Owning a cat is like having a companion that comes with financial responsibilities especially if it when it comes to their health. The cost of veterinary care has increased over the years, which means without cat insurance, your feline companion could become a financial burden to you.

With cat insurance, you are assured of financial security which ensures your feline companion has the best medical care available without a financial strain on you.

This content will explain to you everything you need to know about getting cat insurance for your pet and by the end of the content, you will have all the information you need to make an informed decision about getting pet cat insurance and protecting your companion’s health.

What is Cat Insurance?

Cat insurance is similar to health insurance–it is a financial safety net that helps pet owners cover unexpected veterinary expenses. A cat pet insurance covers medical expenses like accident illness and even euthanasia – depending on your cat insurance. Usually, most cat insurance works by; cat owners paying a monthly or annual premium for coverage of certain medical costs.

How does Cat insurance work?

Cat insurance follows the following steps to take effect for any medical needs; In case of any emergency and you plan to use your pet insurance,

- Visit the Vet: Take your cat to any licensed vet. This is unlike human health insurance. Cat insurance allows you to visit any provider (vet) without any restrictions.

- Pay the bill upfront: If your cat requires any medical attention, you have to pay the bill at full cost as most pet policies work on reimbursement.

- Submit your claim: After your visit to the vet and your cat has been treated, file a claim with your pet insurance provider. Ensure to include any required information while filling the claim.

Get your repayment: Depending on the type of coverage you are on, your insurance provider will refund you a certain percentage of the total cost spent.

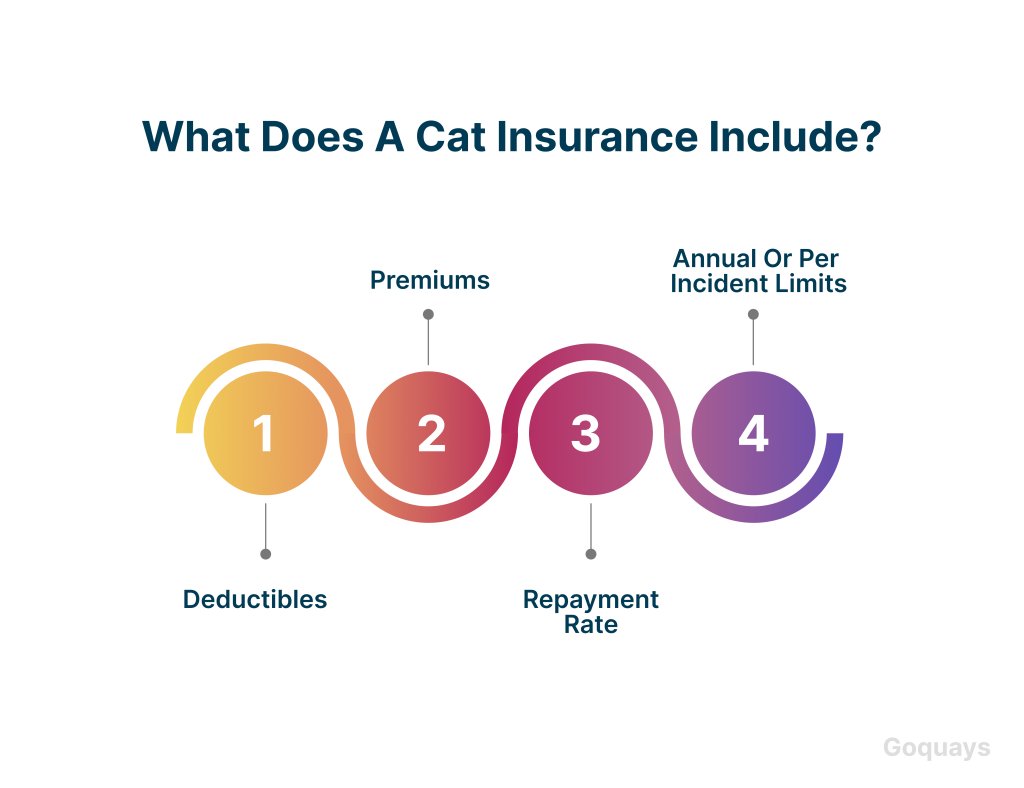

What does a cat insurance include?

