Caring for your cat goes beyond providing food, shelter, and affection—it also involves planning for their health and well-being. Cat insurance plays a key role in helping pet owners manage unexpected vet expenses, ensuring their cats receive the best possible care without breaking the bank. However, understanding what conditions are covered under a policy becomes especially important when dealing with pre-existing conditions.

This blog post will explore what pre-existing conditions mean in the context of cat insurance, how they are assessed by insurers, and what conditions are eligible for coverage. By understanding these details, as a cat owner, you can make informed decisions when selecting an insurance plan that best meets your pet’s health needs and financial situation.

Pre-existing Conditions in Cat Insurance

When purchasing pet insurance for your cat, one of the most important factors to consider is how cat insurance providers handle pre-existing conditions. These conditions determine the type of coverage your cat is eligible for and whether your provider will cover medical expenses related to them in the future.

What is a Pre-existing Condition?

Pre-existing conditions are health issues or illnesses that existed before purchasing an insurance policy. Having a cat with a pre-existing condition can impact your coverage eligibility. While many insurance providers exclude pre-existing conditions from their policies, some companies offer limited coverage under specific circumstances.

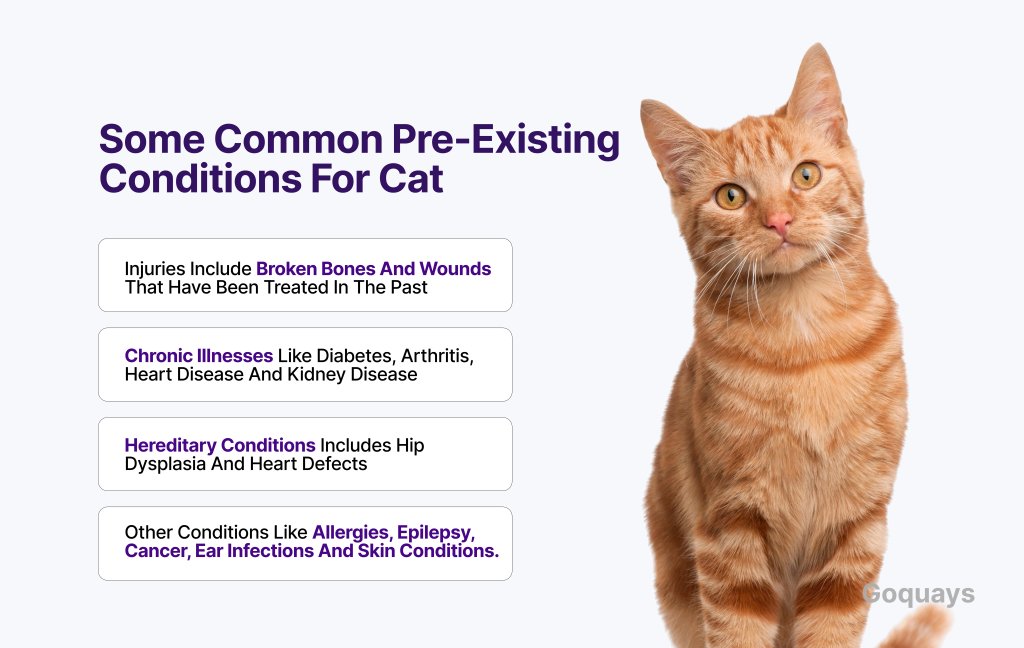

Some common pre-existing conditions in cats include injuries, chronic illnesses, hereditary conditions and other conditions.

- Injuries include broken bones and wounds that have been treated in the past

- Chronic illnesses like diabetes, arthritis, heart disease and kidney disease

- Hereditary conditions includes hip dysplasia and heart defects

- Other conditions like allergies, epilepsy, cancer, ear infections and skin conditions.

