Dog insurance is a smart way to protect your pet and your wallet. But let’s face it—dog insurance cost is often the first thing on every owner’s mind. Vet bills can pile up quickly, and one unexpected illness or injury might set you back hundreds or even thousands of pounds. That’s why many dog owners turn to insurance to ease the financial pressure and gain peace of mind.

Still, one big question remains: what exactly goes into calculating dog insurance cost? The truth is, the price can vary widely depending on several factors. Your dog’s breed, age, health condition, and even your postcode can all play a role in the final premium.

If you’ve ever searched for dog insurance online, you’ve probably seen a massive range of prices. Some policies seem affordable, while others feel far too expensive. What causes such a big gap? That’s what we’re here to explain.

In this blog, we’ll explore everything that affects dog insurance cost, so you’re better equipped to compare and choose wisely. We’ll break down the factors that matter most, from the type of coverage to how often your dog visits the vet.

Even better, we’ll show you clever ways to save money without sacrificing quality. Whether you’re a first-time pet parent or switching providers, this guide will help you find the best plan for your pup—and your budget.

By the end, you’ll understand why dog insurance cost isn’t one-size-fits-all and how to make a choice that keeps both your dog and your finances safe.

Average Cost of Dog Insurance

The average dog insurance cost can vary widely depending on several factors. On a national scale, most dog owners pay between £20 and £60 per month for a standard policy. However, this number depends heavily on the type of coverage you choose and where you live.

There are three main types of dog insurance coverage you’ll come across. Accident-only plans are the most affordable, usually ranging from £10 to £20 per month. These only cover injuries from unexpected events like car accidents or falls. They won’t help if your dog develops an illness or needs routine care.

Accident and illness policies are the most common. They typically cost between £25 and £45 monthly. These plans cover a wide range of medical needs—from infections to chronic conditions. They’re more expensive but offer peace of mind if your dog gets sick.

Wellness plans are the priciest, with monthly costs ranging from £40 to £60. They cover preventive care like vaccinations, dental cleanings, and checkups. While some owners add this for convenience, others prefer to budget for these expenses themselves.

Location plays a huge role in dog insurance cost too. If you live in a busy city like London, you might pay more due to higher vet bills and living costs. In contrast, rural areas with fewer clinics often come with lower premiums.

When weighing your options, consider your dog’s health, age, and lifestyle. Picking the right level of coverage can help you save in the long run, even if it means paying a bit more upfront. Dog insurance cost isn’t one-size-fits-all, so taking the time to compare plans is always worth it.

Dog Insurance Cost by Coverage Type

The cost of dog insurance can vary dramatically based on the type of coverage you choose. Each plan offers different levels of protection and pricing, so understanding your options is crucial. Typically, there are three types of dog insurance: accident-only, accident & illness, and wellness plans.

- Accident-only insurance: This is the most affordable option, with monthly premiums starting as low as £10. This type of dog insurance covers treatment for injuries caused by accidents, like fractures or poisoning. However, it won’t cover illnesses or preventive care, making it ideal for young, healthy dogs with low risk of disease.

- Accident & illness: These are more comprehensive and cost more—averaging between £30 and £60 per month. These policies cover vet visits related to injuries and a wide range of illnesses, including cancer, infections, and hereditary conditions. This is the most popular type of dog insurance and is often chosen by owners who want broader protection without the highest costs.

- Wellness plan: This focuses on routine and preventive care. These include annual check-ups, vaccinations, flea treatments, and dental cleanings. While some dog insurance providers offer wellness as an add-on, others include it in premium plans. The additional cost can range from £10 to £25 per month.

Choosing the right coverage type depends on your budget and your dog’s needs. If your pet is older or prone to specific health issues, a comprehensive accident & illness plan may be best. For younger, low-risk dogs, accident-only plans might suffice. Wellness plans are great for proactive owners focused on long-term health. By comparing what each policy covers and at what cost, you can find a dog insurance plan that protects both your pup and your pocket.

Factors That Affect Dog Insurance Cost

- Breed and Size: Your dog’s breed plays a major role in determining the premium. For example, French Bulldogs are known for respiratory issues, while Golden Retrievers are prone to joint problems. Insurers consider the medical history associated with each breed, and those with higher risk often face higher premiums. Size also matters—larger dogs usually have shorter lifespans and more expensive treatments, which can drive up the dog insurance cost.