A cat insurance policy includes the following components;

- Deductibles: This is the amount you have to pay out of your pocket before the insurance starts covering expenses. If you have higher deductibles it means lower monthly premiums.

- Premiums: This is the monthly or annual amount you have to pay for coverage. Your insurance premium varies based on factors like your cat’s age, breed, location and the type of coverage.

- Repayment rate: This is the percentage of the vet bill that your insurance covers after you meet the deductible. This could be (70%, 80% or 90%).

Annual or per incident limits: Some policies have a maximum payout per year or per condition while others offer unlimited coverage.

Who should get a Cat Insurance?

You should consider getting a cat pet insurance if;

- You have a new kitten: It’s important to get pet insurance early as it gives room for full coverage before any pre-existing health conditions. Also, younger cats generally have lower premiums to pay.

- Your cat is a pure breed: Some cat breeds like Persians or Siamese are prone to genetic health issues, so ensure to get cat insurance before you get crippled by your companion’s medical expenses.

- You like to have financial security: If any major medical expense for your cat would put you under financial strain, then it’s best to get insurance for your pet.

You have outdoor cats: These sets of cats have a higher chance of getting injured, facing accidents or contracting illnesses when they roam about in outdoor spaces.

Do I need Cat insurance?

Vet bills can be expensive, with emergency treatments often costing £500–£1,500, and surgeries exceeding £3,000. According to the Association of British Insurers (ABI), the average pet insurance claim in 2023 was £667, highlighting the financial burden of unexpected medical costs. While the National Health Service (NHS) covers human healthcare, pet treatment is private, making insurance essential for many owners. If your cat develops a chronic condition like diabetes or kidney disease, lifelong treatment can cost thousands. Cat insurance ensures you can afford the best care without financial strain, giving you peace of mind and protecting you against unexpected expenses.

Which is the best pet insurance for cats?

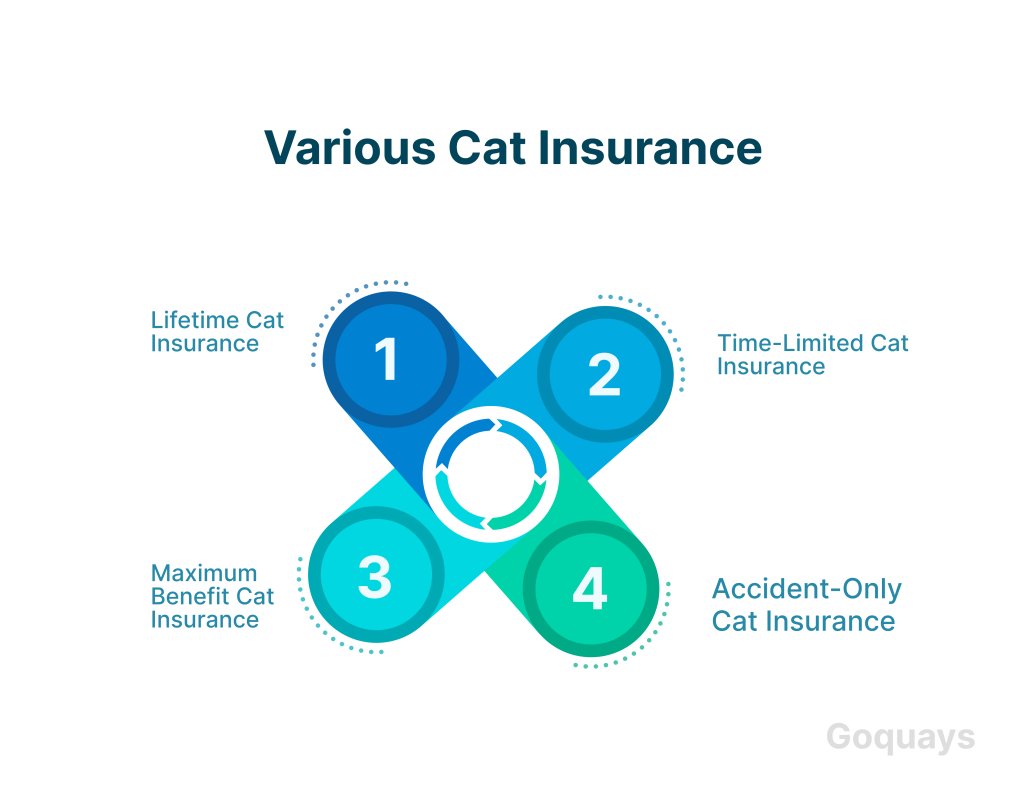

When looking to opt for cat insurance, it’s important to understand the different types of pet insurance policies available. This is because each one of them offers varying levels of coverage and pricing so choosing the right one depends on your cat’s needs and your budget. Here are some of the cat insurance you should consider.

