Pets are a major part of many households and as a pet owner, you want to ensure the health and well-being of your pet regardless of whether it is just one pet you have or several furry feet running around your house. Juggling the medical expenses of several pets can easily become too much to handle, especially with rising veterinary costs.

That’s where multi-pet insurance comes in, it is an easy and cost-effective method to insure all your pets under one policy. Not only does it simplify coverage, but it also gives significant savings and increased peace of mind. We present to you ten reasons why multi-pet insurance is a wise decision for smart pet owners. Learn how this type of insurance can make life easier while guaranteeing your pets receive the best care possible, from financial advantages to hassle-free administration.

What is Multi Pet Insurance?

Multi pet insurance is a specialized type of pet insurance that enables pet owners to insure several animals under one policy. Multi-pet insurance streamlines coverage, frequently offers discounts, and makes handling claims easier than managing individual policies for each pet. A multi-pet insurance plan guarantees that all of your pets; dogs, cats, rabbits, birds, and more can get medical care when they need it without the trouble of managing several policies.

You can save money, simplify paperwork, and have a more convenient insurance experience overall by combining your pets under a single policy. This kind of insurance offers complete protection with no administrative hassles, making it particularly helpful for homes with multiple pets.

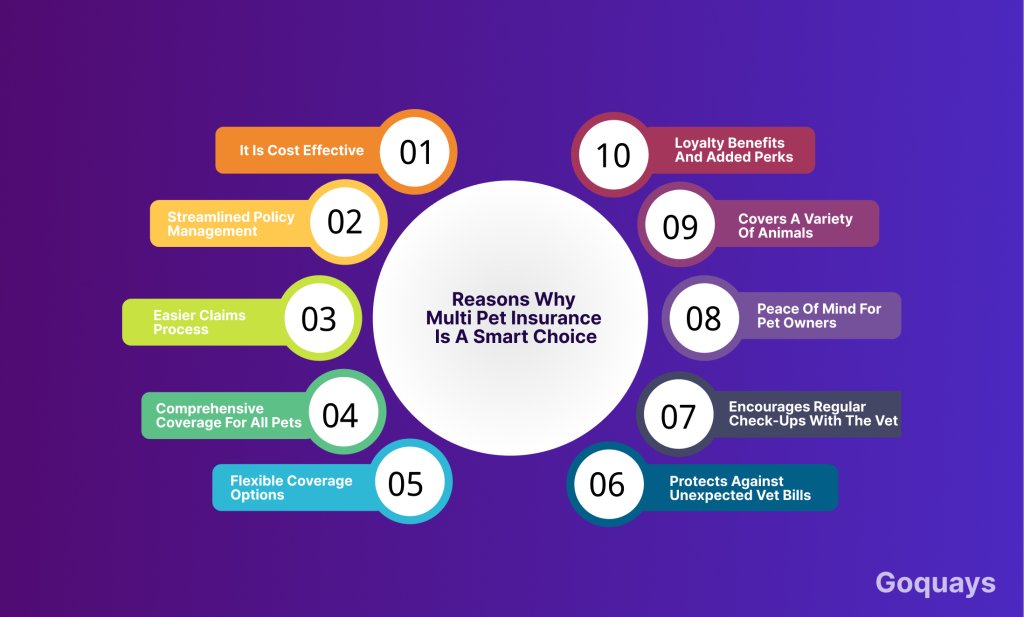

10 Reasons Why Multi Pet Insurance is a Smart Choice

- It is Cost Effective

Saving money is one of the main advantages of multi-pet insurance. When several pets are insured under a single policy, many insurance companies offer discounts, which lowers the total cost of premiums when compared to individual coverage. Households with multiple pets can particularly benefit from this, as the savings can increase over time.

Additionally, policy holders with many pets may be eligible for promotional savings, loyalty benefits, and package deals from insurance companies. For families with several animal friends, this makes it a cost-effective and a perfect option.

- Streamlined Policy Management

It can be very difficult to manage several separate policies, particularly when you have to deal with various policy terms, renewal dates, and claim processes. By combining all pets under a single policy, multi-pet insurance simplifies the process. This entails a single point of contact for claims, fewer renewal dates to remember, and easier documentation.

As a result of this convenience, pet owners can concentrate on the welfare of their animals rather than becoming bogged down in paperwork. Maintaining coverage for all of your pets is ensured by having a single policy, which also lessens the chance of missing renewal dates.