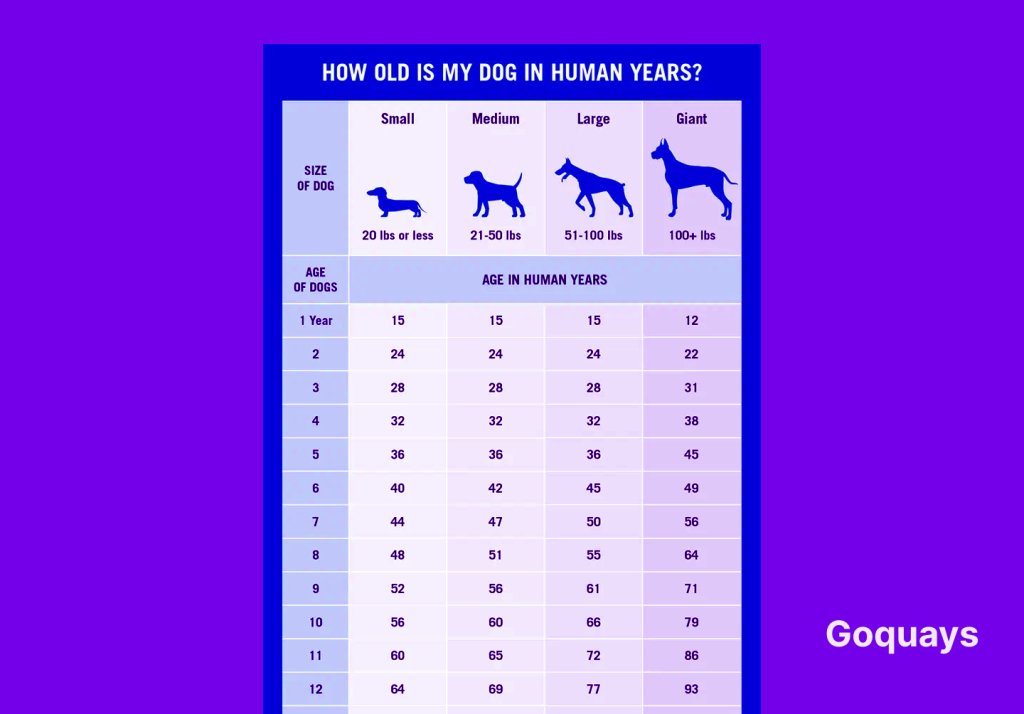

- Age of the Dog: Age is another critical factor. Puppies are generally cheaper to insure at first, but may require frequent vet visits, vaccinations, and checkups. As dogs age, they become more vulnerable to health conditions like arthritis, cancer, or diabetes. Older dogs come with a higher dog insurance cost because they’re more likely to need ongoing medical care.

- Pre-existing Conditions: If your dog already has a medical condition, most insurers won’t cover it. Chronic issues like hip dysplasia or diabetes raise red flags. Dogs with pre-existing conditions often face much higher premiums or limited coverage options.

- Coverage Type and Policy Limits: The more coverage you want, the more you’ll pay. Comprehensive plans with high annual limits or low deductibles can significantly increase your dog insurance cost. If you want 90% reimbursement instead of 70%, expect to pay more each month.

- Location and Veterinary Costs: Where you live affects how much you pay. Urban areas tend to have higher vet costs, which raises premiums. Even neighborhoods within the same city can have price differences.

6. Additional Coverage Options: Add-ons like dental care, exam fee coverage, or alternative therapies can boost your premium. Wellness plans are convenient but come at a higher price.

How to Save on Dog Insurance

Saving on dog insurance cost doesn’t mean you have to compromise your dog’s health or peace of mind. Taking a proactive approach can go a long way in managing your dog insurance cost while still keeping your pup protected. With a few smart strategies, you can reduce your premiums while keeping solid coverage in place.

- Compare Insurance Providers: Not all insurers charge the same price for similar plans. It pays to research multiple providers to compare coverage levels, customer reviews, and pricing. Look out for companies offering flexible plans or special deals. Some offer lower dog insurance cost structures for new customers or provide loyalty perks.

- Enroll Your Dog at a Young Age: You’ll often pay a lower dog insurance cost if you sign up your pup early. Puppies are generally healthier, and insurers reward this with cheaper rates. Early enrollment also helps you avoid issues with pre-existing conditions later.

- Opt for Accident-Only Coverage: If you’re on a tight budget, accident-only plans can offer a more affordable alternative. While they don’t cover illnesses, they’re useful for sudden injuries or emergencies. This is a good choice for healthy, young dogs that don’t need frequent medical attention.

- Take Advantage of Discounts: Many insurers offer discounts that can bring down your dog insurance cost. You could save by insuring multiple pets, paying yearly instead of monthly, or qualifying through your employer’s membership.

5. Maintain Your Dog’s Health: A healthy dog often means fewer claims and lower costs in the long run. Regular exercise, a balanced diet, and annual vet checkups can prevent costly health issues. Insurers often take health into account, so keeping your dog fit can mean cheaper premiums over time.

