If you run a dog grooming business, you know how rewarding it is to make pets look and feel their best. But working with animals comes with risks, which is why having dog grooming insurance is essential. Accidents can happen—a dog might get injured during a grooming session, have an allergic reaction to a product, or even bite a staff member. There’s also the risk of property damage, whether it’s a pet damaging a client’s belongings or expensive grooming equipment getting broken. Without the right insurance, these incidents could lead to costly claims, legal fees, or business disruptions.

Dog grooming insurance acts as a financial safety net, protecting you from unexpected expenses and ensuring that your business runs smoothly. Whether you operate from a salon, a mobile van, or offer in-home services, having the right coverage gives you peace of mind and reassures your clients that their pets are in safe hands.

In this guide, we’ll cover everything you need to know about dog grooming insurance, from what it includes to how to choose the best policy for your business.

What is dog grooming insurance?

Dog grooming insurance is a specialized type of business insurance designed to protect pet groomers from unexpected expenses and liabilities. Working with animals, sharp tools, and various grooming products presents risks, no matter how experienced you are. A dog may get nicked by clippers, have an allergic reaction to a shampoo, or become anxious and cause property damage. In some cases, an aggressive or frightened pet may even bite you or a staff member, leading to medical expenses and potential legal claims.

This type of insurance covers a range of incidents, including injuries to pets in your care, damage to client property, and liability claims if a pet owner accuses you of negligence. It also protects your business assets, such as grooming equipment, from theft, fire, or accidental damage. Some policies even offer coverage for lost income if your business is temporarily shut down due to an unforeseen event.

Whether you operate from a salon, work as a mobile groomer, or provide in-home grooming services, dog grooming insurance is a must-have for financial security and professional credibility. Having the right coverage not only safeguards your business but also reassures your clients that their beloved pets are in safe, responsible hands

How to choose the best dog grooming insurance policies for small businesses

If you own a small grooming business, choosing the right insurance is crucial for protecting yourself, your clients, and the pets in your care. As a small business owner, you may not have the financial cushion to handle unexpected incidents, so having the right insurance policy ensures you can continue operating smoothly, even if something goes wrong.

When selecting dog grooming insurance, look for policies that offer essential coverage, such as:

- Public Liability Insurance – This protects you if a pet owner or a third party files a claim due to injuries or property damage caused during a grooming session. For example, if a client slips and falls in your salon or if a dog accidentally knocks over and breaks an expensive item in a customer’s home, this coverage helps pay for legal fees and compensation.

- Care, Custody, and Control Coverage – Accidents can happen, and if a pet gets injured or lost while in your care, this coverage can help cover veterinary expenses and potential legal claims from pet owners.

- Business Property Insurance – Your grooming tools, equipment, and salon space (if you have one) are essential to your business. This coverage protects against theft, fire, or accidental damage, ensuring you don’t face significant financial setbacks.

- Personal Accident Coverage – Grooming can be physically demanding, and injuries such as cuts, bites, or back strain are common. Personal accident insurance helps cover medical bills and lost income if you’re unable to work due to an injury.

Workers’ Compensation (If You Have Employees) – If you hire staff, some regions legally require you to carry workers’ compensation insurance. This protects both you and your employees in case of work-related injuries or illnesses.

How dog grooming insurance protects you from liability claims

Even experienced dog groomers can face unexpected incidents. Dogs can be unpredictable, and accidents may happen despite the best precautions. A slip of the clippers, an allergic reaction to a grooming product, or a nervous dog jumping off the table can cause injuries or distress. In these cases, pet owners may hold you responsible, leading to lawsuits or compensation claims.

Liability insurance protects you by covering medical expenses, legal fees, and compensation costs. Here’s how it safeguards your business:

- Injury-Related Claims – If a dog gets nicked during trimming, suffers burns from grooming tools, or falls off the table, the owner may demand reimbursement. Liability insurance covers veterinary expenses, preventing financial strain on your business.

