Senior pet insurance is important to have in place, especially when dealing with older cats. With the right insurance plan, you can cover the cost of age-related illnesses, diagnostic tests, medication, and even alternative therapies. An older cat insurance policy ensures your cat receives the best possible care in their later years.

However, not all policies provide the same level of coverage for older pets, and some insurance providers impose age limits, exclusions, or higher premiums for senior cats.

This guide will explore what to look for in cat insurance for older cats and offer practical tips on finding the best coverage for your senior cat.

Why do senior cats need specialized insurance?

As cats age, their healthcare needs change significantly, making pet insurance even more important than when they were younger. Many pet owners assume that insurance is most useful for accidents and emergencies, but in reality, chronic illnesses, ongoing treatments, and age-related conditions are the primary reasons why senior cats require specialized coverage.

Below, we explore reasons why senior cats need specialized pet insurance and what differentiates it from standard policies.

Increased risk of age-related conditions

As cats get older, they become more prone to chronic conditions that require ongoing medical attention. Unlike younger cats, who may only need occasional vet visits, senior cats require regular check-ups, diagnostics, medications, and treatments to manage their health. Some of the common age-related conditions include Arthritis, Kidney disease, Diabetes, Heart disease, Hyperthyroidism and Cancer.

Increased veterinary costs

As your cat grows older, so do their vet bills increase. This is as a result of frequent check-ups, diagnostic tests, medications, and specialized treatments. A routine vet visit for a senior cat may involve bloodwork, urine tests, and X-rays, which can cost hundreds of pounds per visit.

Limited coverage for older cats

Not all pet insurance providers offer the same level of coverage for senior cats. Many standard pet insurance plans:

- Stop offering new policies to cats over a certain age (e.g., 8-10 years old)

- Exclude pre-existing conditions

- Limit payouts on chronic conditions

- Increase deductibles or co-pays for older pets

However, specialized senior cat insurance policies are tailored to provide long-term financial protection. This includes:

- No upper age limit for enrollment (Some insurers stop offering new policies for cats over 10 years old)

- Coverage for chronic conditions (arthritis, diabetes, kidney disease)

- High annual coverage limits

- Coverage for prescription medications (some insurers have restrictions)

Flexible deductible options

Emergency care for senior cats

Older cats are more prone to medical emergencies that usually require specialist care, advanced diagnostics (MRI, CT scans), and hospitalisation, which can be extremely expensive. Without proper insurance, these costs can be financially overwhelming. Having a comprehensive pet insurance policy for senior cats ensures that owners can make medical decisions based on their cat’s needs—not their budget.

Coverage for alternative therapies

Many older cats benefit from alternative treatments such as acupuncture, hydrotherapy, physiotherapy, and laser therapy for conditions like arthritis and joint pain. Some specialized insurance policies cover these therapies, while standard plans may not.

Additionally, end-of-life care— like euthanasia and cremation services—can also be covered under some senior cat insurance policies, helping owners manage the financial burden during difficult times.

