Many cat owners believe that if their older cat has a pre-existing condition, pet insurance for pre-existing conditions is out of the question. But is that true?

When you got your cat as a kitten, it was the most adorable companion you could ever ask for, but as it got older, you had to deal with your cat’s health issues day by day. You want to give your cat the best care possible but veterinary bills are digging a hole in your finances and you are unsure of when it’s going to be your breaking point. This leaves you wondering “Can I still get cat insurance for my older cat? “Does pet insurance cover pre-existing conditions in older cats”?

The short answer is: that it depends on the insurance provider and the type of policy you choose. Many standard pet insurance policies exclude pre-existing conditions, but some specialist insurers offer limited coverage under certain conditions.

Many pet owners assume that if their cat has a pre-existing condition, pet insurance for pre-existing conditions is no longer an option. This can be frustrating, as senior cats often need coverage the most. Some owners might feel forced to pay out of pocket for costly treatments or even delay medical care due to financial concerns.

Understanding these details can help you make an informed decision about your cat’s healthcare. By the end of this article, you will have a clearer understanding of your options and how to ensure your older cat receives the best possible care—without breaking the bank.

What is considered a Pre-existing condition

When it comes to pet insurance, one of the most important factors influencing coverage—especially for older cats—is whether or not your pet has a pre-existing condition. But what exactly does a pre-existing condition mean?

What is a pre-existing condition?

A pre-existing condition is any illness, injury or medical issue that your cat had before signing up for cat/pet insurance for pre-existing conditions. This includes diagnosed conditions as well as any symptoms your cat may have shown even if they were not medically diagnosed by a vet. To determine if your cat has a pre-existing condition, insurance companies make use of your cat’s medical history to determine if they had prior health issues before signing up.

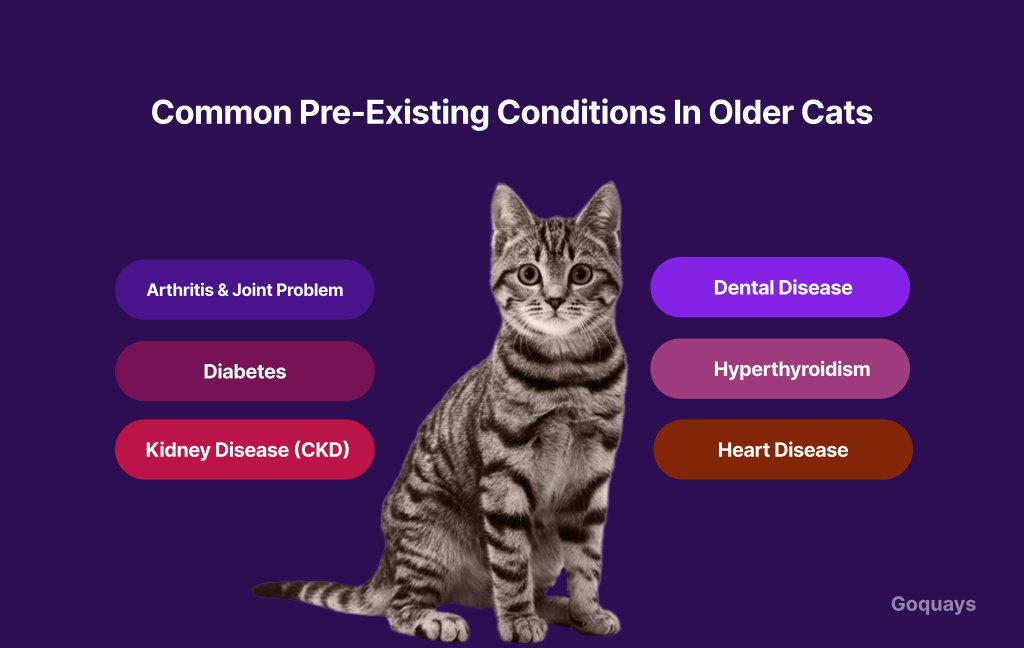

Common Pre-existing Conditions in Older Cats

As cats age, they become more prone to certain chronic illnesses that insurance providers classify as pre-existing conditions. This includes;

- Arthritis & Joint Problems: Common in senior cats and may cause mobility issues.

- Diabetes: Requires lifelong insulin treatment and frequent vet checkups.