- Allergic Reactions or Skin Irritations – Some dogs react to shampoos, conditioners, or flea treatments. If a pet develops rashes or infections, liability insurance helps cover vet bills and legal claims.

- Bites and Aggressive Behavior – Even calm dogs may become stressed during grooming. If a dog bites you, a staff member, or a client, liability insurance helps with medical costs and legal claims.

- Property Damage – A dog may chew expensive equipment, damage furniture in a client’s home (for mobile groomers), or break valuable items in your salon. Liability insurance covers repair or replacement costs.

- Legal Defense Costs – If a pet owner sues you for negligence, liability insurance helps pay for legal representation, settlement fees, and court costs, protecting your business.

Beyond financial protection, having dog grooming insurance reassures clients that their pets are in responsible hands. Without proper coverage, a single claim could lead to severe financial loss. Insurance ensures you can focus on providing excellent service while staying protected from unexpected risks.

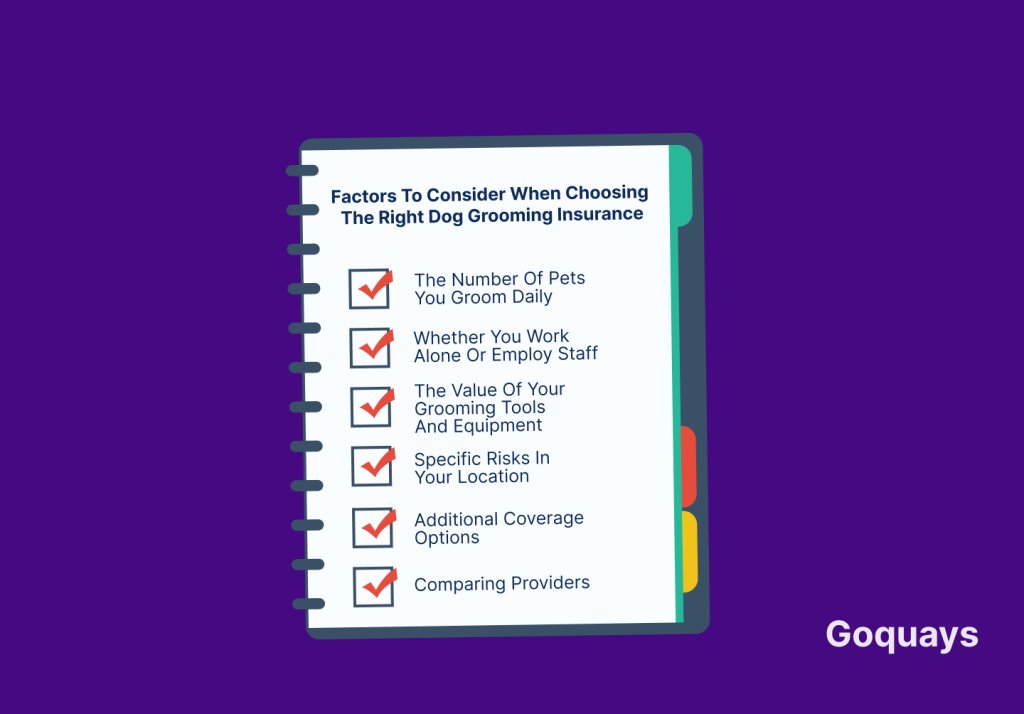

Factors to consider when choosing the right dog grooming insurance

Selecting the right dog grooming insurance is crucial for protecting your business. The best policy should cover your unique risks while remaining affordable. To choose wisely, consider the following factors:

- The Number of Pets You Groom Daily

If you handle a high volume of dogs each day, your exposure to risks increases. More pets mean a greater chance of injuries, allergic reactions, or property damage. Ensure your policy offers enough coverage to manage potential claims. - Whether You Work Alone or Employ Staff

If you have employees, you may need employer’s liability insurance. This protects you if a staff member gets injured while working. Even part-time workers or volunteers could increase your insurance needs, so be sure to factor this in. - The Value of Your Grooming Tools and Equipment