- Easier Claims Process

Multi-pet insurance enables pet owners to submit claims under a single umbrella policy rather than submitting claims for each pet separately. This guarantees that pet owners are compensated for veterinary expenditures more effectively by clearing up uncertainty and expediting reimbursement times.

For families with several pets, insurance companies usually offer specialised customer service departments, which streamlines the claims procedure. Pet owners can easily upload invoices and medical records using the online claim submission options offered by Quays pet insurance.

- Comprehensive Coverage for all Pets

high medical costs, such as those related to illness, accidents, surgeries, and even preventive treatment, are covered by multi-pet insurance. All of your pets receive the required medical care under a single plan, regardless of how old they are.

To guarantee that your pets receive comprehensive medical care, some policies even cover dental care, behavioural therapy, and alternative therapies. Multi-pet insurance is the smart choice for conscientious pet owners who want the best for their furry companions because of its comprehensive coverage.

- Flexible Coverage Options

Multi pet insurance allows you to choose from varying levels of coverage for each pet within the single policy. For instance, you can adjust the plan if one pet needs more intensive medical care than another.

This flexibility guarantees that pet owners will not have to pay for superfluous coverage but will still have sufficient protection for animals with unique medical requirements. Some insurance companies even provide dental care, preventive care such as vaccinations, and wellness coverage as optional extras.

- Protects Against Unexpected Vet Bills

Accidents and unexpected illnesses can be expensive to treat. Having multiple pet insurance guarantees that you are ready for any medical situation without having to worry about high vet costs.

Hundreds or even thousands of pounds can be spent on emergency care, surgery, and consultations with specialists. You won’t have to decide between your financial security and your pet’s health if you have multi-pet insurance.

- Encourages Regular Check-ups with the Vet

Pet owners are more inclined to take their animals for routine examinations as pet insurance helps reduce expenses. Early sickness detection and improved pet health are the results of preventive treatment.

Maintaining pets’ health requires regular wellness checks, immunisations, and diagnostic testing. Pet owners are more inclined to spend money on preventive care when they have insurance than when they wait until a problem gets out of hand

- Peace of Mind for Pet Owners

Pet owners can definitely relax and heave a sigh of relief knowing that their furry friends will receive medical care without breaking the bank because all pets are protected under a single policy. In an emergency, this peace of mind is priceless.

It can make a huge difference to know that you have a safety net in place for your pets’ medical requirements, particularly when coping with aging animals, chronic illnesses, or unplanned accidents.

- Covers a Variety of Animals

A lot of multi-pet insurance policies cover more than just dogs and cats. It’s a practical and inclusive option if you have exotic pets, birds, or rabbits. You might locate a policy that covers them all.

Some insurance companies include coverage for small mammals, ferrets, and reptiles, so even unusual pets are covered. It’s crucial to enquire with insurers about the kind of animals that qualify for multi-pet coverage.

- Loyalty Benefits and Added Perks

Additional benefits like wellness programs, free pet health examinations, and loyalty discounts for policy renewals are offered by certain insurance companies to their loyal clients. These benefits can further increase the value of multi-pet insurance even more, making it a wise long-term investment for both pet owners and their animals.

How Multi Pet Insurance Works?

Instead of buying different insurance plans for each pet, multi-pet insurance enables pet owners to insure several animals under a single policy. Through multi-pet discounts, this kind of coverage frequently results in cost savings while streamlining the pet insurance management process.

Key Aspects of How Multi Pet Insurance Works

Single Policy, Multiple Pets, instead of having individual policies for each pet, all pets in a household are protected under one umbrella policy, making it easier to handle renewals, payments, and claims.

- Tailored Coverage: A few insurance companies let pet owners personalise their coverage for every animal. For instance, a younger, healthier pet could merely need accident coverage, but an elderly dog might require a more extensive plan.

- Multi-Pet Discounts: When several pets are covered by a single insurance, most insurers provide a discount, which lowers the total cost in comparison to purchasing separate policies.

- Simplified Claims Process: By using a single insurer, pet owners can submit claims for several animals, cutting down on paperwork and speeding up and improving the reimbursement process.