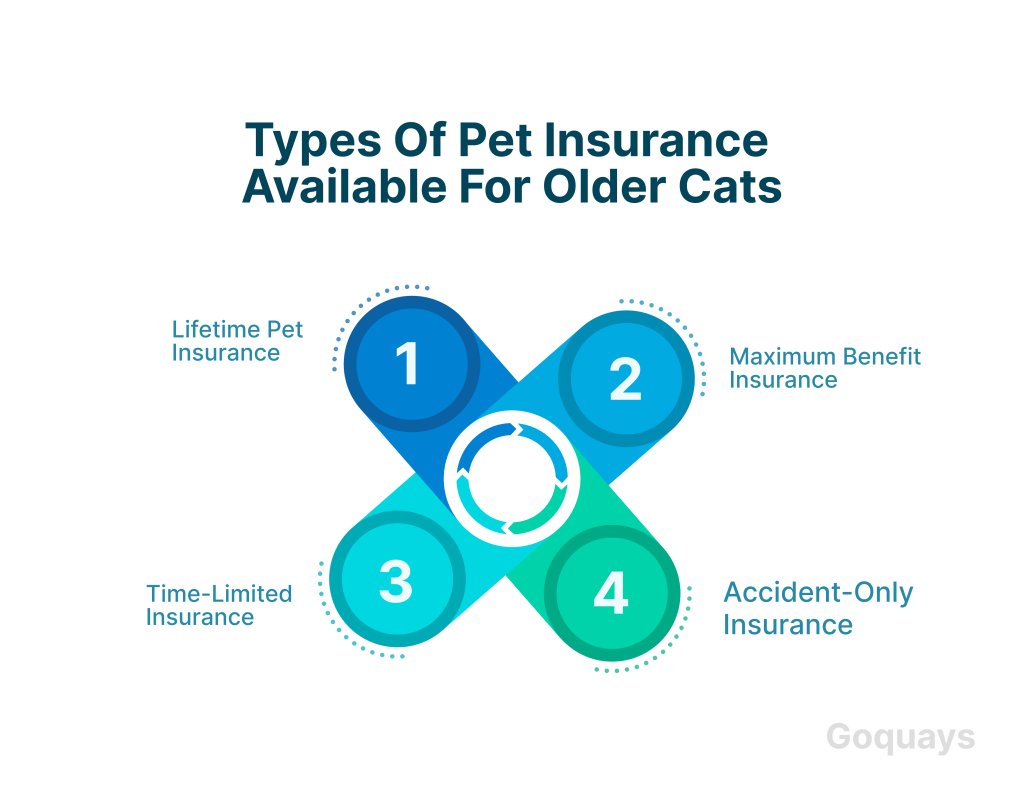

Types of Pet insurance available for older cats

Below, we have made a list of the four main types of pet insurance you can explore for your senior cats.

Lifetime Pet Insurance

Lifetime pet insurance is the most comprehensive option for older cats. This policy covers ongoing illnesses and chronic conditions throughout your cat’s life, provided the policy is renewed annually without a coverage gap.

However, while it is comprehensive, there are some limitations you may want to look out for.

- It is more expensive than other policies, with premiums increasing as the cat ages.

- Some insurers impose age limits (e.g., coverage may be unavailable for cats over 10 years old if applying for the first time).

- Pre-existing conditions may not be covered.

Maximum benefit insurance

Maximum benefit plans provide a fixed amount of coverage per condition (e.g., £2,000-£5,000 per illness or injury). Once the limit is reached for a particular condition, your provider will not cover costs related to that issue. The major limitation of this policy is it’s not a good choice of coverage for long term illness in older cats. Which is what your older cat needs in the long run.

Time-limited insurance

The time-limited policy only covers illnesses and injuries for a maximum of 12 months from the first diagnosis. After this period, the condition will be considered pre-existing and will no longer be covered. This is also not an ideal coverage for older cats because most age-related conditions last beyond 12 months.

Accident-only Insurance

Accident-only pet insurance is the cheapest and most basic type of coverage. It only covers veterinary expenses related to accidents, injuries, and emergencies, but not illnesses or chronic conditions. Since older cats are more prone to illness-related health issues, this type of insurance offers very limited protection for senior pets.

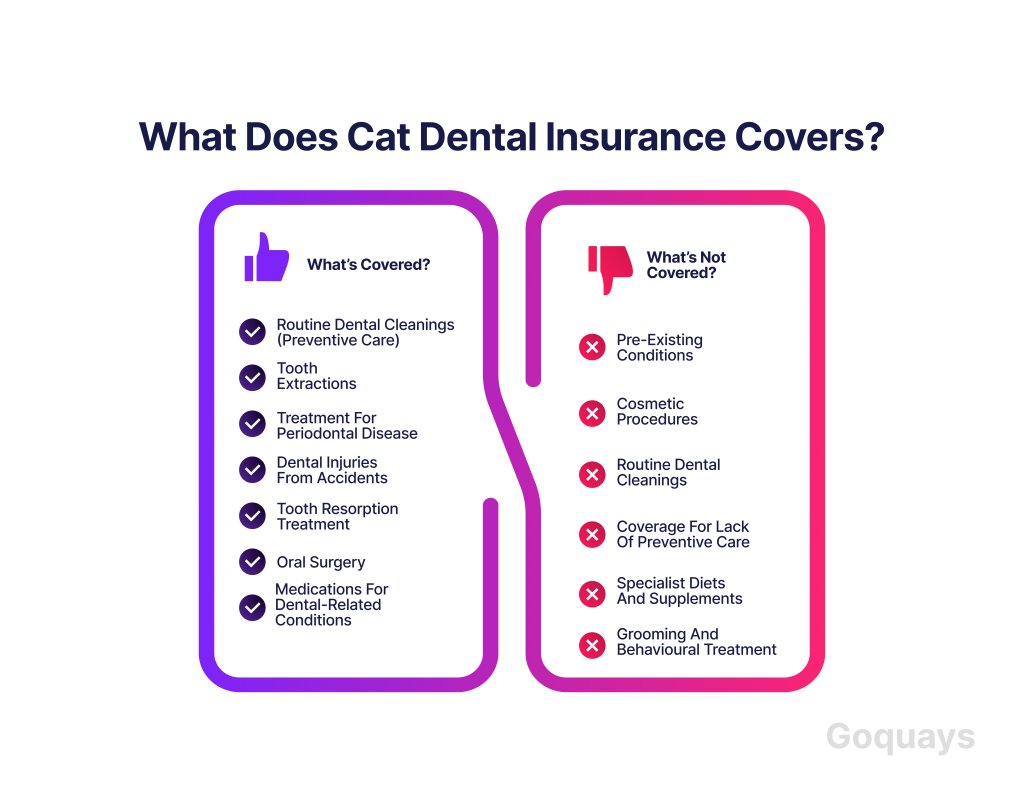

What does cat dental insurance covers?

