your dog develops a long-term illness requiring ongoing treatment.

Lifetime Cover – This is the most comprehensive and reliable type of pet insurance. It covers illnesses, accidents, and chronic conditions for your dog’s entire life, provided you renew the policy each year. This option is ideal for pet owners who want long-term financial protection, especially for breeds prone to hereditary conditions or age-related health problems.

Check what’s included

A policy might seem like a great deal at first glance, but what really matters is what it actually covers. Some policies offer only basic protection, while others include a range of benefits that can save you thousands in vet bills. When comparing plans, look for coverage that includes:

- Vet fees for both accidents and illnesses

- Hereditary and congenital conditions, which are common in certain breeds

- Alternative treatments like physiotherapy, hydrotherapy, or acupuncture, which can help with recovery and pain management

- Dental care, as many policies exclude it unless caused by an accident

- Prescription medication, including long-term treatments for chronic illnesses

- Diagnostic tests such as X-rays, MRIs, ultrasounds, and blood tests

Comprehensive coverage ensures that your dog gets the best care without unexpected costs. Always read the fine print to confirm what’s included and avoid gaps in coverage.

Watch out for exclusions

Knowing what isn’t covered is just as important as knowing what is. Many dog insurance policies have exclusions that could impact your ability to claim, so reading the fine print is essential.

Here are some common exclusions to watch for:

- Pre-existing conditions – Most insurers won’t cover any illnesses or injuries your dog had before the policy started. Some may offer coverage for conditions that have been symptom-free for a certain period, so check the details.

- Routine care – Standard insurance usually doesn’t cover vaccinations, flea and worm treatments, or regular check-ups. These services typically fall under wellness plans.

- Elective procedures – Treatments such as spaying, neutering, and cosmetic surgeries (like ear cropping and tail docking) are generally excluded.

- Breeding and pregnancy costs – If your dog becomes pregnant, most standard policies won’t cover vet costs related to pregnancy, birth, or complications. Some insurers offer breeding coverage as an add-on.

Dental care limitations – While some policies include dental coverage, others may only cover dental issues caused by accidents, not general tooth decay or gum disease.

Look at the annual limit

Every dog insurance policy has a maximum payout limit, which is the total amount your insurer will cover per year. These limits can vary widely—from a few hundred pounds to tens of thousands. If your dog faces a serious illness or injury, a low annual limit might not be enough to cover all medical costs, leaving you to pay the remaining expenses out of pocket.

A higher annual limit provides better financial security, especially for unexpected vet bills. Treatments such as emergency surgeries, cancer care, ongoing medications, and specialist consultations can be incredibly expensive. A policy with a generous annual limit ensures your dog gets the best possible care without financial strain.

When comparing policies, consider your dog’s age, breed, and potential health risks. If they’re prone to hereditary conditions or likely to need long-term care, opting for a higher annual limit can save you money in the long run.

At Quays Pet Insurance, we offer plans with comprehensive annual coverage, so you never have to worry about exceeding your policy limit when your dog needs care the most.

Don’t forget about sub-limits

Even if a policy boasts a high annual limit, it doesn’t always mean every treatment is covered up to that amount. Many policies include sub-limits, which are smaller caps placed on specific treatments. For example, your insurance might offer £10,000 in total coverage, but if there’s a £1,500 cap on dental care, you’ll have to pay out of pocket for anything beyond that.

Common treatments that often have sub-limits include:

- Dental care – Some policies only cover treatment for accidents, not general dental health.

- Alternative therapies – Coverage for acupuncture, hydrotherapy, or physiotherapy might be restricted.

- Behavioural therapy – Not all policies cover treatments for anxiety or aggression.

- Specialist referrals – Some providers limit the amount covered for specialist treatments like oncology or cardiology.

- Diagnostic tests – While general vet visits might be covered, scans like MRIs or CT scans may have their own cap.

Checking the sub-limits ensures that your chosen policy covers your dog’s specific needs. If your dog is prone to dental issues, joint problems, or allergies, make sure these treatments aren’t restricted under sub-limits. A high annual limit doesn’t always mean full coverage, so always read the policy details carefully.