To determine if your cat has a pre-existing condition or not, insurance providers review your cat’s veterinary history before approving a policy. Doing this helps them identify any signs of illness or past health concerns. Some factors they consider include:

- Medical records from past vet visits

- Prior treatments and prescriptions

- Symptoms reported by the owner or vet before the policy start date

- Diagnostic tests indicating potential or existing conditions

If your cat ever has a recurring health issue or symptoms that suggest an underlying problem, insurers may classify it as pre-existing, even if there is no official diagnosis at the time.

Cat Insurance policies that cover pre-existing conditions

In coverage for a cat with pre-existing conditions, some providers offer partial or conditional coverage depending on your cat’s pre-existing conditions and its overall health history. Understanding these as a cat owner will help you find the best coverage for your cat, no matter its health condition.

Types of coverage for cats with Pre-existing conditions

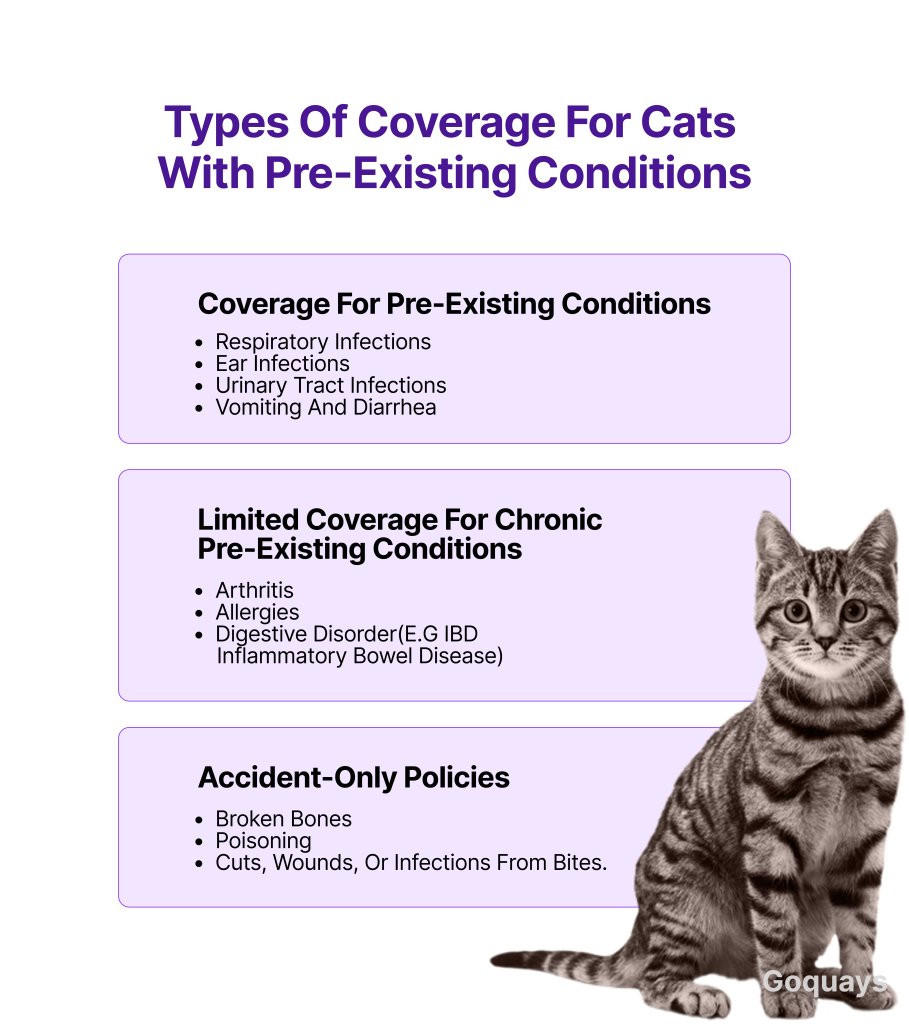

While most pet insurance providers do not cover pre-existing conditions outright, some offer exceptions based on specific criteria. These policies are divided into three categories;

