Pet insurance has become a crucial consideration for many pet owners because it offers financial security against unforeseen veterinary expenses. Maybe you’re wondering what type of pet insurance you should choose whether basic or comprehensive pet insurance and which plan offers the best defense. This should not be a difficult decision to make, we will break it down for you.

The goal of choosing the best plan is to make sure your pet receives the care they need without going over budget, not just to save money. We’ll explain the main distinctions between basic and comprehensive pet insurance, compare the benefits and drawbacks of each, and assist you in choosing the plan that best suits your pet’s requirements. This comparison will assist you in making an informed choice, regardless of whether you’re searching for all-inclusive coverage or a cost-effective safety net. Let’s get started!

Understanding Pet Insurance and Its Importance

The main objective of pet insurance is to cover for any medical bills pertaining to your pet’s well-being. Insurance helps cover the costs of veterinary care, which can be high, particularly during emergencies. The right insurance plan will guarantee your pet receives the care they require without straining your wallet, whether it is for regular checkups, vaccinations, accidents, or illnesses.

Our lives are greatly enhanced by the unconditional love, companionship, and joy that pets provide. However, they are susceptible to accidents, injury, and chronic illnesses that need medical care, just like people. Emergency procedures, prescription drugs, and specialist consultations can cost thousands of pounds, making veterinary care costly. Pet insurance can help you handle these unforeseen costs and make sure your pet receives the finest care available.

What is Pet Insurance?

Pet insurance is a policy that, in return for a monthly or yearly premium, reimburses pet owners a percentage of veterinarian costs. It can cover everything from illnesses, inherited disorders, and even normal wellness care, depending on the amount of coverage and the terms and conditions set by each provider. There are different types of pet insurance policies including:

- Basic (Accident-Only) Plans: this insurance policy covers accident-related injuries and emergency care, but not illnesses or routine vet checks.

- Comprehensive Plans: this type of policy covers diseases and accidents, and they may also cover preventative care like dental cleanings and vaccinations. This plan offers complete protection for your pets.

Wellness plans: These plans provide yearly checkups, flea treatments, and vaccinations, but they do not cover diseases or accidents.