Below, we have made a list of the four main types of pet insurance you can explore for your senior cats.

Lifetime Pet Insurance

Lifetime pet insurance is the most comprehensive option for older cats. This policy covers ongoing illnesses and chronic conditions throughout your cat’s life, provided the policy is renewed annually without a coverage gap.

However, while it is comprehensive, there are some limitations you may want to look out for.

- It is more expensive than other policies, with premiums increasing as the cat ages.

- Some insurers impose age limits (e.g., coverage may be unavailable for cats over 10 years old if applying for the first time).

- Pre-existing conditions may not be covered.

Maximum benefit insurance

Maximum benefit plans provide a fixed amount of coverage per condition (e.g., £2,000-£5,000 per illness or injury). Once the limit is reached for a particular condition, your provider will not cover costs related to that issue. The major limitation of this policy is it’s not a good choice of coverage for long term illness in older cats. Which is what your older cat needs in the long run.

Time-limited insurance

The time-limited policy only covers illnesses and injuries for a maximum of 12 months from the first diagnosis. After this period, the condition will be considered pre-existing and will no longer be covered. This is also not an ideal coverage for older cats because most age-related conditions last beyond 12 months.

Accident-only Insurance

Accident-only pet insurance is the cheapest and most basic type of coverage. It only covers veterinary expenses related to accidents, injuries, and emergencies, but not illnesses or chronic conditions. Since older cats are more prone to illness-related health issues, this type of insurance offers very limited protection for senior pets.

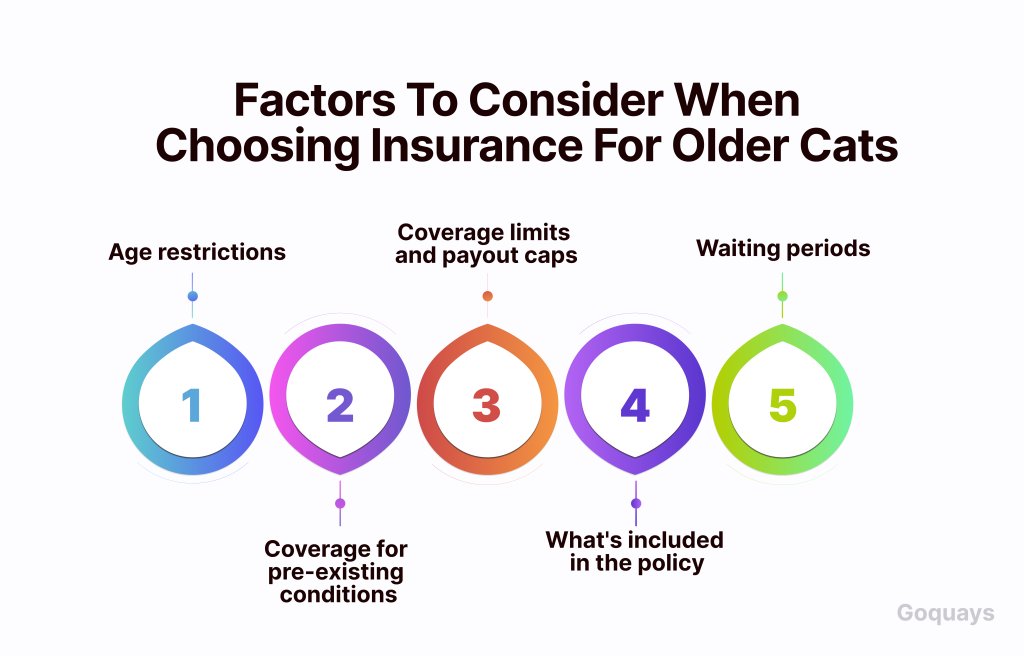

Factors to consider when choosing insurance for older cats

There are several factors to put into consideration when choosing the best cat insurance for older cats.

- Age restrictions: Some insurers set upper age limits for new policies, making it harder to find coverage if your cat is already in their senior years.

- Coverage for pre-existing conditions: Some providers do not cover pre-existing conditions. But some may offer specialised coverage for your cat’s condition.