Why Dog Insurance Cost Varies Between Breeds

When it comes to dog insurance cost, your dog’s breed plays a big role. Some breeds are genetically predisposed to certain illnesses, and that increases the likelihood of vet visits and treatment. Insurance companies know this, and they calculate premiums based on the level of risk associated with each breed.

For instance, French Bulldogs and Pugs often have respiratory problems due to their short snouts. That means higher vet bills and, in turn, higher dog insurance cost. Similarly, large breeds like Great Danes or Saint Bernards are more likely to experience joint problems, heart issues, or even shorter lifespans. Again, this pushes premiums up.

On the other hand, mixed-breed dogs tend to have fewer inherited health issues. That usually translates into a lower dog insurance cost. They’re generally healthier and less likely to need expensive medical procedures.

Insurers also consider the breed’s popularity. Popular breeds like Labradors and Golden Retrievers may have slightly higher premiums due to the volume of claims filed. It’s a numbers game—if many dogs of a certain breed are insured and frequently treated, the average cost goes up.

Some companies even have specific breed exclusions or higher deductibles for breeds that are considered high-risk. So when you’re shopping for a policy, it’s important to compare how different insurers treat your specific breed.

Is Dog Insurance Cost Worth It for Older Dogs?

Many pet parents wonder if paying the dog insurance cost is still worth it once their furry friend reaches senior years. The short answer? It depends—but in many cases, yes, it’s absolutely worth considering.

As dogs age, they become more prone to health issues like arthritis, diabetes, heart disease, or even cancer. Treating these conditions often means frequent vet visits, medication, and sometimes surgery—all of which can be expensive. With older dogs, the chance of needing care rises, and so does the potential cost of that care.

Now, it’s true that dog insurance cost increases as your pet gets older. Monthly premiums can be significantly higher than those for a young puppy. Some insurers may also limit the coverage available to senior dogs or require a full health screening before approval. And in many cases, pre-existing conditions won’t be covered.

However, if your older dog is still relatively healthy and you can find a plan that includes the conditions most likely to arise, the savings can be huge. A single hospitalization or chronic illness can cost hundreds or even thousands of pounds. Insurance helps spread those costs over time and provides financial relief when you need it most.

To make it worth the cost, compare insurers that specialise in senior pet coverage. Look for flexible options with no lifetime payout limits and policies that don’t automatically drop coverage when your dog turns a certain age. Also, consider the total value—not just monthly cost—of having peace of mind as your pet grows older.

Dog Insurance Cost for Common Health Conditions

Some health conditions can significantly affect your dog insurance cost. Insurance companies assess risk, and dogs with higher risks of illness will come with higher premiums. Common health issues like hip dysplasia, allergies, diabetes, cancer, and dental disease often lead to expensive treatments. If your dog is a breed known for a specific condition, your premiums may reflect that.

For instance, Golden Retrievers are prone to cancer, while Dachshunds often face spinal issues. These known risks increase the likelihood of claims, so insurers raise costs to cover those risks. Additionally, if your dog already has a pre-existing condition, most providers will not cover treatment for it, but they may still adjust your premium due to the dog’s overall health profile.

Managing these health conditions with preventive care can reduce vet bills in the long run, even if your insurance premium is slightly higher. But it’s crucial to know that the type of policy you choose also affects the coverage for these issues. Some basic policies only cover emergencies, while others include chronic or hereditary conditions.

When shopping for coverage, review the fine print to ensure the policy includes conditions your dog may be at risk for. Ask about waiting periods, exclusions, and whether hereditary conditions are covered.

Ultimately, choosing a policy that addresses your dog’s potential health risks can lead to better care and financial savings. While the dog insurance cost may be higher for dogs with common conditions, it often pays off over time, especially when vet bills start adding up.

How to Calculate the True Dog Insurance Cost Over a Lifetime

Understanding the full picture of dog insurance cost means looking beyond monthly premiums. Lifetime costs can vary depending on how long your dog lives, their health status, and what type of policy you choose. On average, dog insurance costs between £20 and £60 per month. That might not seem like much until you calculate the total across a dog’s lifespan.

For example, if your dog lives for 12 years and you pay £40 per month, you’ll spend around £5,760 in premiums. Now, add deductibles, co-pays, and any non-covered vet visits, and the number rises. But also consider how much you could save. A single surgery or chronic condition could cost thousands, and insurance may cover 70–90% of that bill.

Accident-only plans cost less but offer limited coverage. If you go that route, you might save on monthly payments but pay more out-of-pocket during emergencies. Wellness plans cost more but may help you manage routine care more affordably.

To calculate the lifetime cost accurately, factor in your dog’s breed, age, and likelihood of illness. Consider whether your insurer raises premiums over time or adjusts them based on claims history. Read the terms regarding coverage caps—some policies limit total payouts per year or lifetime.