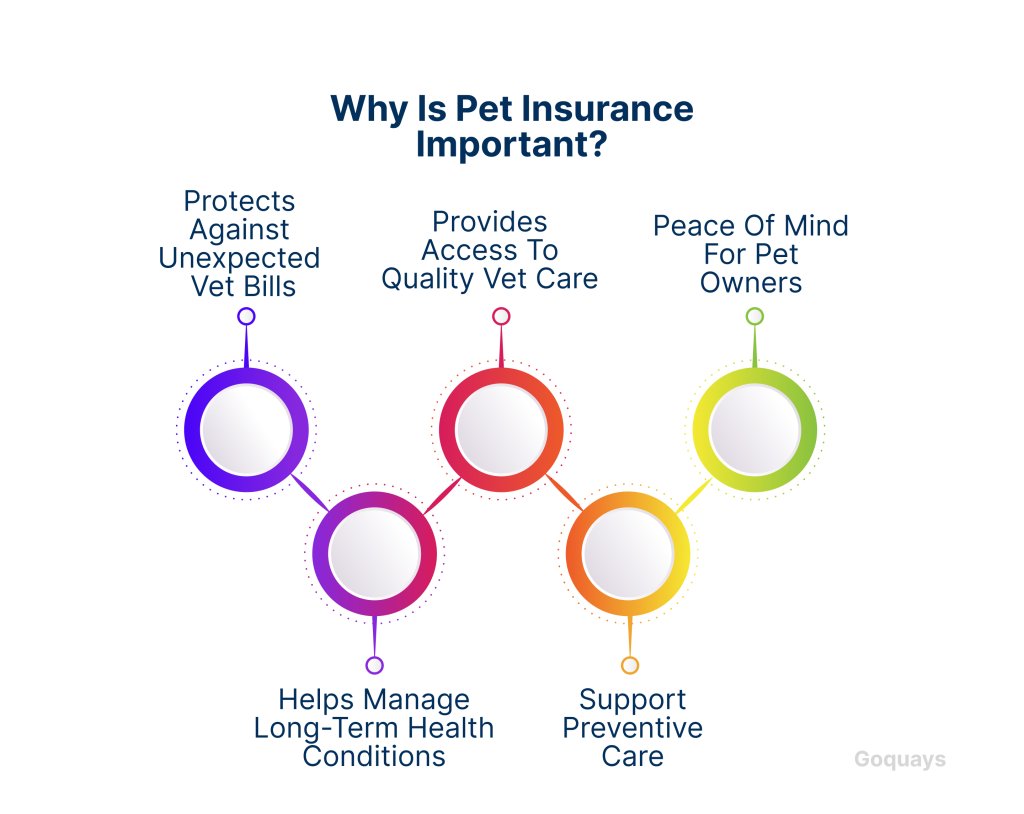

Why is Pet Insurance Important?

Protects Against Unexpected Vet Bills: accidents and illnesses can happen at any time, especially when you are not financially prepared for it. Diagnostic testing, hospital stays, and emergency procedures can be expensive. You won’t have to decide between your finances and your pet’s health thanks to pet insurance.

Provides Access to Quality Vet Care: Pet owners who have insurance are more likely to take their animals to the vet right away rather than putting off care because it would be too expensive. Pet insurance grants you access to the best care possible.

Peace of Mind for Pet Owners: You can concentrate on your pet’s recuperation rather than worrying about veterinary expenditures when you know that they are insured for ailments and accidents.

Helps Manage Long-Term Health Conditions: Certain pets experience long-term medical conditions that need constant care, such as diabetes, arthritis, or heart disease. Over time, comprehensive insurance can pay for these costs.

Support Preventive Care: some policies include wellness packages, helping pet owners stay proactive with vaccinations, dental cleanings, and routine check-ups that can help discover symptoms of illnesses before they become major health issues.

Is Pet Insurance Worth It?

The burning question on the minds of pet owners is not “should I get pet insurance?” rather it is “which plan is best for my pet?”. Most owners assume that they do not need pet insurance when their animal is young and healthy. However, accidents and illnesses can strike when you least expect them and pet insurance can help cushion its effect on your finances.

Similarly, some breeds or elderly pets may be more susceptible to inherited diseases that need constant care. Having the appropriate pet insurance plan will help you avoid hundreds of pounds in future veterinary expenditures in such situations.

To help you choose the plan that provides the best protection for your pet, we’ll go over the main distinctions between basic and comprehensive pet insurance.

What is Basic Pet insurance?

Basic pet insurance is the simplest and most affordable kind of pet insurance, sometimes known as accident-only coverage. It is intended to pay for medical costs associated with unexpected accidents, such fractures, wounds, poisoning, or urgent procedures. It does not, however, cover diseases, inherited disorders, or regular veterinarian treatment, such as vaccinations and routine check-ups.

For pet owners who do not mind paying for treatments and preventative care out of pocket but still want financial security in the event of unexpected accidents and injuries, this kind of insurance is perfect

What Does Basic Pet Insurance Cover?

The majority of basic pet insurance plans cover the following, though coverage may vary depending on your pet insurance provider.

- Accidents and Injuries: Coverage for wounds, fractures, and other physical injuries caused by accidents.

- Emergency Veterinary Care: Hospitalisation and surgery are necessary medical interventions for unexpected injuries.

- Poisoning and poisonous Ingestion: Basic insurance can assist in paying for treatment if your pet consumes poisonous foods or household chemicals.

- Animal Trauma and Bite Wounds: Injuries brought on by collisions with other animals or outside forces (such as being hit by a car).

However, the following is not covered by basic pet insurance:

- Illnesses: Diseases like diabetes, cancer, infections, and allergies are not covered.

- Routine Care: Wellness examinations, dental cleanings, flea/tick prevention, and vaccinations are not included.

- Chronic ailments: Ongoing treatments for illnesses like arthritis, renal disease, or thyroid problems are not covered.

- Hereditary & Congenital Conditions: Breed-specific ailments like hip dysplasia or heart disease are not covered.

When Should I Consider Basic Pet Insurance

You should consider basic pet insurance if you:

- Have a young, healthy pet with little chance of developing chronic or genetic diseases.

- Want some financial security but are on a tight budget and cannot pay higher monthly premiums.