- Lifetime Cat Insurance

It is best for cat pet owners looking for extensive and long-term coverage. Lifetime pet insurance is the most comprehensive cat insurance. It covers accidents, illness, and chronic conditions for your cat’s entire life as long as you renew it each year.

This type of insurance is best for cat breeds like Maine Coons, Persian and Scottish that are prone to hereditary diseases. While this insurance is a comprehensive one and covers for everything concerning your cat, the downside to it is, that it is more expensive than other policies and some insurers tend to set lower limits for some treatments.

- Maximum Benefit Cat Insurance

This is best for cat owners who want affordability and coverage. The maximum policy provides a fixed amount of money per condition. For example; if you only have £1,000 allocated for an illness or injury, that is the only amount you will get as repayment no matter the cost you acccrued for your cat’s treatment. However, the maximum benefit policy does not have time restrictions on claims, unlike the limited policy. While this policy can be useful for medium-term illnesses like infections, fractures, or minor chronic conditions, some medical conditions can be uninsurable if they exceed the policy’s limit.

- Time-Limited Cat Insurance

This is best for cat owners on a budget who want short-term illness and injury coverage. Time-limited policies cover medical costs for a specific period (usually 12 months) after an illness or injury is first diagnosed. Once the time frame expires, the condition will no longer be covered, even if you renew the policy. The downside to this policy is that it’s not suitable for long-term conditions (e.g., diabetes, arthritis) or for situations whereby your cat develops a chronic illness, you will have to cover the costs yourself.

- Accident-only Cat Insurance

This is a policy to opt for if you only want emergency accident coverage. Accident-only insurance is the cheapest and most basic form of pet insurance. It only covers injuries caused by accidents (e.g., broken bones, poison ingestion, car accidents) but does not cover illnesses like infections, cancer, or chronic conditions. The downside to this policy is if your cat develops a health issue, all costs will be out-of-pocket

Which cat insurance plan is best for you?

Insurance Type | Covers Illnesses | Covers Accidents | Covers chronic Conditions | Cost Range | Best for |

Lifetime Insurance | Yes | Yes | Yes(Ongoing) | £15–£40/month | Best for long-term protection |

Maximum Benefit | Yes(up to a limit) | Yes | Yes(Until the payout limit is reached) | £10–£25/month | Mid-range option for medium-term conditions |

Time Limited | Yes(for 12 months) | Yes | No long-term coverage | £6–£20/month | Budget-friendly, short-term coverage |

Accident only | No | Yes | No | £5–£15/month | Cheapest, but only covers accidents |

How much does a cat cost?

One of the biggest concerns for pet owners considering cat insurance is how much it will actually cost. The truth is, that cat insurance premiums can vary depending on several factors, like your cat’s age, breed, health status, and the level of coverage you choose. Below, we have a breakdown of how much a cat insurance cost

Average Cost of Cat Insurance

On average, cat insurance costs range between £5 to £30 per month in the UK However, these numbers fluctuate based on coverage type:

Type of cat insurance | Average Monthly Cost | Coverage Level |

Accident-Only | £5 – £10 | Covers injuries, not illnesses |

Time-Limited | £10 – £15 | Covers condition for a set period |

Maximum Benefit | £15 – £25 | Covers up to a fixed amount per condition |

Lifetime Coverage | £20 – £30 | Comprehensive coverage for life |

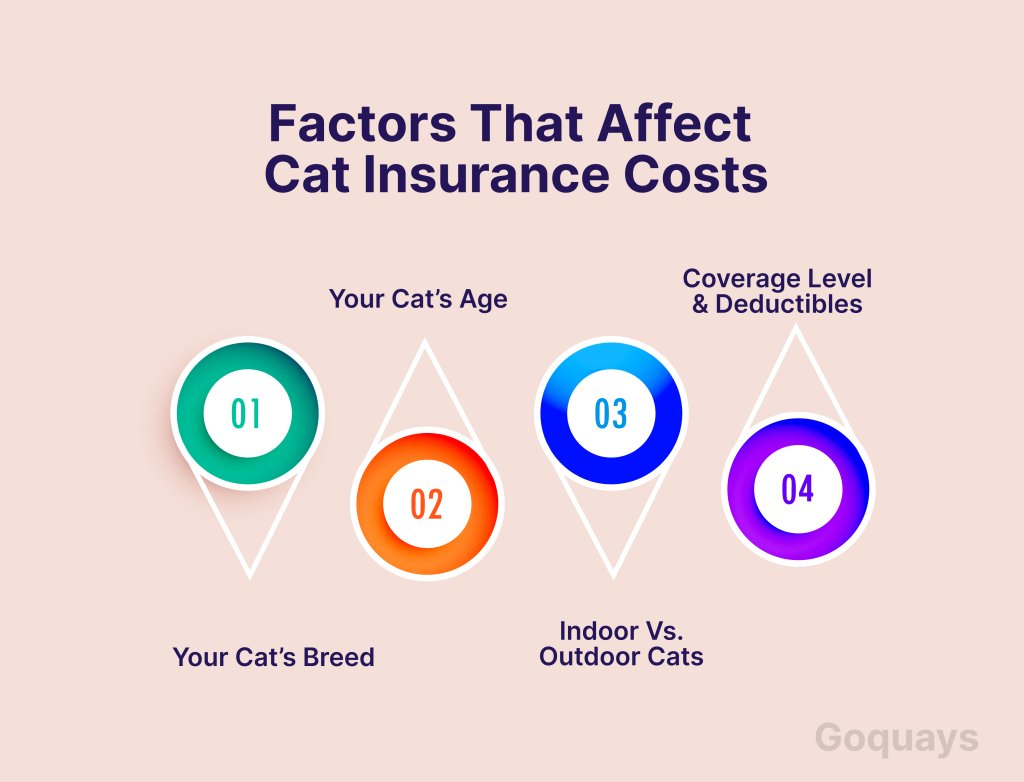

Factors That Affect Cat Insurance Costs

Several key factors determine how much you will pay for your cat’s insurance premium:

- Your Cat’s Breed

Certain breeds are more prone to health issues, which means higher insurance costs. For example:

- Persian & Maine Coon Cats: Higher risk of heart and kidney disease, leading to expensive premiums.

- Bengal & Siamese Cats: More prone to genetic disorders, making them more expensive to insure.

- Mixed Breed & Domestic Cats: Generally cheaper to insure as they have fewer hereditary conditions.

- Your Cat’s Age

The older your cat, the more expensive the insurance. Insurance providers charge higher premiums for senior cats because they are more likely to develop health issues.

To save cost on your cat insurance, insure your cat as a kitten. This allows you to lock in a lower rate and avoid pre-existing condition exclusions.

- Indoor vs. Outdoor Cats

Outdoor cats face higher risks of accidents, injuries, and infections, making them more expensive to insure. Some insurance providers charge 10-20% more for outdoor cats.

Example: An indoor cat might have a monthly premium of £12, while an outdoor cat of the same breed and age could cost £18 per month.

- Coverage Level & Deductibles

The more comprehensive the policy, the higher the premium. Here’s how different choices impact cost:

- Higher Coverage Limits = Higher premiums.

- Lower Deductibles = Higher monthly costs but lower out-of-pocket expenses.

- Reimbursement Rate (70%, 80%, 90%) = The higher the reimbursement, the more you pay.