Lifetime dog insurance cost isn’t just a financial figure—it reflects your approach to pet care. Being prepared financially allows you to make health decisions based on need, not affordability. Though the cumulative cost may seem high, the peace of mind and potential savings in emergencies make it a worthwhile investment for many pet parents.

Dog Insurance Cost: Monthly vs Annual Payment Plans

Payment Plan | Pros | Cons | Additional Information |

Monthly Payment | – More manageable for budgeting. | – Slightly higher total cost over the year due to processing fees. | – Suitable for owners who prefer smaller payments monthly. |

– Easier to adjust if you need to cancel or switch plans. | – Can add processing fees by insurers. | – Flexibility to switch providers or policies without long-term commitment. | |

– Offers short-term financial relief. | – Missed payments may result in loss of coverage. | – Helps if you have unpredictable or tight finances. | |

Annual Payment | – Lower overall cost due to potential discounts. | – Requires upfront payment of the full premium. | – Best for owners who have the financial ability to pay all at once |

– No worries about monthly reminders or fees. | – Less flexibility; hard to change insurers mid-year. | – Typically comes with a discount, reducing the total dog insurance cost. | |

– More stable and predictable for the long term. | – Large upfront cost may not be feasible for everyone. | – Can save £20–£50 on the yearly premium. |

How Spaying or Neutering Impacts Dog Insurance Cost

Spaying or neutering your dog can have a positive impact on its insurance cost. Many insurers offer discounts for spayed or neutered dogs due to the lower likelihood of certain health risks. These procedures eliminate the risk of reproductive organ-related conditions, such as cancers of the uterus or testicles, which could lead to expensive medical treatments down the line.

Insurance companies often view spayed and neutered dogs as less risky and, therefore, may offer lower premiums. On top of that, spaying or neutering your dog can also reduce the chances of behavioral issues, such as aggression or marking territory, which may result in fewer claims or a lower likelihood of needing veterinary care.

It’s worth noting that the savings from spaying or neutering vary across different providers and plans. If you’re planning to have your dog spayed or neutered, check with your insurer to find out if they offer any discounts or reduced rates for these procedures.

For younger dogs, the benefits of spaying or neutering can also include avoiding health problems that might arise in the future. It’s a good idea to have the procedure done while your dog is still young to secure the potential benefits in terms of dog insurance cost.

The Hidden Fees Behind Low Dog Insurance Cost Plans

Low-cost dog insurance plans often seem attractive at first glance, but they can come with hidden fees that drive up the overall cost of coverage. One of the main hidden costs is the deductible. Some low-cost plans have higher deductibles, meaning you’ll need to pay more out-of-pocket before your insurance kicks in. Although your monthly premium may be lower, the deductible can quickly add up if your dog requires frequent medical care.

Another hidden cost is the reimbursement rate. Some low-cost plans only reimburse a small percentage of your medical expenses, leaving you with higher out-of-pocket costs. Additionally, some policies might include limits on specific treatments, such as surgery, dental care, or medications, which can be restrictive if your dog needs specialized care.

Additionally, some low-cost insurance plans may come with exclusions. These plans may not cover certain treatments or conditions, such as pre-existing conditions or certain types of veterinary care, even though they seem comprehensive. Always review the fine print of a low-cost plan to ensure you fully understand the limitations and potential fees.

To avoid unexpected costs, it’s crucial to compare the benefits and coverage limits of multiple plans, focusing on what is and isn’t included. While low-cost options may seem appealing, ensure they provide the coverage you truly need without hidden fees that can increase your overall expenses.

Final Thoughts

In conclusion, understanding the costs associated with dog insurance is essential for making informed decisions that will benefit both your dog and your wallet. With vet expenses on the rise, dog insurance offers financial protection, ensuring that you won’t face a heavy burden in times of unexpected medical emergencies. However, it’s important to remember that the cost of dog insurance can vary widely depending on factors such as breed, age, location, and coverage type.

By breaking down the different aspects that influence premiums—such as breed and size, age, pre-existing conditions, and location—you can better understand what affects your premiums and how to manage them. Choosing the right policy and coverage limits that fit your dog’s needs and your budget can also make a significant difference in controlling insurance costs.

To save on dog insurance premiums, consider comparing different providers, opting for a higher deductible, enrolling your dog at a younger age, or selecting accident-only plans if appropriate. Additionally, taking advantage of discounts and maintaining your dog’s health can help reduce the overall cost of dog insurance over time.

Ultimately, ensuring that your dog has the right coverage for their needs is crucial. By making thoughtful decisions and planning ahead, you can secure the best dog insurance plan for both you and your pet while keeping costs manageable. Remember, the investment in dog insurance today could save you from unexpected financial strain in the future, ensuring that your dog receives the best possible care throughout their life.