We all want what’s best for our pets, be it high-quality, nutritious foods, comfortable bedding or cage, ample play area, or regular veterinary checks. However, if you want to be able to do all these without breaking the bank, getting pet insurance for your furry friends should not be such a difficult task.

Owning a pet can be a wonderful experience as you can create cherished memories with your pets, but it can also put a strain on your finances as vet expenses can quickly pile up leaving you stranded if you’re unprepared for it. Pet insurance can help with that. It gives you peace of mind and guarantees that your pet receives the best care without breaking the bank. However, with so many choices, how can one find affordable pet insurance that still provides extensive coverage?

In this guide, we will explore the importance of pet insurance, the type of policies available, factors that influence cost, and tips to secure affordable insurance for the budget-conscious pet owner. We will assist you in selecting the best plan without sacrificing the quality of care you receive. Whether you’re a first-time pet owner or an old pet parent looking to switch to a more affordable option, we’ve got you covered!

Why do I Need Pet Insurance?

Pet insurance offers a buffer against unanticipated veterinary costs brought on by diseases, accidents, or long-term ailments. Treatments can be expensive without insurance, which could force you to make tough choices regarding your pet’s medical care. For example, diagnostic tests to ascertain the type of illness you pet is suffering from can cost as much as £300

Having pet insurance guarantees that your pet’s health will not be jeopardized due to financial limitations. Other reasons why you need pet insurance include:

The Rising Cost of Veterinary Care

Recent years have seen tremendous advancements in veterinary care, but these advancements also signify rising costs in pet healthcare management. Emergency surgeries, treatments for diseases, and consultations with specialists can cost thousands of pounds, but routine procedures like vaccinations and dental care may be reasonably priced. Many pet owners struggle to pay for these huge vet costs without pet insurance, and they occasionally have to make difficult decisions regarding the care of their pets.

Unexpected Accidents and Emergencies

Curiosity is the inherent nature of pets, they want to explore and this can ultimately lead to accidents and injuries. These accidents can sometimes lead to an emergency vet visit. Emergency veterinarian visits can occur at the most inconvenient times, whether it’s due to an unforeseen sickness, an accident, or an ingestion of something they shouldn’t have. By making sure you’re ready for these eventualities, pet insurance frees you from worrying about the expense and lets you concentrate on your pet’s health.

Chronic Illnesses and Ongoing Care

Certain pets get chronic illnesses that need continuous medical care. The expense of prescription drugs, routine checkups, and specialised care might be overwhelming without insurance. These costs can be covered by a quality pet insurance plan, which will relieve financial strain and make it simpler to maintain your pet’s health.

Peace of Mind

Pet insurance offers peace of mind in addition to paying for significant medical expenses. Instead of being constrained by prices, knowing that you have financial help in case of an emergency enables you to make the best treatment decisions for your pet. Whether your pet has a chronic sickness, an accident, or a sudden illness, having pet insurance guarantees that you will always be prepared to give them the best care possible.