- Kidney Disease (CKD): A leading cause of health issues in older cats.

- Heart Disease: This can lead to complications requiring long-term medication.

- Hyperthyroidism: Affects metabolism and can lead to weight loss, heart problems, and high blood pressure.

- Dental Disease: Gum infections and tooth decay, which can be costly to treat.

How Insurers Determine Pre-Existing Conditions

Most pet insurance providers require vet records before approving a policy. They typically look at:

- The last 12-24 months of medical history to assess existing conditions.

- Any symptoms your cat showed (even if undiagnosed) that could indicate an underlying issue.

- Whether the cat has been symptom-free for a certain period (e.g., two years) before considering coverage for a past condition.

Do Pet Insurance providers cover pre-existing conditions?

When it comes to pet insurance for pre-existing conditions, most pet insurance providers have strict policies. The general rule is that standard pet insurance does not cover pre-existing conditions, but there are exceptions. Some insurers offer specialized policies for cats with past or ongoing health issues, while others may only cover conditions under certain circumstances.

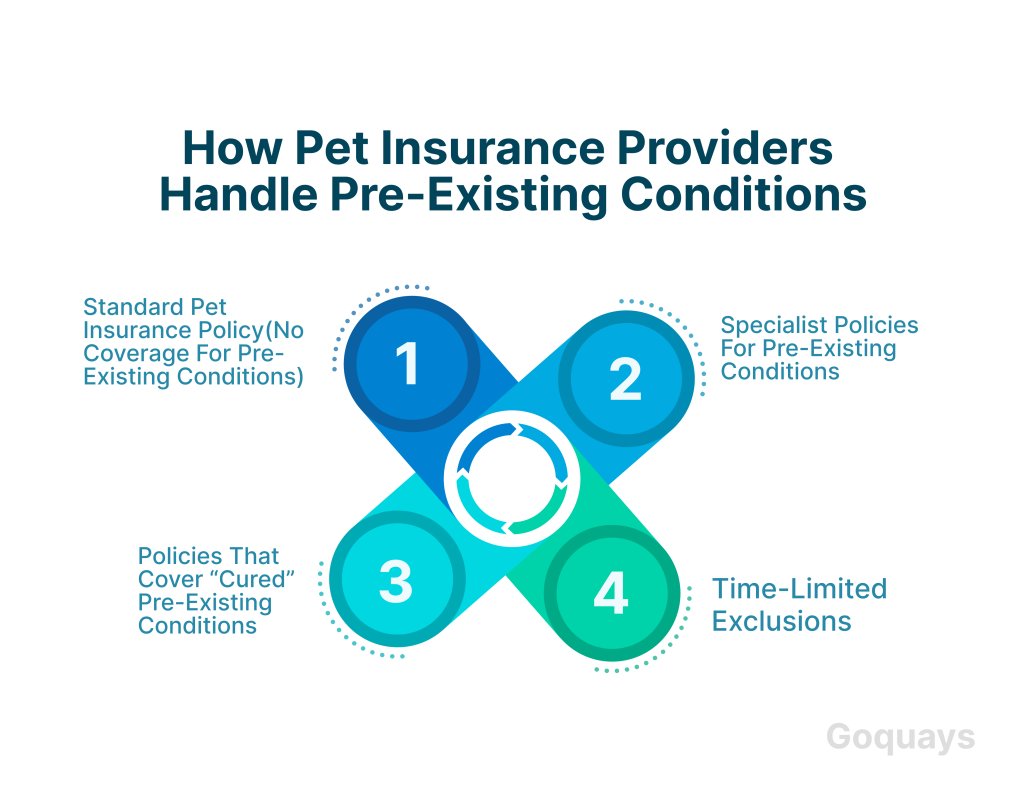

How Pet Insurance providers handle pre-existing conditions

- Standard pet insurance policy(no coverage for pre-existing conditions)

Most insurance providers exclude any medical issue that happened before the policy start date. This includes diagnosed conditions and undiagnosed symptoms in the vet records. For example, if your cat was limping before you signed up for a policy, insurers may refuse to cover any future claims related to joint or mobility issues.

- Policies that cover “cured” pre-existing conditions

Some insurers may cover past conditions if your cat has been symptom-free for 12-24 months. For example, some policies might cover future ear infections. if your cat had an ear infection two years ago but has not had symptoms since then.