Consider the contract type and extra fees

Dog insurance contracts aren’t always as straightforward as they seem. Some policies lock you into an annual contract, meaning you’re committed for a full year, while others operate on a monthly rolling basis, allowing you to cancel or switch providers at any time. Understanding the type of contract you’re signing up for is crucial, especially if you want flexibility in managing your dog’s insurance.

One of the first things to check is cancellation policies. Some insurers allow you to cancel at any time without penalties, while others may charge a cancellation fee or require you to finish the contract term before ending coverage. If you’re unsure about committing long-term, a provider with a flexible cancellation policy may be a better fit.

Extra fees can also add up over time. Some insurers charge administrative fees for simple changes, such as updating personal details or switching plans. While these costs might seem small, they can make a difference if you frequently adjust your policy. It’s always a good idea to read the fine print and ask about any hidden charges before signing up.

Another key factor to consider is premium increases. Most insurance providers raise premiums each year, particularly as your dog gets older and becomes more likely to need veterinary care. Some insurers may offer fixed-rate plans for a certain period, while others increase rates significantly over time. Checking past customer reviews can give you an idea of how much prices tend to rise.

At Quays Pet Insurance, we believe in transparent pricing with no hidden fees, so you always know what to expect. Before committing to any policy, make sure you fully understand the contract terms and potential costs to avoid surprises down the road.

Investigate the claims process

When your dog needs medical care, dealing with a complicated claims process is the last thing you want. A reliable insurance provider should make it simple to submit claims and get reimbursed quickly, allowing you to focus on your pet’s health rather than paperwork and waiting times.

One of the first things to check is how you can submit a claim. Some insurers allow you to file claims online or through a mobile app, making the process faster and more convenient. Others may require paperwork, which can slow things down and add unnecessary hassle. Before choosing a policy, find out whether the insurer offers digital claims submission and whether their process is straightforward.

Speed is another important factor. Some insurance companies process claims within a few days, while others may take several weeks to reimburse you. Long processing times can be frustrating, especially if you have already paid a large vet bill out of pocket. Look for an insurer with a reputation for fast claim approvals and clear communication about how long reimbursement typically takes.

Another key consideration is whether the insurer pays the vet directly or if you have to cover the cost upfront and wait for reimbursement. Some providers have direct payment agreements with vets, which can ease financial pressure and eliminate the need to wait for your claim to be processed. If paying out of pocket and waiting for reimbursement isn’t an option for you, choose an insurer that offers direct vet payments.

Customer reviews can provide valuable insights into how well an insurer handles claims. Reading about other pet owners’ experiences can help you determine whether a company has a hassle-free claims process or if customers frequently face delays and denied claims. A smooth and efficient claims process can make all the difference in stressful situations, so it’s worth doing your research before committing to a policy.

Understand the excess structure

Excess is the amount you need to pay before your insurance starts covering the rest of the vet bill. Every pet insurance policy has an excess structure, and understanding how it works is crucial for avoiding unexpected costs.

Some policies have a fixed excess, which means you pay a set amount per claim. For example, if your policy has a £100 excess and your vet bill is £500, you will pay £100, and the insurer will cover the remaining £400. This structure is straightforward and makes it easy to anticipate costs.

Other policies use a percentage-based excess, meaning you will pay a certain percentage of the total vet bill rather than a fixed amount. For instance, if your policy requires you to cover 20% of each claim and your vet bill is £1,000, you would pay £200, and the insurer would pay £800. While this can work well for lower-cost treatments, it can become expensive for high medical costs.

Some insurers also have an increasing excess, which means the amount you pay rises as your dog gets older. This is something to watch out for, as pet healthcare costs tend to increase with age, and a rising excess could make claims more expensive over time.

Choosing the right excess structure depends on your financial situation and preferences. A policy with a low monthly premium might come with a high excess, meaning you’ll pay less each month but more when making a claim. On the other hand, a higher premium often comes with a lower excess, reducing your out-of-pocket expenses when your dog needs care. Carefully weigh the pros and cons to find the right balance between affordability and coverage.