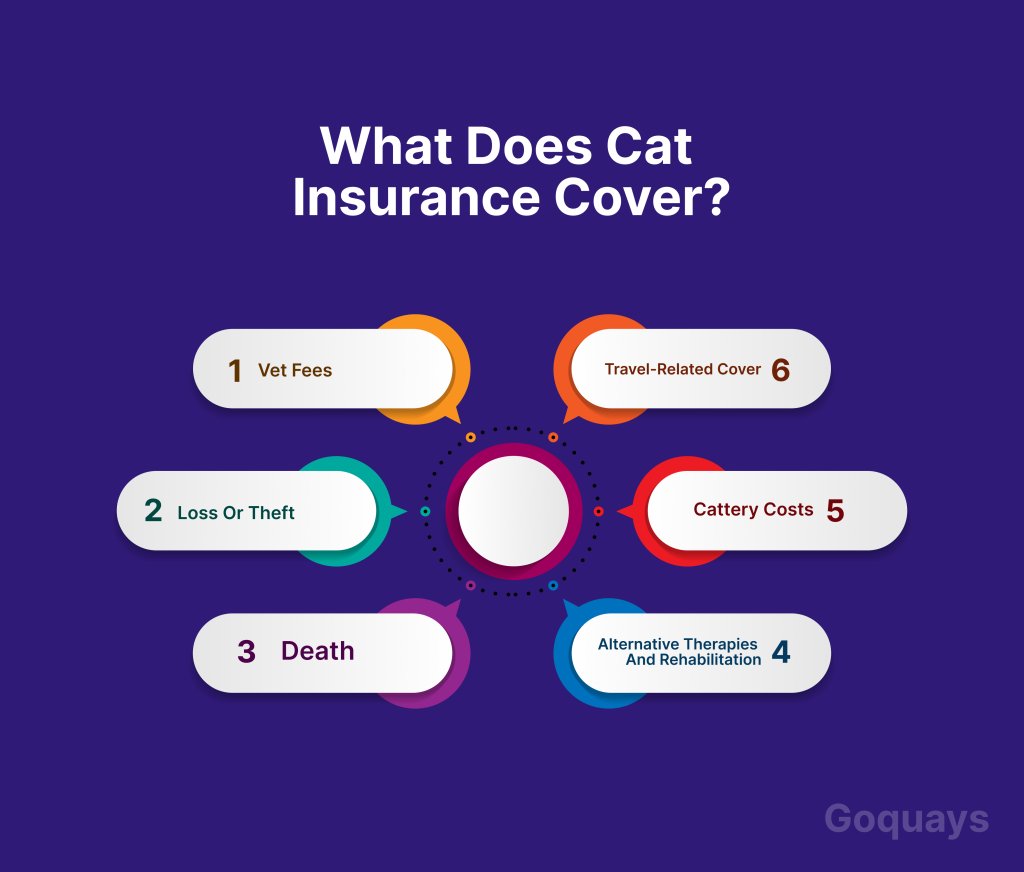

What does cat insurance cover?

Cat insurance policies vary depending on the provider and the plan you opt for. When choosing a cat insurance policy, it’s important to understand what expenses are covered. However, a typical pet cat insurance covers accidents, illnesses, emergency care, and in some cases, routine wellness treatments. Below is the comprehensive breakdown of what cat insurance essentially covers.

- Vet fees: Most cast insurance covers fees to the vet which include medical diagnosis, and treatment for accidents or illnesses. All these will be covered depending on the level of your insurance policy.

- Loss or theft: This covers when your cat got lost or found stolen. It covers the cost of advertising lost or stolen cats and some policies also cover rewards for some other policies, you can get paid a portion of your cat’s value if they are never found.

- Death: This covers for the end of life care and euthanasia depending on your plan. Some policies would only cover this on the fact your cat passes away due to an accident or an illness.

- Travel-related cover: If your cat accompanies you on a trip, or you need to cancel your trip because your cat gets injured or sick while on the trip.

- Cattery costs: Some policies cover the cost of your cat to be looked after when you are unavailable in cases of emergency hospitalization.

Alternative Therapies and Rehabilitation: Some insurance policies include or allow add-ons for alternative treatments.

What does cat insurance not cover?

