“Can I still get insurance for my 10+ year-old cat?” is a question most cat owners have in mind as their cat gets older especially when they have to deal with vet bills from time to time. Yes, you can. However, there are limitations and certain factors you have to consider.

This is as a result of various pet insurance providers imposing age limits, restricting coverage for pre-existing conditions, or charging higher premiums due to the increased likelihood of health issues in senior cats. However, the right insurance plan can help cover unexpected medical expenses, giving you peace of mind and ensuring your cat receives the best possible care in their golden years.

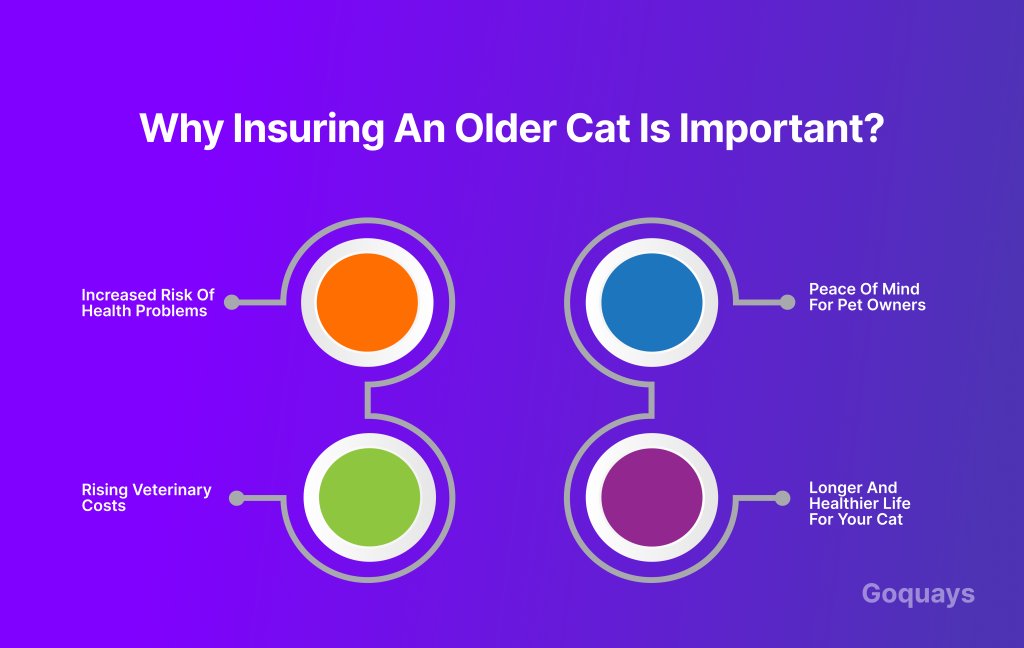

Why Insuring an Older Cat is Important?

As cats age, they become more prone to health issues, and veterinary care can become more expensive. Many pet owners assume that their cat won’t need insurance after a certain age, but in reality, senior cats are at the highest risk of requiring medical attention, making insurance even more valuable.

- Increased risk of health problems

Older cats (those aged 10+) are more susceptible to chronic illnesses and age-related conditions, including

- Arthritis: This leads to joint pain, stiffness, and mobility issues.

- Kidney Disease: One of the most common illnesses in senior cats, often requiring lifelong treatment.

- Diabetes: Managing cat diabetes involves regular vet visits, insulin injections, and blood sugar monitoring.

- Dental Disease: Older cats frequently suffer from gum disease, infections, and tooth decay, leading to costly dental procedures.

- Cancer: The risk of tumours increases with age, requiring surgery, chemotherapy, or long-term care.

- Rising veterinary costs

Without insurance, the cost of treating an older cat’s medical conditions can add up quickly. Some common vet expenses include:

- Routine check-ups and blood tests

- X-rays and scans

- Surgery for tumours or injuries

- Chronic disease management (e.g., diabetes, kidney disease)

- Peace of mind for pet owners

Insurance helps pet owners make healthcare decisions based on their cat’s needs, rather than financial limitations. Without coverage, some owners may face the difficult choice of delaying treatment or opting for less effective care due to cost concerns.