Check Waiting Periods

When you sign up for dog insurance, coverage doesn’t start immediately. Instead, most policies include a waiting period, which is the time you must wait before you can make a claim. This waiting period helps prevent fraud by ensuring that pet owners don’t purchase insurance after their dog has already developed a health issue just to claim expenses.

Waiting periods vary depending on the type of coverage:

- Accidents – Most insurers cover accidents within 24 to 48 hours of starting your policy. This means if your dog has an unexpected injury shortly after enrollment, you’ll likely be covered.

- Illnesses – Coverage for illnesses typically has a longer waiting period, usually 14 days. This prevents owners from insuring their pet after noticing symptoms of an illness and then immediately filing a claim.

- Pre-existing conditions – These are generally not covered at all. Some insurers might reconsider pre-existing conditions if your dog has been symptom-free for a certain period, but this varies by provider.

Waiting periods can be frustrating if you need urgent coverage, but they are standard in the insurance industry. If your dog currently has no insurance, it’s best to get covered as soon as possible to avoid gaps in protection. Unexpected accidents and illnesses can happen at any time, and being proactive ensures that your pet is protected when they need it most.

How often should I compare dog insurance policies?

Absolutely. Taking the time to compare dog insurance can make a huge difference in both cost and coverage. Without comparing, you may end up with a policy that doesn’t cover key health conditions, has high out-of-pocket costs, or comes with restrictive exclusions. Some policies may seem cheaper at first but could lack essential benefits, such as coverage for long-term illnesses or breed-specific conditions. By carefully comparing options, you can ensure your dog gets the best possible protection while avoiding unexpected expenses down the line.

Can I compare dog insurance online, and is it accurate?

Yes, you can compare dog insurance online, and it’s one of the easiest ways to assess different policies. Many comparison websites provide side-by-side breakdowns of coverage, costs, and exclusions. However, while these tools are helpful, they may not always show the full policy details. Insurance providers often have fine print regarding exclusions, waiting periods, and reimbursement processes that may not be immediately visible in a quick comparison. To ensure accuracy, always visit the provider’s website, read the policy documents thoroughly, and, if needed, contact the insurer for clarification before making a final decision.

What’s the best way to compare dog insurance for an older dog?

When comparing dog insurance for an older dog, focus on policies that offer comprehensive coverage for age-related conditions, as senior dogs are more prone to illnesses like arthritis, diabetes, and heart disease. Many insurers have age limits or may charge higher premiums as your dog gets older, so look for policies with reasonable premium increases and minimal restrictions on coverage. Some providers exclude pre-existing conditions or impose higher excess fees for older pets, so be sure to check those details. Choosing a policy with lifetime cover can be beneficial, as it ensures continuous protection for chronic conditions your dog may develop later in life.

Are there specific things to watch for when I compare dog insurance for a specific breed?

Yes, breed-specific health risks should always be considered when comparing dog insurance. Certain breeds are more susceptible to hereditary or congenital conditions, which some insurers may exclude from coverage. For example, large breeds like German Shepherds and Labradors are prone to hip dysplasia, while brachycephalic breeds like Bulldogs and Pugs often suffer from respiratory issues. Insurers may charge higher premiums for breeds with known health risks, so check whether the policy includes coverage for hereditary and congenital conditions. If you own a purebred dog, look for a provider that explicitly covers breed-specific medical issues to avoid gaps in protection.

Final thoughts

As your dog grows and their needs change, having the right insurance can provide peace of mind, knowing you’ll be covered no matter what happens. From unexpected accidents to long-term health conditions, a solid insurance plan helps you focus on your pet’s well-being instead of worrying about the costs.

At Quays Pet Insurance, we believe in clear, comprehensive, and reliable coverage—so you’re never left wondering what’s included or facing hidden fees. We’re here to help you find the right protection for your furry companion. Ready to compare your options? Get a quote today and find the best plan for your dog!