- Coverage for Pre-existing conditions

Some insurance providers will cover conditions that are considered curable under the condition that your cat has been symptom-free for a certain period (around 6 – 12 months). Some curable conditions include;

- Respiratory infections

- Ear infections

- Urinary tract infections

- Vomiting and diarrhea

If your cat remains healthy without signs of the condition reappearing, your provider can begin to cover it under normal terms

- Limited coverage for chronic Pre-existing conditions

While some pet insurance providers only cover for curable cat conditions, some others are known to offer coverage partially or for a limited period. This means they may cover some aspect of your cat’s treatment but not the entire health issue. For example, a provider may cover medications, excluding diagnostic tests or specialist visits for a chronic illness. Conditions that may qualify for partial coverage include:

- Arthritis

- Allergies

- Digestive disorder(e.g IBD Inflammatory Bowel Disease)

- Accident-only Policies

If an insurance provider does not cover pre-existing conditions, they may still offer accident-only policies which cover injuries unrelated to any health issue. For accident-only policies, it covers emergency treatments for;

- Broken bones

- Poisoning

- Cuts, wounds, or infections from bites.

While accident-only policies do not cover chronic illnesses, they provide financial protection for unexpected accidents.

Types of Pre-existing Conditions

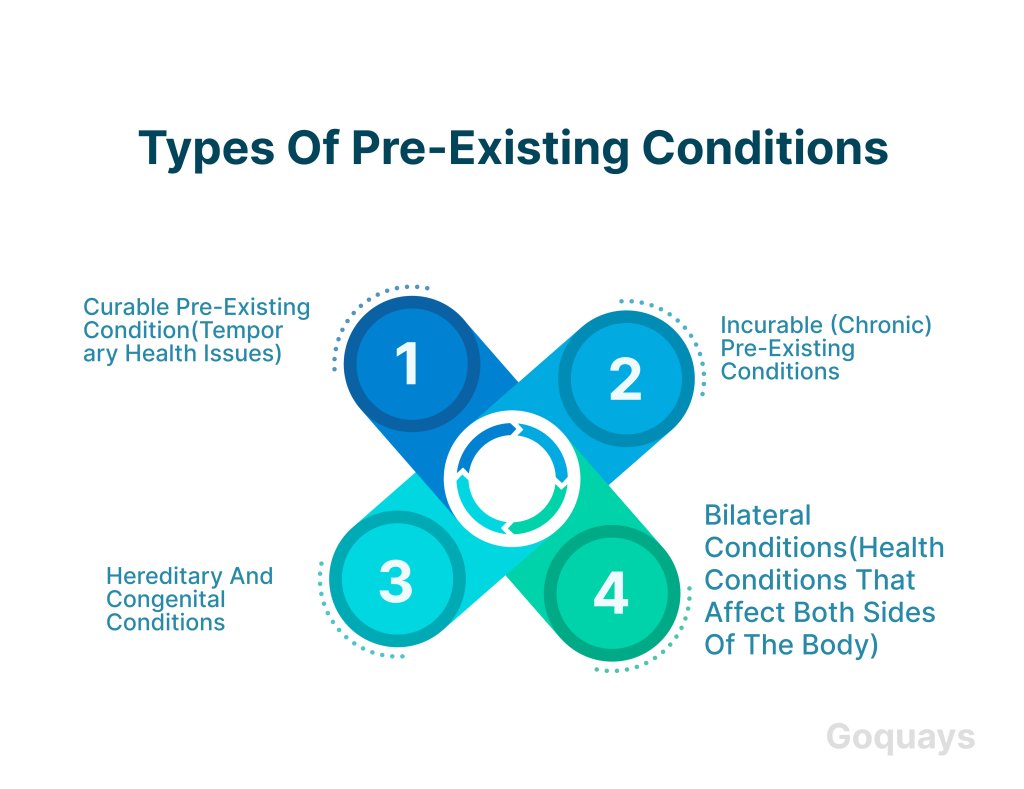

Pet insurance companies classify pre-existing conditions based on whether they can be cured or managed over time. Understanding these differences is important if you seek coverage as it determines if your insurer will cover certain conditions. Pre-existing conditions are divided into two categories: curable and incurable conditions.