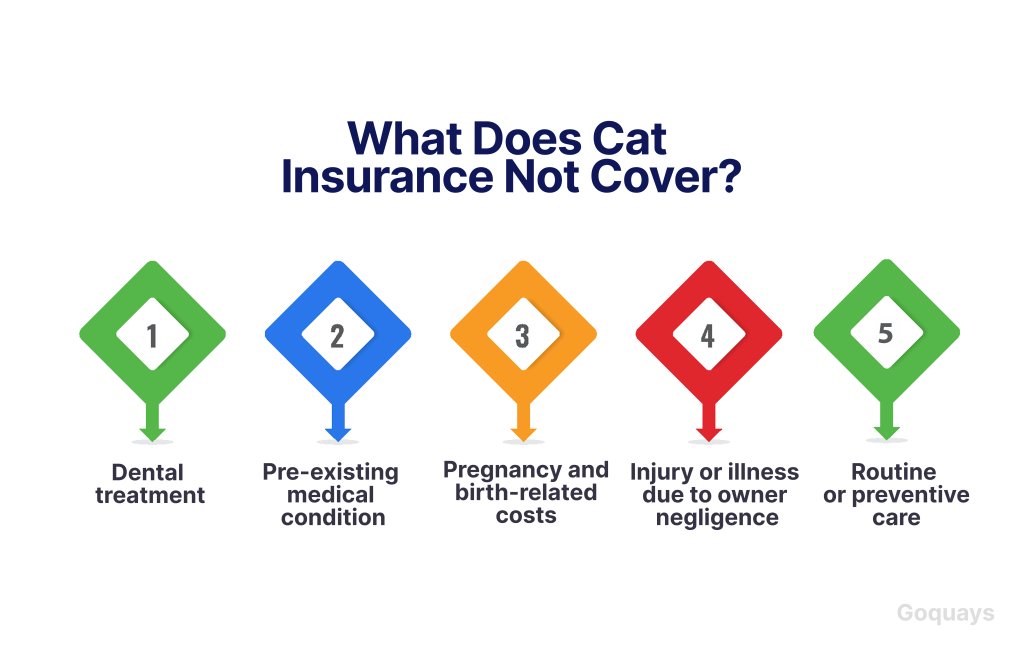

While cat insurance helps cover a wide range of medical expenses, not everything is included in standard policies. Understanding what your cat insurance won’t cover helps you avoid unexpected out-of-pocket expenses when your cat needs medical care. Most insurance providers have specific limitations, exclusions, and conditions that are not eligible for repayment. Here are what your cat insurance will not cover;

- Dental treatment: Most basic policies do not cover routine dental cleanings or treatments unless they are related to an injury or illness like; tooth extractions after an accident or injury or dental surgery for serious infections.

- Pre-existing medical condition: This is any illness, injury, or health issue that was diagnosed or showed symptoms before your insurance policy started. While some policies reconsider curable conditions like ear infections, chronic or terminal illnesses are never covered.

- Pregnancy and birth-related costs: If your cat becomes pregnant, most insurance policies will not cover pregnancy-related expenses unless you purchase a specialized plan.

- Injury or illness due to owner negligence: If an injury or illness occurs due to owner neglect, abuse, or intentional harm, insurance will not cover treatment.

- Routine or preventive care: Standard pet insurance does not cover routine vet visits or preventive care unless you purchase an optional wellness plan.

How to choose Cat Insurance?

The Association of British Insurers (ABI) report shows that pet insurance payouts in the UK reached £872 million in 2022, a record high at the time, showing an upward trend in veterinary expenses. With vet costs rising, this makes cat insurance more important.

Choosing the right cat insurance can be tricky, with many providers offering different levels of coverage, pricing, and exclusions. To make it easy, we have made a list of factors to consider when choosing cat insurance.

- Consider age limits: Cat insurance usually has age limits. Some insurers won’t cover cats over 10 years old for new policies. In pet insurance, there is an upper age and lower age limit, that is there is a certain age limit you can insure your cat and there is a certain age limit you can’t insure your cat. Ensure to look into this and ask the right questions before signing up with a provider. It is advisable to get cat insurance while your cat is young to avoid pre-existing conditions.

- Check coverage details: Before choosing a policy, check what’s covered and excluded. Use the information above to be sure of what’s typically included in cat insurance and what’s not.

- Check for additional perks or discounts of your policy plan: Some insurers offer extra benefits, such as; multi-pet discounts – that is you get a discount for insuring multiple pets. And for vet direct payment, your insurer pays the vet directly (so you don’t have to worry about claiming cost).