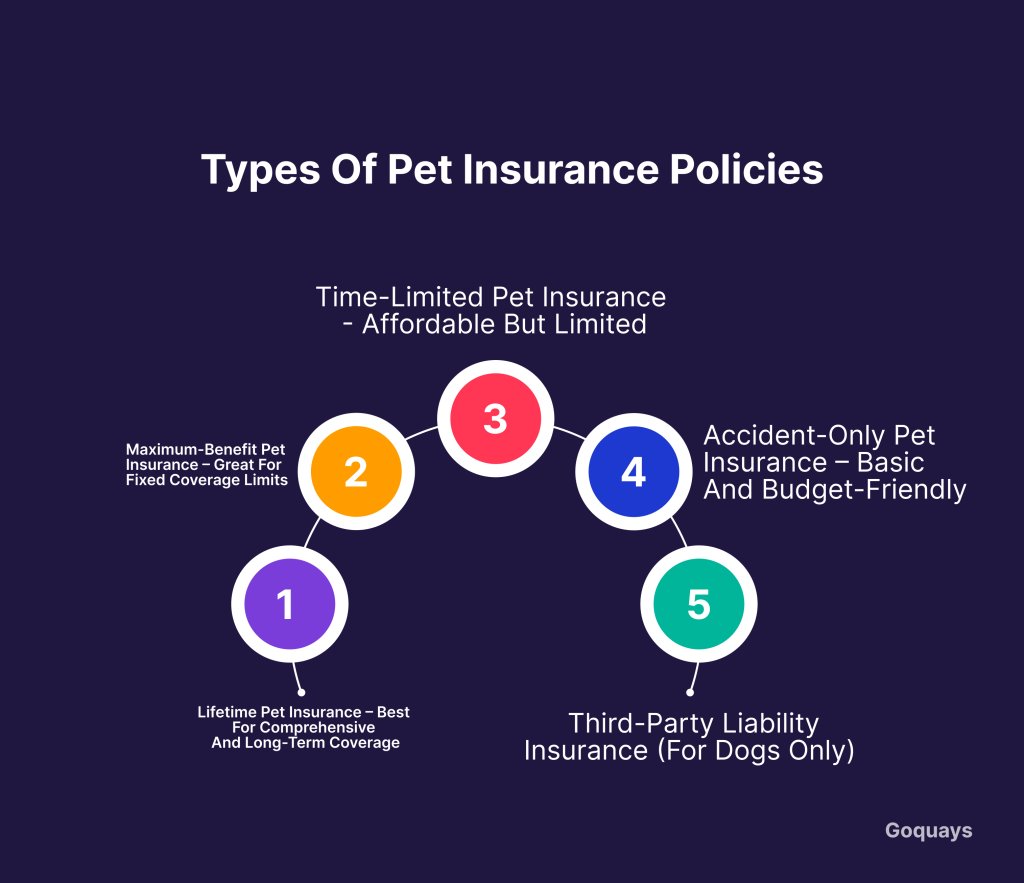

Types of Pet Insurance Policies

It is important to understand the various coverage options available when choosing a pet insurance policy. Selecting the best policy for your pet can have a significant impact on the cost and type of medical care that your pet receives. Note that not all policies are the same, they differ based on the level of coverage they offer. The main categories of pet insurance policies are broken down as follows:

- Lifetime Pet Insurance – Best for Comprehensive and Long-term Coverage

Lifetime pet insurance is the most extensive and long-term pet insurance coverage. It is valid for the rest of your pet’s life as long as you renew the policy annually. It covers recurring treatments, chronic illnesses, and persistent ailments. Lifetime pet insurance is ideal for owners seeking comprehensive coverage, particularly for breeds susceptible to genetic disorders. It is important to note that pre-existing condition coverage may be lost if a renewal is missed, and premiums are often higher than those of regular policies.

- Maximum-Benefit Pet Insurance – Great for Fixed Coverage Limits

This type of policy provides a fixed amount of money for every illness that your pet develops. Once the limit is reached, that condition will no longer be covered, even if the policy is renewed. Maximum benefit insurance is ideal for pet owners looking for an affordable alternative to lifetime insurance with a decent coverage and a lower premium. Note that after the limit is reached, you may have to pay vet bills out of pocket if your pet becomes seriously ill.

- Time-Limited Pet Insurance – Affordable but Limited

Time-limited insurance offers protection for a predetermined amount of time, typically 12 months for each ailment. Even if the policy is renewed after that time, the condition is no longer covered. It is ideal for pet owners seeking a less expensive solution that still offers some security. Emergency treatments, accidents, and short-term diseases are all covered. However, it is important to note that beyond the predetermined time, chronic or recurrent illnesses will not be covered.

- Accident-Only Pet Insurance – Basic and Budget-Friendly

Accident-only insurance, as the name implies, only covers injuries caused by accidents, it does not cover illnesses or diseases. It’s the simplest and least expensive type of pet insurance. Accident-only insurance is ideal for pet owners who want affordable protection against unexpected injuries.

- Third-Party Liability Insurance (for Dogs Only)

Dogs can get third-party liability insurance from some insurance companies. This includes legal fees in the event that your dog injures someone else or damages property. It is ideal for dog owners seeking protection against lawsuits. It covers; damage from your dog, compensation claims, and legal fees. Note that it does not cover any of your pet’s medical bills.

Which Type of Pet Insurance Should I Choose?

The breed, age, and medical history of your pet, as well as your budget, will determine the appropriate coverage for you. The best option for long-term coverage is lifetime insurance. A time-limited insurance or maximum benefit can be a better option if you’re searching for a less expensive option. An accident-only coverage can be adequate if protection for accidents is your primary concern.

A Comparison of Pet Insurance Policies

Policy Type | Covers accidents? | Covers illnesses? | Covers chronic conditions | Time limit? | Cost |

Life-Time | Yes | Yes | Yes | No | Can be a bit pricey |

Maximum-benefit | Yes | Yes | Limited cover | No | Moderately priced |

Time-limited | Yes | Yes | No | Yes (usually 12 months) | Affordable |

Accident-only | Yes | No | No | No | Affordable |

Third-Party liability | No | No | No | No | Varies |

How Much Does Pet Insurance Cost?

Understanding the factors that influence pet insurance costs can help you find the right balance between affordability and coverage. The cost of pet insurance varies greatly depending on a number of factors, including your pet’s breed, age, health history, and the level of coverage you choose. While some pet owners can find affordable policies for as little as £5 – £10 per month, others may pay upwards of £50 or more per month for comprehensive coverage.