- Complete Protection: Depending on the plan selected, multi-pet insurance frequently covers illnesses, accidents, regular checkups, surgeries, and even preventive care

- Flexible Add-Ons – Many insurers offer optional add-ons like wellness coverage, dental care, and alternative therapies, allowing pet owners to tailor the policy to their pets’ specific needs.

- Coverage for Various Pets – While most multi-pet insurance policies cater to dogs and cats, some insurers also offer plans for rabbits, birds, reptiles, and exotic pets.

By insuring multiple pets under one policy, pet owners benefit from reduced costs, less paperwork, and greater convenience, ensuring that all their pets receive necessary medical care without financial stress.

Types of Multi pet insurance Cover

There are different types of multi-pet insurance cover, offering varying degrees of coverage. Pet owners can choose the coverage plan that is most suitable to the needs and requirements of both them and their beloved pets. It is important to note that some policies are renewed monthly while others are done yearly. Consider the policy that is most suitable for your budget. Here are the most common types of multi pet insurance.

Lifetime Coverage: this type of multi pet insurance is renewed annually. It provides continuous coverage for chronic or long-term illnesses. Its premium is higher than those of other pet insurance types but it offers the most comprehensive coverage. It is ideal for pet owners who desire a lasting coverage for their pets especially those with chronic conditions such as diabetes or heart disease.

Time-Limited Cover: this type of pet insurance covers illnesses and injuries over a specified period of time usually 12 months. Though it may not cover long-term conditions once the coverage period ends, it is less expensive than the lifetime cover.

Maximum Benefit Cover: this type of multi pet insurance offers coverage for each illness up to a predetermined amount with no time restrictions. Once the limit is reached for a specific illness, the insurance provider will no longer reimburse for treatments.

Accident-Only Cover: this covers vet bills resulting from accidents but does not include treatment for illnesses. This plan is ideal for owners with young healthy pets who have a lower risk of hereditary or chronic diseases. It is the most affordable type of pet insurance; it however offers very limited coverage.

Third-Party Liability Cover (For Dogs Only): this covers for legal fees and damages if your dog injures someone or damages property. It is necessary for some dog breeds but it does not cover vet bills.

Whichever type of pet insurance coverage you choose, has its benefits and drawbacks, so it is critical to select a plan that suits both your budget and your pets’ medical requirements.

How Can I Get Cheaper Multi Pet Insurance?

As a multi pet owner, you are always looking for how to get the best deals on your pet insurance and save money. Here are a few tips to help you reduce the premium on your multi pet insurance.

Compare Providers: you can find the greatest offers by shopping around. Compare different plans and offers by different providers, use comparison websites. Check the price and what each plan actually covers and what it doesn’t. Quays offers the most comprehensive multi pet insurance at a very affordable price.

Select Multi-Pet Discounts: When you include numerous pets in a single policy, many insurers provide discounts that lower the total cost of premiums. At Quays the more pets you insure, the lower your premium will be.

Opt for Higher Excess Fees: Your monthly premiums may be reduced if you select a higher voluntary excess, or the sum you contribute to a claim.

Consider Accident-Only Cover: An accident-only policy is less expensive than comprehensive coverage if you’re a budget-conscious owner.

Pay Annually Rather Than Monthly: Paying annually can save you money because some insurance providers charge more for monthly payments.

Keep Your Pets Healthy: Vaccinations and routine veterinary examinations are examples of preventive care that can lower the chance of expensive medical conditions.

Look for Loyalty Discounts: If you’ve had a service from a provider for a long time, enquire about renewal discounts or loyalty benefits.

Check for Employer or Membership savings: Members of some unions, pet organisations, and companies may be eligible for insurance discounts.

Will Multi Pet Insurance Cover Pre-Existing Conditions?

This depends on your provider; some policies cover pre-existing conditions which are illnesses that were present before the commencement of the policy. Before you choose a plan, it is important to go through the terms and conditions of the policy to determine if it covers pre-existing conditions or not.

Conclusion

For pet owners who want to simplify their coverage, save money, and guarantee their furry friends receive the best care possible, multi-pet insurance is a wise investment. With advantages including complete coverage, cost savings, and convenience of administration, it’s no surprise that more pet owners are choosing multi-pet policies.

To safeguard both your wallet and the health of your pets, look into multi-pet insurance alternatives right now. Purchasing coverage today will ensure that you and your cherished friends can live worry-free in the future.

Request a quote today!