- Curable Pre-existing condition(Temporary health issues)

Some conditions are considered temporary (curable health issues), which can be covered by insurance after a waiting period (6-12 months) when your cat is symptom-free during this time. Most curable conditions are usually short-term illnesses or injuries that have completely healed without any long-term complications.

Examples of curable pre-existing conditions include;

- Respiratory infections: Conditions like upper respiratory infections (URIs) caused by bacteria or viruses can be covered if the cat has been symptom-free for several months.

- Urinary tract infections (UTIs): If your cat experiences a one-time UTI that resolves without complications, some insurers may cover future UTIs.

- Gastrointestinal issues (vomiting or diarrhea): If the symptoms are linked to a short-term illness rather than a chronic disorder, they may be covered.

- Ear infections: A temporary ear infection that clears up without recurring may be eligible for future coverage.

- Minor injuries (sprains, cuts, or fractures): If your cat recovered from an injury in the past without long-term effects, insurers may cover future injuries of the same type.

Conditions that are not considered curable

Even if some illnesses appear to be curable, insurers may classify them as chronic or recurrent if they happen multiple times. For example, if a cat has repeated UTIs within a short period, your insurance provider may consider it a chronic issue and exclude coverage.

- Incurable (chronic) pre-existing conditions

Incurable pre-existing conditions are long-term illnesses or diseases that require lifelong management. These conditions develop gradually and either worsen over time or reoccur, consequently requiring ongoing veterinary care, medication, or treatments. Most pet insurance policies do not cover chronic conditions if they were diagnosed before the pet insurance policy.

Some incurable pre-existing conditions include;

- Diabetes: This is a lifelong metabolic disorder that requires insulin injections, dietary management, and regular veterinary monitoring.

- Arthritis: Arthritis is a joint disease that causes pain and stiffness, which affects older cats.

- Chronic kidney disease: This is a condition that is common in older cats and affects their kidney function. It requires special diets and ongoing medical care.

- Feline asthma: It’s a respiratory condition that causes wheezing, coughing, and difficulty breathing. It requires lifelong treatment with inhalers or medication.

- Cancer: Tumors or cancers diagnosed before signing up for insurance are excluded from coverage.

- Heart disease: Conditions like hypertrophic cardiomyopathy (HCM) are common heart diseases in cats.

- Allergies: Chronic allergies, whether food-related or environmental, often require long-term treatment and are usually excluded.

- Hyperthyroidism: A common hormonal disorder in older cats that affects metabolism and requires medication or surgery.

- Epilepsy or seizures: Neurological disorders that cause recurring seizures require lifelong medication and are rarely covered.

Since most insurance providers exclude chronic conditions, as a cat owner, if your cat is suffering from any of the above conditions, you can seek alternative medical care like veterinary discount plans, wellness packages, or a savings account for medical expenses.

- Hereditary and Congenital Conditions

Some conditions are inherited(genetic) or present at birth, which insurance providers classify as pre-existing conditions as it is a condition before signing up for insurance. But it’s important to remember that some pet insurance companies cover hereditary and congenital conditions if no signs or symptoms were present before opting for an insurance policy.

Some of these conditions include;

- Hip dysplasia: A genetic condition affecting the hip joints, common in some cat breeds.

- Polycystic kidney disease (PKD): A genetic disorder common in Persian cats, causing kidney cysts.

- Feline hypertrophic cardiomyopathy (HCM): A hereditary heart disease that thickens the heart muscle.