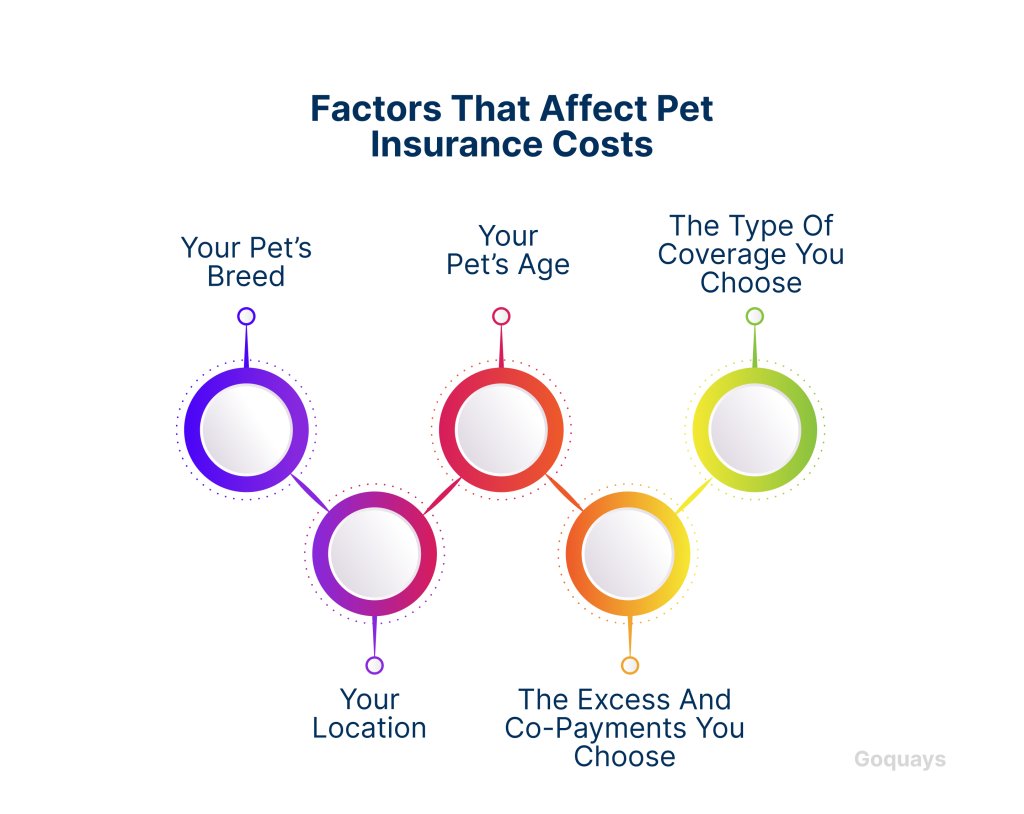

Factors That Affect Pet Insurance Costs

Your Pet’s Breed

Certain breeds are more expensive to insure because they are more prone to genetic disorders and health challenges. For example, French bulldogs commonly have breathing problems due to their flat face, Rottweilers and Great Danes, because of their large size, are likely to suffer from joint problems. Breeds of pets that are susceptible to health problems usually have higher insurance premiums.

Your Pet’s Age

Pets are more likely to get sick as they get older, which raises insurance costs. As your pet ages, many pet insurance providers increase premium rates, and some may no longer issue new insurance for elderly pets. You can lock in a lower rate before age-related issues arise if you cover your pet when they are still young.

The Type of Coverage You Choose

The price of pet insurance plans varies depending on the amount of coverage it offers. A lifetime policy provides the most comprehensive coverage and will cost more than a time-limited or accident-only plan which offers limited coverage.

Your Location

Where you live has a major role to play in the amount you pay for insurance. Vet bills cost way higher in urban centres than in rural areas. For example, if you live in a big city like London, veterinary care will be more expensive.

The Excess and Co-Payments You Choose

Most pet insurance policies come with an excess fee, which is the amount you pay out-of-pocket before your insurance covers the rest. You can reduce your monthly premium by selecting a higher excess, but you will have to pay more when you file a claim. A co-payment is another feature of some policies that requires you to pay a portion of each claim, like 10% or 20%.

How to Reduce the Cost of Pet Insurance?

When it comes to insuring your beloved pets, do not let the cost scare you, there are ways that you can reduce the cost of your insurance premium, some of them include:

- Compare policies: research different policies from different providers to determine which is most suitable to your pet’s requirements.

- Choose a Higher Excess: opting to pay a higher excess fee will reduce the amount you have to pay for your monthly premium.