- Longer and healthier life for your cat

Insurance ensures that you can provide early diagnosis and treatment, extending your cat’s lifespan and improving their quality of life. Conditions like kidney disease or arthritis, if treated early, can be managed effectively, allowing your cat to remain comfortable and active well into their senior years

Can you get Insurance for a 10+ year-old Cat?

Yes, you can still get pet insurance for a cat over 10 years old in the UK, but options become more limited and expensive as cats age. Many pet insurance providers set age restrictions, this means some will not accept new policies for cats over a certain age, while some may impose higher premiums and excess fees for senior cats.

- Age limits and policy availability

Pet insurance providers have different rules regarding maximum age limits for new policies:

- Some insurers stop offering new policies for cats over 8–10 years old.

- Others provide coverage up to 12, 14, or even 20 years old, but with conditions.

- If your cat is already insured before reaching the age limit, many lifetime policies allow continued coverage as long as you keep renewing without a gap.

- Types of Insurance available for older cats

There are several types of insurance policies you can get for a senior cat:

- Lifetime Insurance: Covers ongoing conditions (e.g., kidney disease, arthritis) but is the most expensive option.

- Time-limited Insurance: Covers illnesses/injuries for a set period (e.g., 12 months) before exclusions apply.

- Accident-only Insurance: Covers injuries from accidents but not illnesses (cheaper but limited).

- Pre-existing condition policies: Some insurers, may offer limited coverage for past conditions.

- Higher costs and exclusions

- Premiums & excess fees tend to increase with your pet age.

- Pre-existing conditions (any illness diagnosed before the policy starts) are often excluded.

- Some insurers require co-payments (e.g., paying 20-30% of vet bills on top of excess fees) for older pets.

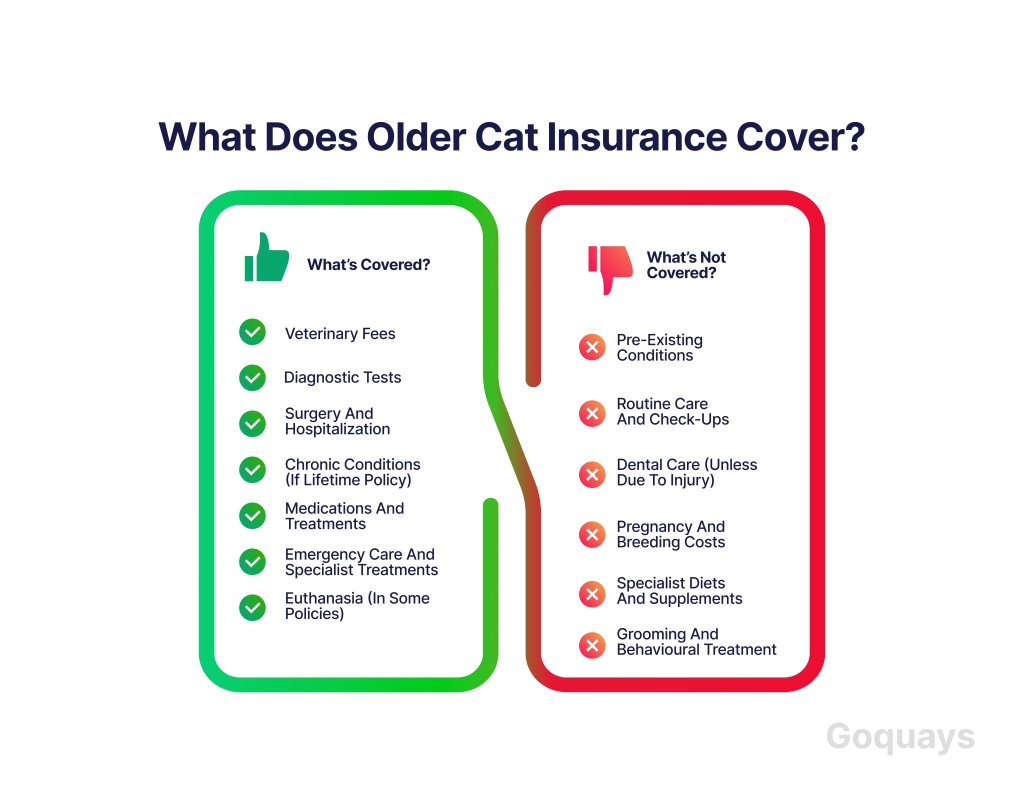

What does older cat insurance cover?