- Are willing to pay for diseases and regular veterinary care out of pocket and only want accident coverage.

- Keep indoor pets that are less likely to contract illnesses but could still sustain unintentional injury.

Pros and Cons of Basic Pet Insurance

Pros | Cons |

Lower monthly premiums | Does not cover illnesses or diseases |

Covers emergency accidents and injuries | No reimbursement for routine vet checks |

Provides financial relief for unexpected mishaps | Limited coverage compared to comprehensive plans |

Ideal for young, healthy pets | Pet owners may have to deal with high out-of-pocket costs for medical treatments. |

The table highlights the advantages and disadvantages of basic pet insurance, helping pet owners to determine at a glance if this is the best plan for their pet.

What is Comprehensive Pet Insurance?

Comprehensive pet insurance is a premium plan intended to cover a wide range of medical requirements for your pet. Comprehensive plans provide protection against illnesses, including chronic and hereditary problems, as well as accidents, in contrast to basic pet insurance, which only covers accidents. It is a well-rounded option for pet owners seeking total peace of mind, some policies may even cover preventative care like vaccinations, flea/tick treatments, and dental cleanings.

For pet owners seeking more comprehensive financial protection against unforeseen veterinary expenses, this kind of insurance is perfect because it guarantees that your furry friends will receive the best treatment available for the duration of their lives.

What Does Comprehensive Pet Insurance Cover?

Coverage usually varies based on the provider, but most comprehensive plans cover the following:

- Accidents and Injuries: this covers for fractures, wounds, bites injuries and emergency surgeries.

- Illnesses: this covers for ailments including infections, allergies, gastrointestinal problems, and other diseases common to your kind of pet.

- Chronic Conditions: this covers long-term ailments such as heart disease, kidney disease, and arthritis.

- Hereditary Problems: this plan also covers breed-specific illnesses like hip dysplasia, epilepsy, and respiratory problems.

- Diagnostic Tests and Specialist Care: this includes consultations with a vet, blood tests, and X-rays.

- Emergency Care and Hospitalization: this includes critical care treatments and hospital stays if it becomes necessary.

- Surgical Procedures: most comprehensive plans cover major surgeries, minor procedures, and orthopedic treatments.

Additional Coverage

Some providers offer additional coverage when you sign up for certain plans. These include:

- Routine and Preventive Care: this includes routine vet checks, wellness examinations, vaccinations, and flea/tick prevention.

- Dental Care: this covers dental cleanings, extractions and treatment for any dental disorder.

- Alternative Therapies: this includes treatments that help your pet recuperate from an injury or illness such as; physiotherapy, hydrotherapy, and acupuncture.

- Prescription medications: this includes drugs prescribed for chronic illnesses and specialized treatments.

Who Should Consider Comprehensive Pet Insurance?

Comprehensive pet insurance is ideal for:

- Pet owners with breeds that are prone to genetic disorders and hereditary conditions that require on-going treatments.

- Pet owners looking for maximum coverage, this plan is the ideal choice if you want to protect your pet from a variety of health issues.

- Pet owners with elderly pets who may be more susceptible to chronic illnesses that need continuous care as they get older.

- People who want coverage for routine care for their pets as some plans also include Wellness benefits that pay for routine and veterinary check-ups and vaccinations.

Pros and Cons of Comprehensive Pet Insurance

Pros | Cons |

Covers accidents and illnesses | Higher monthly premiums |

Provides coverage for chronic and hereditary conditions | May not cover pre-existing conditions |

Pays for diagnostic tests, surgeries, and hospital stays | Some policies have extended waiting periods |

Some plans cover routine care | You may have to pay additional fees for wellness packages |

Some providers pay for boarding fees if you have to travel | Additional perks can drive up the overall cost. |

This table highlights the main benefits and drawbacks of comprehensive pet insurance, allowing pets owners to weigh their options properly before making a decision.

How to Compare Pet Insurance Plans?

Given the wide range of policies available, selecting the best pet insurance coverage can be difficult. You must examine several insurance policies based on a number of important criteria to make sure your pet has the best coverage possible while remaining within your budget. Here are a few factors to consider to help you make an informed choice.