- Specialist policies for pre-existing conditions

Some pet insurance providers offer dedicated pre-existing condition coverage but with limitations;

- Higher premiums compared to standard policies.

- Limited payouts per year for ongoing conditions.

- Some conditions may still be excluded if they are severe or progressive

- Time-limited Exclusions

Some insurers temporarily exclude pre-existing conditions but may cover them after a set period if your cat remains symptom-free. But keep in mind that chronic conditions like kidney disease or diabetes are usually permanently excluded.

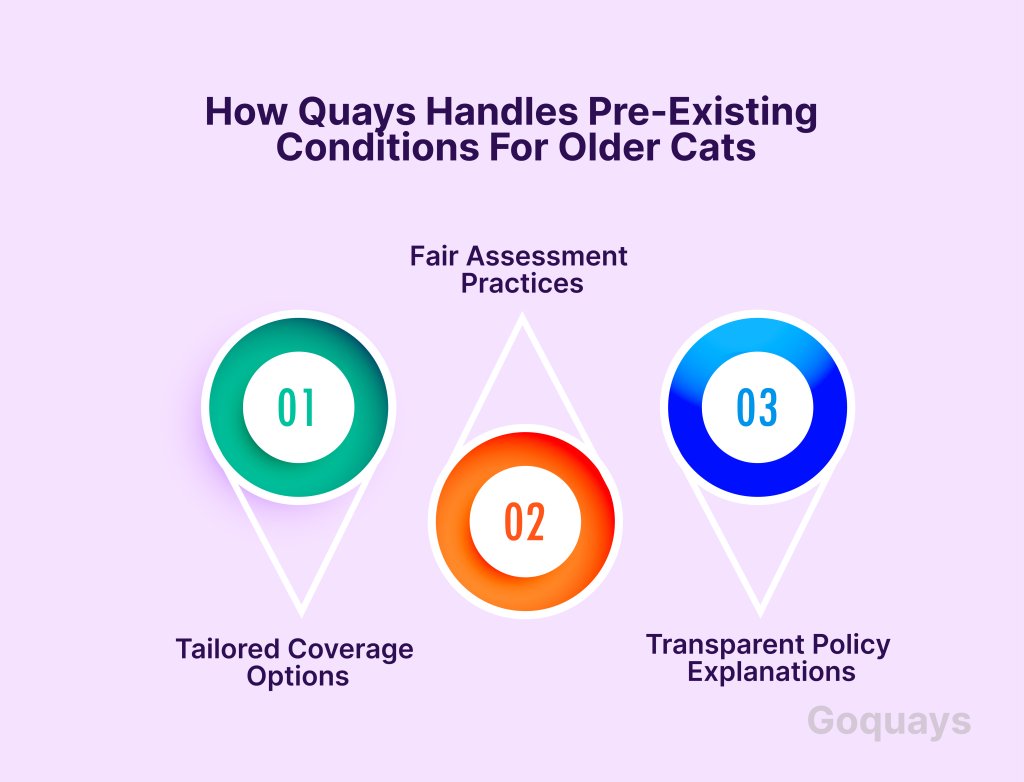

How Quays handles Pre-existing conditions for Older Cats

As a pet insurance provider, we understand that older cats require special care—and that many senior cats may already have existing health conditions. Unlike some insurers that outright reject pets with pre-existing conditions, we aim to provide accessible and fair coverage for senior cats while ensuring transparency for pet owners.

While most insurance providers place strict exclusions on pre-existing conditions, we offer a different approach by offering;

- Tailored Coverage Options: Exploring flexible policies that consider individual pet health histories.

- Fair Assessment Practices: Reviewing cases individually rather than applying blanket rejections.

- Transparent Policy Explanations: Ensuring pet owners fully understand what is covered and what isn’t.

Do Quays Cover Pre-existing Conditions?

While pet insurance policies typically exclude pre-existing conditions, we may offer alternative solutions for owners of older cats. This includes:

- Coverage for “Cured” Conditions: If a condition has been symptom-free for a certain period (e.g., 12-24 months), it may not be considered pre-existing.

- Time-Limited Exclusions: Some conditions may not be covered immediately but could become eligible after a waiting period.

- Customizable Plans: Offering flexible plans where certain pre-existing conditions might be covered at an adjusted premium.