- Coverage limits and payout caps: Different insurance providers offer different levels of financial protection for veterinary expenses. If your cat requires frequent vet visits, a higher coverage limit is recommended. There are two main types of coverage limits: annual coverage limit and per-condition limit.

- What’s included in the policy: Know exactly what’s covered in the insurance you are opting for. This is because coverage varies, and some providers exclude important treatment for older cats.

- Waiting periods: Most pet insurance providers have waiting periods before coverage starts. This means if your cat develops a condition during the waiting period, it will be considered pre-existing and excluded from coverage.

Cost of Pet insurance for Older cat

One of the most important factors when choosing pet insurance for older cats is understanding the costs involved. As cats age, the risk of chronic illnesses, injuries, and emergency treatments increases, which means insurance premiums also rise.

While pet insurance can be a lifesaver in covering expensive vet bills, it’s important to balance affordability with comprehensive coverage. Below, we break down the key cost factors, what to expect in premiums, and ways to manage expenses when insuring a senior cat.

The cost of pet insurance for your cat depends on the risk factor your insurer measures your pet against.

How much does cat insurance cost?

The most expensive cat breeds to insure in the UK are;

Breeds | Average Annual Premium |

Maine Coon | £309.21 |

Sphynx | £293.81 |

Russian Blue | £277.06 |

Bengal | £275.50 |

Persian | £263.56 |

The cheapest cat breeds to insure in the UK are;

Breed | Average annual premium |

Domestic shorthair | £180.82 |

Moggie | £200.43 |

Ragdoll | £211.18 |

British Shorthair | £222.39 |

British tabby shorthair | £226.78 |

Why do some car breeds cost more to insure?

The cost of pet insurance varies widely by breed, and some cats are significantly more expensive to insure than others. But why? This is because;

- Personality: Just like humans, cats have unique personalities, and some breeds are naturally more adventurous, active, or accident-prone than others. Insurers take these traits into account when determining premiums.

- Indoor vs. outdoor cat behaviour : Your cat’s lifestyle—whether it is an indoor or outdoor cat—also plays a major role in insurance costs. Outdoor cats mean higher insurance costs. This means breeds that have outdoor lifestyles have a higher risk of facing road accidents, injuries from fights with other animals and Exposure to diseases like FIV (Feline Immunodeficiency Virus).

- Health risks from selective breeding: Selective breeding has led to some breeds developing hereditary health issues, which increase vet bills and insurance costs.

Flat-faced (Brachycephalic) breeds mean higher costs

Some breeds, especially Persians, are known for distinct facial features, which can cause serious breathing and eye issues.

Breed | Common Health issues | Effect on insurance cost |

Persian | Brachycephalic airway syndrome, kidney disease, eye problems | High |

Scottish fold | Genetic cartilage disorder, arthritis | High |

For example, Persians have a high risk of respiratory problems due to their flat faces. This makes them more expensive to insure than a breed like the British Shorthair, which has fewer genetic health risks.

Additional costs to consider

In addition to monthly premiums, there are other costs that pet owners should factor in when choosing an insurance policy for their older cat.

Deductibles(excess fees): Most pet insurance policies require owners to pay an excess (deductible) before coverage kicks in. There are two types:

- Fixed excess: A set amount you pay per claim (e.g., £100 per condition).

- Percentage copayments: Some insurers require owners to pay 10-20% of vet bills once the cat reaches a certain age.

Renewal premium increases: One common issue with insuring older cats is that premiums increase each year upon renewal. This is because insurers reassess risk and adjust costs based on

- The cat’s age: Older cats are more likely to develop health conditions.

- Previous claims history: If you have made claims in the past year, expect a higher renewal cost.

- Vet inflation rates: Veterinary costs rise each year, affecting policy pricing.

Ways to reduce insurance costs for Senior cats

While insuring an older cat can be expensive, there are ways to reduce costs without sacrificing essential coverage:

- Compare multiple insurers: Different insurance providers offer varying levels of coverage at different prices. It’s important to shop around and compare quotes to find the best deal.

- Choose a higher excess: Selecting a higher fixed excess (e.g., £200 instead of £100) can lower monthly premiums while still ensuring coverage for major medical expenses.

- Consider multi-pet discounts: If you have multiple pets, some insurers offer discounts for covering more than one animal under the same policy.

- Check for lifetime policies with locked premiums: Some insurers offer policies with locked-in premium rates, meaning your monthly cost won’t increase dramatically as your cat ages.

- Insure your cat early: Getting insurance before your cat reaches their senior years (e.g., before age 8-10) helps avoid pre-existing condition exclusions and secure lower premiums before age-related price increases.