Your clippers, dryers, tables, and cleaning products are vital to your business. Insuring your tools against theft, fire, or accidental damage can save you from costly replacements. - Specific Risks in Your Location

Certain areas may have higher rates of dog bites, theft, or vandalism. If you operate in a busy urban center or an area with aggressive dog breeds, you may require higher coverage limits. - Additional Coverage Options

Some policies include extras like business interruption cover, which protects you if an unexpected event forces you to close temporarily. This can be helpful if equipment breaks down or if your premises become unusable. - Comparing Providers

Don’t settle for the first quote you receive. Compare multiple insurers to find a policy that offers the right balance of coverage and affordability. Look for providers with experience in the pet care industry, as they often understand your specific risks better.

Dog grooming insurance for independent groomers vs. salon owners

Coverage Type | Independent Groomers | Salon Owners |

Liability Insurance | Protects against client claims for injuries or damages. | Covers client claims and employee-related incidents. |

Care, Custody & Control | Covers injuries or accidents involving pets in your care. | Essential for handling multiple pets at once. |

Business Property | May need mobile equipment protection if traveling. | Covers grooming tools, furniture, and salon space. |

Employee Coverage | Not required if working alone. | Necessary for staff injuries and workplace risks. |

Cost Factors | Generally lower due to fewer assets and responsibilities. | Higher due to employees, rental space, and equipment. |

Equipment protection in dog grooming insurance

Your clippers, dryers, grooming tables, and other tools are the backbone of your business. If they’re damaged, lost, or stolen, replacing them can be costly and disrupt your work. Business equipment coverage ensures that you can continue operations without financial strain.

Equipment protection covers accidental damage, theft, and even breakdowns in some policies. Whether you run a salon or a mobile grooming service, having insurance for your tools means you won’t have to cover expensive replacements out of pocket. Some policies also include coverage for rented or leased equipment, which is useful if you don’t own all your tools.

To get the right coverage, assess the total value of your grooming equipment and choose a policy that provides adequate protection. Keep an updated inventory of your tools, including receipts and serial numbers, to make filing a claim easier if the need arises.

What is mobile dog grooming insurance?

Mobile dog grooming insurance is a specialized type of coverage designed for groomers who operate on the go, visiting clients’ homes instead of working from a fixed salon. Since mobile groomers face unique risks, such as vehicle accidents, equipment theft, and grooming-related injuries, this insurance provides financial protection against unexpected incidents.

Unlike traditional grooming salons, mobile groomers rely heavily on their vans and portable equipment, making them more vulnerable to road accidents, weather damage, and on-site liabilities. If a pet gets injured during a session or a client claims property damage, mobile dog grooming insurance helps cover legal fees, medical expenses, and repair costs.

With the right coverage, mobile groomers can focus on delivering top-quality care without worrying about financial setbacks from accidents or unexpected claims.

Does mobile dog grooming insurance cover vehicle damage?

Mobile dog grooming insurance is designed to protect groomers who travel to clients’ homes, but coverage for your vehicle may not always be included in a standard policy. Since your grooming van is essential to your business, ensuring it is adequately covered is crucial to avoiding costly repairs or replacements in case of an accident, theft, or breakdown.

Some mobile grooming insurance policies provide limited coverage for vehicle-related incidents, particularly if the van itself is customized with built-in grooming stations, water systems, or electrical setups. However, this coverage typically applies to the grooming equipment inside the van rather than the vehicle itself. If your van is damaged in an accident, stolen, or vandalized, you may need a separate commercial auto insurance policy to cover repair or replacement costs.

Why commercial auto insurance is necessary for mobile dog groomers

Unlike personal auto insurance, commercial auto insurance is specifically designed for business use. If you get into an accident while driving to a client’s home, a personal auto policy may not cover the damages because the vehicle was being used for business purposes. Commercial auto insurance covers:

- Accidents – If you cause an accident, this policy pays for damages to other vehicles, medical expenses, and legal fees.