How to apply and get a Quote from Quays

If you are considering pet insurance for your older cat, here’s how you can check if we are the right fit:

- Visit our website and explore policy options.

- Fill out a quick quote form, including your cat’s medical history.

- Speak with one of our representatives to discuss pre-existing conditions.

- Choose a policy that works best for you and start protecting your cat’s health today

Tips for Insuring an Older Cat with Pre-existing Conditions

Finding pet insurance for an older cat with pre-existing conditions can be challenging, but it’s not impossible. While most standard policies exclude pre-existing conditions, there are tips you can employ to ensure your cat gets the healthcare they need.

- Shop around for specialised policies

This is important because not all pet insurance have the same rules in terms of pre-existing conditions so when you are comparing policies, you should check the following;

- Look for insurers that cover pre-existing conditions if the cat has been symptom-free for a certain period (e.g., 3 months, 12 months, or 24 months).

- Check the annual coverage limits for pre-existing conditions, as these may be lower than for new illnesses.

- Read the fine print carefully—some policies cover only “cured” conditions, not chronic or recurring ones.

- Check the symptom-free clause

Some insurance providers reconsider previously diagnosed conditions if your cat has been symptom-free for a set period. This means;

- If your cat had a minor issue (e.g., an ear infection) over a year ago but has been fine since some insurers might cover future occurrences.

- Chronic conditions like diabetes or kidney disease are unlikely to be covered even if your cat’s symptoms are well-managed.

- Always check how long your cat needs to be symptom-free before a condition is eligible for coverage.

- Consider alternative coverage options

If traditional insurance is not available, alternative options can help manage vet expenses:

- Pet Wellness Plans: Some vets offer preventative care packages covering routine checkups, vaccinations, and dental cleanings.

- Vet Savings Accounts: Setting aside a fixed monthly amount for emergency pet expenses can be a self-insurance alternative.

- Vet Payment Plans & Charity Support: Some organizations, such as PDSA, Blue Cross, and RSPCA, offer financial assistance for vet bills.

- Get a medical review before purchasing

Some insurers may request a pre-insurance vet check to assess your cat’s health. You can:

- Ask your vet for a detailed report on your cat’s current condition.

- Use this information to find an insurer with favourable terms for pre-existing conditions.

Alternative ways to Manage vet costs for Older Cats

If pet insurance for pre-existing conditions is not an option due to high premiums, there are other ways to manage veterinary costs for your senior cat. These alternatives can help cover routine checkups, emergency treatments, and ongoing care without straining your finances.

- Pet savings accounts: A pet savings account is a simple but effective way to set aside money specifically for vet bills. Start by opening a separate savings account and deposit a fixed amount monthly. Having this can reduce reliance on insurance and reduce strain on your finances when your cat needs urgent care

- Charities that help with vet bills: Various animal charities assist pet owners struggling with vet costs. These include;

- PDSA (People’s Dispensary for Sick Animals): They provide low-cost or free vet care for eligible pet owners receiving certain benefits.

- Blue Cross: They offer financial assistance for vet treatments, particularly for senior pets.

- RSPCA: Some local RSPCA branches offer discounted veterinary care for low-income pet owners.

Do your research before you reach out to them as they are more inclined to help low-income households or pensioners.

- Veterinary payment plans: Many vet clinics offer payment plans that allow you to spread the cost of treatments over several months. So instead of paying a large bill upfront, you can split payments into manageable instalments. You can also inquire about your vet payment plans as some vets also work with finance companies that offer 0% interest plans for pet care.

Preventative Care Plans: Many vets offer wellness plans that cover routine checkups, vaccinations, flea/worm treatments, and dental care for a fixed monthly fee.

Conclusion

Finding pet insurance for pre-existing conditions in older cats can be challenging, but it’s not impossible. While most insurers exclude pre-existing conditions, some offer limited coverage if your cat has been symptom-free for a specific period.

If pet insurance is not an option, there are alternative ways to manage vet costs, such as pet savings accounts, charity assistance, vet payment plans, and preventative care programs. By researching all available options, you can ensure your senior cat receives the best possible care without financial strain.

However, the key is to plan. Whether that means shopping for specialized insurance, setting aside emergency funds, or exploring financial assistance programs, taking steps now can make a significant difference in your cat’s long-term well-being.