- Cleft palate or other congenital defects: Structural abnormalities present at birth.

If a cat has not shown symptoms before the policy starts, some insurers may cover these conditions, but coverage varies by provider.

- Bilateral Conditions(Health conditions that affect both sides of the body)

Some pet insurance providers apply bilateral condition exclusions, meaning if a cat has a condition on one side of the body, they will not cover it if it later develops on the other side.

Bilateral health conditions include;

- Cataracts: If a cat has cataracts in one eye before insurance starts, the insurer may not cover cataracts in the other eye later.

- Hip dysplasia: If diagnosed in one hip, the insurance may exclude coverage if it later develops in the other hip.

Cruciate ligament injuries: If a cat injures one knee before insurance, some policies exclude coverage if the other knee develops issues later.

How to find cat insurance for pre-existing pet conditions

While most pet insurance companies do not cover pre-existing conditions, there are several ways cat owners can secure the best coverage for their cat.

- Research insurance providers that cover pre-existing conditions

Not all pet insurance providers have the same policies for pre-existing conditions. Some companies may offer partial coverage for curable conditions after a waiting period, while others provide specialized plans that cover chronic conditions under certain conditions.

What to look for in an insurance provider

- Coverage for curable pre-existing conditions

- Comprehensive illness and accident coverage

- Shorter waiting periods

- Lifetime coverage options

- Bilateral condition policies

- Enroll your cat in pet insurance as early as possible

One of the most effective ways for ensuring your cat gets full insurance coverage is enrolling them as early as possible, preferably when they are still a kitten. By doing this, it;

- Minimizes the risk of pre-existing exclusions: If your cat is covered before developing any medical conditions, your cat is less likely to be excluded from coverage due to any conditions.

- Provides coverage for hereditary and congenital conditions: Many insurers cover genetic conditions as long as they are not diagnosed before the insurance policy.

- Reduces long-term medical costs: Younger cats have lower premiums, and early coverage ensures they are protected from future illnesses or injuries.

- Maintain regular veterinary check-ups and health records

Having an up-to-date medical record for your cat can help you demonstrate their health status when applying for insurance. To achieve this, you can;

- Schedule annual wellness exams for your cat.

- Keep copies of all vet records, test results, and treatment history.

- If your cat has had a past illness, ensure your vet provides written confirmation that it has fully resolved.

- Explore alternative financial assistance

If your cat has a chronic, incurable, pre-existing condition that is not covered by insurance, there are still financial options available to help manage medical costs.

- Pet wellness plans

Unlike traditional pet insurance, wellness plans cover routine preventive care such as vaccinations, annual check-ups, dental cleanings, and parasite control. While they don’t cover chronic conditions, they can help reduce the cost of overall veterinary care.

- Veterinary discount programs

Some veterinary clinics offer discount programs for pet owners who need financial assistance. These programs provide reduced rates on treatments, surgeries, and medications.

- Setting up a pet health savings account

If traditional insurance doesn’t cover pre-existing conditions, consider setting aside money in a dedicated savings account for unexpected medical expenses.

- 4. Consider hybrid pet insurance plans (Accident-only coverage + savings plan)

If your cat has a chronic condition that is excluded from standard insurance, combining an accident-only policy with a savings plan can be a cost-effective strategy. This type of policy only covers injuries, broken bones, and emergencies. You can also use a savings plan to cover chronic condition expenses that insurance does not cover.

Conclusion

Choosing the right cat insurance policy for pre-existing conditions requires careful consideration, as not all plans offer the same level of coverage. Understanding how insurers classify curable, incurable, hereditary, and bilateral conditions can help pet owners make informed decisions when selecting a plan.

While most standard pet insurance policies exclude pre-existing conditions, some companies provide limited coverage for curable conditions after a waiting period. If your cat has a chronic or lifelong condition, alternative options such as wellness plans, savings accounts, or veterinary discount programs may help manage healthcare costs.