- Vehicle Repairs – If your van is damaged in a crash, fire, or vandalism, commercial auto insurance helps cover repair costs.

- Theft and Vandalism – If your mobile grooming van is stolen or broken into, commercial auto coverage can help replace the vehicle and any stolen equipment.

Liability Protection – If someone is injured in an accident involving your grooming van, this insurance helps pay for medical expenses and potential legal claims

How much does dog grooming insurance cost?

The cost of dog grooming insurance depends on factors like business size, coverage level, and location. On average, policies range from £300 to £1,500 per year. Your specific premium will vary based on the risks involved in your business.

If you run a small, home-based grooming service, your insurance costs may be lower. Mobile groomers and salons with employees usually pay higher premiums because of added risks. Transporting pets, using mobile equipment, and managing staff all increase the chances of accidents.

The type of coverage you choose also affects the price. Basic policies covering public liability and pet injuries cost less. More comprehensive plans, which include business equipment protection, employer’s liability, and care, custody, and control coverage, are more expensive.

Some insurers offer flexible plans, allowing you to adjust coverage based on your business needs. Paying annually instead of monthly may also reduce overall costs. Comparing quotes from different providers helps you find the best deal while ensuring your business has the right protection.

How to file a claim with your dog grooming insurance provider

Filing a claim with your dog grooming insurance provider is a straightforward process, but acting quickly and following the right steps can ensure a smooth experience. Whether it’s a pet injury, property damage, or legal claim, handling the situation correctly can make a big difference in how fast your claim is processed and whether you receive full compensation.

Steps to File a Claim

- Document the Incident – Gather as much evidence as possible. Take clear photos of injuries, damaged property, or any relevant details. If a dog is injured, get a veterinary report. For property damage, take photos before making any repairs.

- Collect Witness Statements – If there were any witnesses—clients, staff members, or bystanders—ask them for a statement. Their account can provide crucial details that support your claim.

- Notify Your Insurance Provider Immediately – Contact your insurer as soon as possible. Many policies have time limits for reporting claims, so delaying could affect your chances of getting compensated.

- Submit the Required Paperwork – Your insurer may ask for medical records (if a pet or person was injured), repair estimates for damaged equipment, invoices, and proof of expenses related to the incident. Providing accurate paperwork speeds up processing.

- Cooperate with the Investigation – Insurance companies may investigate claims before approving compensation. Be honest and provide all requested details to avoid unnecessary delays.

- Follow Up on Your Claim – Stay in touch with your provider and check the status of your claim. Some claims take time to process, but regular follow-ups ensure nothing is overlooked.

By following these steps, you increase your chances of a successful claim, protecting your business from financial strain and ensuring you can continue operations smoothly.

Do I need dog grooming insurance if I work from home?

Yes, even if you run a home-based dog grooming business, insurance is crucial to protect you from unexpected risks. While operating from home may seem less risky than working in a salon or providing mobile services, you still face potential liabilities that could result in costly claims.

For example, if a dog in your care accidentally injures itself — whether by slipping on a wet floor, jumping off your grooming table, or reacting badly to a product — you could be held responsible for the vet bills. Additionally, if a dog becomes aggressive and bites you, a family member, or a visitor to your home, the medical costs and potential legal claims could be significant.

Home-based groomers may assume that their homeowner’s insurance will cover these incidents, but standard home insurance policies typically exclude business activities. If a client visits your home for a consultation or drops off their dog, and an accident occurs — such as a fall on your driveway or damage to their personal belongings — your homeowner’s policy may not provide protection. Without proper business insurance, you could be left covering these costs out of pocket.

Dog grooming insurance designed specifically for home-based businesses offers the coverage you need. Policies can include public liability insurance, which protects you against claims if a client or their property is harmed. Care, Custody, and Control coverage is also vital, as it protects you if a pet is injured or lost while in your care. Additionally, business property insurance can safeguard your grooming tools and equipment from theft or accidental damage, ensuring you can continue working without financial strain. It also ensures you can focus on providing excellent service without worrying about the financial burden of unexpected incidents.