Assess Your Pet’s Needs: consider the particular health risks related to the breed, age, and lifestyle of your pet before choosing an insurance plan. Also take into account the age of your pet, younger pets may benefit more from accident-only protection, while older pets may require a comprehensive plan that covers chronic illnesses.

Coverage Scope: does the plan cover accidents only or does it include illnesses and basic medical care. Does it include a wellness package or preventive care treatments like vaccinations? You should take into consideration the coverage scope of the plan before you decide.

Monthly Premiums: Comprehensive policies are more expensive but provide broader coverage, while basic plans have lower premiums. Other factors that can affect the premium include your location, the breed of your pet and coverage level you require.

Co-pays and Deductibles: this is the amount of money you have to pay out of pocket before your insurance starts. Generally speaking, higher deductibles result in lower Reimbursement Rate: find out what percentage of veterinary fees will be covered by your provider. This usually falls between 70% and 90%, which means that when you satisfy the deductible, the insurer will pay a portion of the expense.

Check Exclusions and Waiting Period: Pay close attention to the fine print because every pet insurance policy has exclusions and waiting periods. Check that the time stated is favourable to you, some plans have a waiting period (for example, 14 days for illnesses, 48 hours for accidents) before coverage starts.

Check customer reviews and claims process: Not all pet insurance companies have a seamless claims process. Check customer reviews to read what other pet owners have to say about the company. Verify that the provider has reliable customer service and round the clock customer support.monthly premiums but higher out-of-pocket expenses for claims.

Making the Right Choice for Your Pet

Selecting the best pet insurance plan is an important choice that can have a big impact on your financial security as well as the health of your pet. Having a safety net in place guarantees that your pet receives the best medical care available without experiencing unforeseen financial challenges, especially given the escalating cost of veterinary care.

However, the best plan depends on multiple factors, including your pet’s breed, age, health risks, lifestyle, and your budget. By carefully weighing your options between basic and comprehensive pet insurance, you can make an informed decision that provides the right balance of coverage and affordability.

Whatever plan you decide to choose, Quays pet insurance offers both basic and comprehensive insurance plans that are reliable and affordable. Our claims process is fully digital and hassle free. You can file claims from the comfort of your home. Contact us to get a quote today!

Comprehensive Vs. Basic Pet Insurance: FAQs

What is the main difference between basic and comprehensive pet insurance?

Basic pet insurance typically covers accidents only, such as injuries from falls, bites, or car accidents, while Comprehensive pet insurance includes both accidents and illnesses, covering chronic diseases, hereditary conditions, diagnostic tests, and sometimes wellness care.

Is pet insurance worth it?

Yes! Vet bills can be expensive, especially for emergencies, surgeries, and chronic illnesses. Pet insurance ensures that you can afford necessary treatments without financial stress.

Does pet insurance cover pre-existing conditions?

No, most pet insurance plans do not cover pre-existing conditions (health issues diagnosed before purchasing the policy). Some insurers offer limited coverage for curable conditions if the pet has been symptom-free for a specific period.

What factors affect the cost of pet insurance?

These include;

- Your pet’s age (older pets = higher costs)

- Breed (some breeds are prone to health issues)

- Coverage level (comprehensive plans cost more)

- Location (vet costs vary by region)

Can I switch from basic to comprehensive pet insurance later?

Yes, but any health conditions that develop while on a basic plan may be considered pre-existing and excluded from coverage under a new comprehensive policy. It is best to enroll in comprehensive insurance early in your pet’s life.

Does pet insurance cover routine care and vaccinations?

Some comprehensive plans offer optional wellness coverage for vaccinations, flea prevention, and check-ups. Basic plans usually do not cover preventive care.

How do I compare pet insurance providers?

When choosing a provider, check:

- Coverage limits and exclusions

- Reimbursement rates and deductibles

- Waiting periods for illnesses and accidents

- Customer reviews and claim processing times

Can I use any vet with pet insurance?

Most pet insurance plans allow you to visit any licensed vet in your country. Some policies may cover specialist care or alternative therapies (e.g., acupuncture, physiotherapy).

What happens if I don’t have pet insurance?

Without pet insurance, you may have to pay vet bills out-of-pocket, which can be costly for surgeries, treatments, or emergency care. A single accident or illness could cost thousands of pounds.