When insuring a cat over 10 years old, it’s important to understand what is and isn’t covered. While insurance can help manage expensive vet bills, not all policies offer the same level of protection, especially for senior cats.

- What’s covered?

Most comprehensive older cat insurance policies include:

- Veterinary fees: Covers medical treatment for illnesses, injuries, and chronic conditions.

- Diagnostic tests: Blood tests, X-rays, ultrasounds, and MRIs to diagnose medical conditions.

- Surgery and hospitalization: Coverage for major operations and overnight stays.

- Chronic conditions (if lifetime policy): Long-term illnesses like diabetes, kidney disease, and arthritis.

- Medications and treatments: Prescription drugs, chemotherapy, and physiotherapy (depending on the policy).

- Emergency care and specialist treatments: If your cat needs urgent medical attention or specialist consultations.

- Euthanasia (in some policies): Coverage for humane end-of-life care if necessary.

- What’s usually not covered?

Senior cat insurance often comes with exclusions, including:

- Pre-existing conditions: Any illness diagnosed before the policy starts.

- Routine care and check-ups: Vaccinations, flea/worm treatments, and annual health exams.

- Dental care (unless due to injury): Most policies don’t cover dental disease, only accidents affecting teeth.

- Pregnancy and breeding costs: If your cat is still breeding, related costs are excluded.

- Specialist diets and supplements: Even if prescribed by a vet, these are rarely covered.

- Grooming and behavioural treatment: Issues like anxiety or aggression are typically not addressed.

- Key considerations for older cats insurance

- Check for chronic condition coverage: Lifetime policies are the best option for managing long-term illnesses.

- Watch out for co-payments: Many insurers require senior cat owners to pay a percentage (e.g., 20-30%) of vet bills in addition to excess fees.

Compare coverage limits: Some policies have per-condition limits or annual payout caps that might not fully cover expensive treatments.

Alternative options if Insurance isn’t available

If you are unable to get pet insurance for your 10+-year-old cat due to age restrictions, pre-existing conditions, or high premiums, there are still alternative ways to manage veterinary costs and ensure your cat gets the care they need.

- 1. Self-Insurance (creating a pet savings fund)

Instead of paying monthly premiums, you can set aside a fixed amount each month (e.g., £30-£50) into a dedicated savings account. Over time, it will compound which will eventually help cover unexpected vet expenses.

This insurance method is best for owners that prefer to manage their funds instead of paying an insurance company. But the major risk to keep in mind is if your cat becomes ill earlier on than expected, you wouldn’t have enough savings to cover the costs.

- Vet payment plans and low-cost clinics

Some veterinary clinics offer instalment plans for expensive treatments. Instead of making payment upfront, you can spread payments over several months. Also, some vet clinics provide reduced-cost services for senior pets. Ask local vet in your area to inquire about the available options.

- Charities and support schemes

There several charities available to help cat owners who can’t afford their pet’s full vet bills especially senior catscharities help pet owners who can’t afford full vet bills, especially for senior pets:

- PDSA (people’s dispensary for sick animals): Free or low-cost treatment for eligible low-income pet owners.

- RSPCA: Offers emergency medical assistance for pet owners facing financial hardship.

- Blue cross: Provides discounted veterinary care in certain areas of the UK.

- Cats protection: This may help with vet costs for cats in need.

- Pay-as-you-go insurance or discount plans

Some pet insurers offer pay-as-you-go plans where you pay a lower monthly fee in exchange for partial coverage of vet bills. While not full insurance, this can still provide some financial relief.

Conclusions

Insuring a 10+ year-old cat in the UK is possible, but it comes with higher costs, stricter terms, and some limitations. While many insurers still offer lifetime, time-limited, or accident-only coverage for senior cats, comparing policies carefully will ensure you get the best protection for your feline friend.

Ready to find the best insurance for your senior cat? Compare pet insurance providers today to get the right coverage for your cat.