Does dog grooming insurance cover all pet breeds?

Most dog grooming insurance policies provide coverage for a wide range of dog breeds. However, some insurers may place restrictions on breeds that are classified as aggressive or high-risk. This is often due to the perceived increased likelihood of incidents such as bites, attacks, or injuries during grooming sessions.

Breeds such as Rottweilers, Dobermans, Pit Bulls, and German Shepherds are sometimes considered higher-risk by insurers. While this doesn’t mean you can’t find coverage for these breeds, it’s essential to check your policy details to ensure you’re protected when working with them. Some providers may require additional coverage or impose higher premiums for businesses that regularly groom high-risk breeds.

Even if your insurance policy covers all breeds, you should still take extra precautions when working with anxious, aggressive, or unfamiliar dogs. Conducting a thorough behavioral assessment before grooming can help you identify potential risks. Using appropriate safety equipment — such as muzzles, grooming restraints, and protective gloves — can further reduce the chance of accidents.

If you specialize in grooming larger or stronger breeds, choosing a policy with higher liability limits may be wise. This ensures you’re covered in the event of severe injuries or substantial property damage caused by a powerful or reactive dog.

Ultimately, the key is to communicate openly with your insurance provider. Be clear about the types of dogs you groom, any special handling techniques you use, and your experience with high-risk breeds. By doing so, you can find a policy that offers comprehensive protection tailored to your unique business needs.

Are temporary or part-time groomers covered?

If you hire temporary workers, part-time groomers, or independent contractors, ensuring they are covered under your insurance policy is essential for protecting your business from potential liability claims. While some insurance policies automatically cover employees, others may require an extension or an additional policy to include temporary staff.

Why insurance for temporary groomers is important

Even part-time workers can be involved in accidents that result in injuries to pets, clients, or themselves. Without proper coverage, you may be held responsible for medical expenses, legal claims, or damage caused by an uninsured worker. Key risks include:

- Pet Injuries – If a temporary groomer accidentally cuts a dog’s skin or uses a product that causes an allergic reaction, you could be liable for vet bills and compensation claims.

- Workplace Injuries – Dog grooming is a physically demanding job, and groomers are at risk of bites, scratches, falls, or repetitive strain injuries. If a temporary worker gets hurt on the job, they may file a claim against you for medical expenses or lost wages.

- Property Damage – If a part-time groomer accidentally damages a client’s property, such as spilling grooming products on furniture or breaking expensive equipment, you could be held responsible.

How to ensure temporary workers are covered

If you regularly hire seasonal, freelance, or part-time groomers, consider these insurance options:

- Workers’ Compensation Insurance – Required in many regions, this insurance covers medical costs and lost wages if an employee (including temporary workers) gets injured while working.

- Liability Insurance Extensions – Some policies allow you to extend liability coverage to temporary staff to protect against pet injuries, property damage, and legal claims.

Independent Contractor Insurance Requirements – If you hire freelance groomers, require them to carry their own liability insurance. Some insurers offer individual professional liability policies for independent groomers.

Final thoughts

Investing in dog grooming insurance is not just a smart business decision—it’s essential for protecting yourself, your business, and the pets in your care. No matter how skilled or careful you are, accidents can happen. A single mishap could lead to expensive veterinary bills, legal disputes, or damage to your equipment. Without the right coverage, these unexpected costs could put your business at risk.

Whether you operate as an independent groomer, run a mobile grooming service, or own a full-service salon, having comprehensive insurance ensures peace of mind. It reassures your clients that their pets are in safe hands and helps you maintain a professional reputation in the industry.

Choosing the right dog grooming insurance requires careful consideration. Look at different policies, compare coverage options, and ensure the plan you select aligns with your business’s needs. The cheapest policy isn’t always the best—focus on finding a balance between affordability and comprehensive protection.

If you haven’t secured insurance yet, now is the time. Don’t wait until an accident happens to realize the importance of coverage. Start comparing providers today and get the protection you need to keep your business running smoothly and securely.