- Insure your pets when they’re young: insuring your pets early in their lives will ensure that exclusions for pre-existing conditions can be avoided.

- Look for Multi pet discounts: if you have more than one furry friend, then you should look for insurance providers that offer multi pet discounts. Some insurance companies allow you to combine several pets under a single policy.

Look after your pet: A pet with fewer vet visits and a healthy lifestyle may qualify for lower premiums. It is important to take care of your pet’s health, so that they don’t fall ill often.

Who are the Top Affordable Pet Insurance Providers?

Finding the ideal pet insurance that strikes a balance between affordability and comprehensive coverage can be difficult, but it’s necessary to safeguard your pet’s health without breaking the bank. Regardless of whether you own a dog, cat, rabbit or other animal friends, there are many affordable solutions available that offer adequate coverage. Taking coverage, pricing, and customer satisfaction into account, we’ve chosen six of the most affordable pet insurance providers below.

Quays

Quays pet insurance offers a comprehensive and affordable coverage for your pets, we provide insurance for dogs, cats and other pets. Our policies are tailored to suit the needs of every pet, focusing on providing value for budget-conscious pet owners. You can enjoy flexible plans and 24/7 expert support. No matter the age or breed of your pet, our insurance covers vet fees, accidents and unexpected health issues. Our fully digital claims process is fast and hassle-free, allowing you to focus on what’s truly important- the health and wellbeing of your pet.

Animal Friends

Animals friends provides affordable pet insurance and is known for promoting animal welfare, they support many animal charities around the world. Animal friends insurance allows you to choose your excess, they provide cover for vet fees, accidents, public liability as well as missing or stolen pets. Their basic time-limited plan strikes the perfect balance between affordability and coverage.

Manypets

Manypets offers a value policy that provides maximum benefit coverage. This plan is better and more affordable than the time limited offer since it provides a defined financial limit per condition without any time constraints. It is ideal for pet owners seeking affordable mid-range insurance for their pets.

Tesco Bank

Tesco offers one of the most affordable lifetime coverage plans in the country. It covers ongoing treatments for your pet’s lifetime, as long as the policy is renewed each year. It is ideal for pet owners who want lifetime coverage at a lower cost.

Agria Pet Insurance

Agria pet insurance is known for their excellent customer service and quick claims process, they offer a maximum benefit insurance that is ideal for budget-conscious pet owners. Dog owners can benefit from their starter plan, which offers a set sum for each disease and third party liability insurance in the event that your dog injures someone or damages property.

Petplan

Petplan is one of the reputable pet insurance providers in the country. They offer affordable lifetime insurance plans. They also offer essential plans that cover vet bills for chronic illnesses and injuries. This plan is ideal for pet owners whose pets are susceptible to chronic illnesses.

How to Choose the Right Budget-Friendly Pet Insurance?

Consider the following factors while choosing the most cost-effective pet insurance plans.

The Age and Breed of Your Pet: Due to genetic problems, some breeds are more prone to health issues, hence insuring them may cost more. Ask your vet for a detailed medical history of your pet before choosing a plan.

Your budget: determine how much you are willing to spend on monthly or yearly premiums and choose a plan that is within your budget but offers reasonable coverage.

The Type of Coverage you need: the level of coverage you need will help you choose the right budget-friendly pet insurance. Does your pet require a time-limited or maximum benefit plan or would you rather go for a lifetime coverage?

What’s Included in the Policy: check the coverage for alternative therapies, dental care, third-party liability and veterinary fees.

Affordable pet insurance doesn’t mean sacrificing quality care for your furry friend. Whether you opt for an accident-only plan for basic coverage or a lifetime plan for long-term security, there are plenty of options to fit every budget. By comparing policies and choosing wisely, you can ensure your pet gets the care they need without unexpected financial stress.

Ready to find the best policy for your pet? Get a free quote from Quays today!

When choosing an insurance, it’s also critical to take your pet’s particular requirements into account. An elderly pet or a breed that is more likely to have health issues may need full lifetime coverage, while a young, healthy pet may benefit from a less expensive, accident-only policy. You can make an informed decision and avoid unexpected costs when you need assistance by being aware of what pet insurance covers, the limits on claims, and the exclusions.

Pet insurance ultimately provides you with peace of mind so you can concentrate on providing the best treatment for your pet in the event of an emergency without having to worry about unforeseen expenses.

Compare your options now if you’re prepared to choose an affordable insurance plan that provides the appropriate amount of coverage for your pet. Quays provides affordable and reliable pet insurance plans that are tailored to each pet owner’s budget, allowing you to safeguard your beloved pet without going overboard.

Get a quote now to give your pet the protection they deserve!